Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 36.25.

- Set a stop-loss order below 36.05.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.77.

Bearish Entry Points:

- Place a sell order for 36.75.

- Set a stop-loss order at or above 36.90.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.30.

Turkish lira Analysis:

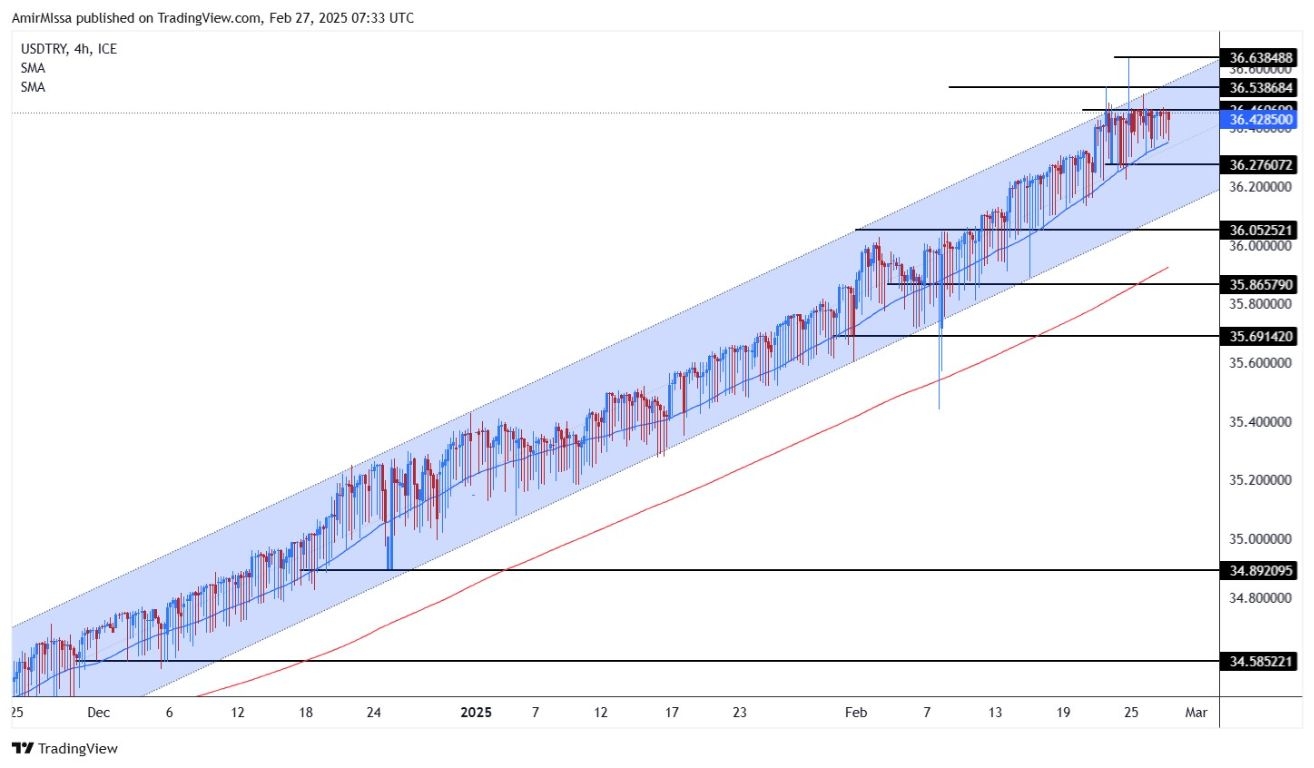

The USD/TRY pair stabilized during the start of European trading on Thursday without significant changes. However, the pair is expected to record greater increases, especially during tomorrow’s Friday trading, according to the pair’s usual movement pattern in recent months. Currently, the pair is trading at 36.45 Lira, near its all-time high recorded earlier in the week at 36.63 Lira.

Reports attribute the main reason for the continued decline in the Turkish currency’s performance to the divergence between Turkish and US monetary policy. Although the Federal Reserve has started cutting interest rates earlier than the Turkish Central Bank, US inflation figures and the inflationary effects of Donald Trump’s tariffs may force the Federal Reserve to maintain interest rates in the medium term. Even if interest rates are cut, the pace of these cuts will be much lower than expected for the Turkish Central Bank. The Central Bank of Turkey has previously cut interest rates from 50% to 45%, supported by a decline in inflation to 42.12% in January.

At the same time, the Turkish Lira is under further pressure due to the clear slowdown facing the Turkish economy. It recorded growth of 2.1% in the third quarter, the weakest since the COVID-19 pandemic, amid rising taxes and fuel prices. Additionally, trade and political tensions between Turkey and the United States put more pressure on the currency. Under these factors, interest rate arbitrage opportunities between the two currencies are narrowing. With these trends continuing, the Turkish Lira appears vulnerable to further volatility and economic pressure in the coming period.

Finally, the Turkish Central Bank’s measure of the Turkish Lira’s value compared to its decline relative to inflation stands out, which opens the way for the Lira to record further declines, especially if inflation data continues to show a greater slowdown.

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair’s trading varied within a limited range, dominated by an upward trend, with the price remaining within an ascending price channel that supports the pair’s overall upward trend in the medium term. Turkish Lira price forecasts indicate that the dollar will continue to gain, especially if the pair continues to move above support levels represented by the 50-moving average on the four-hour time frame. Thus, any decline in the pair to that average represents an opportunity to re-buy. Currently, the pair is targeting 36.75 Lira and 36.99 Lira, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from.