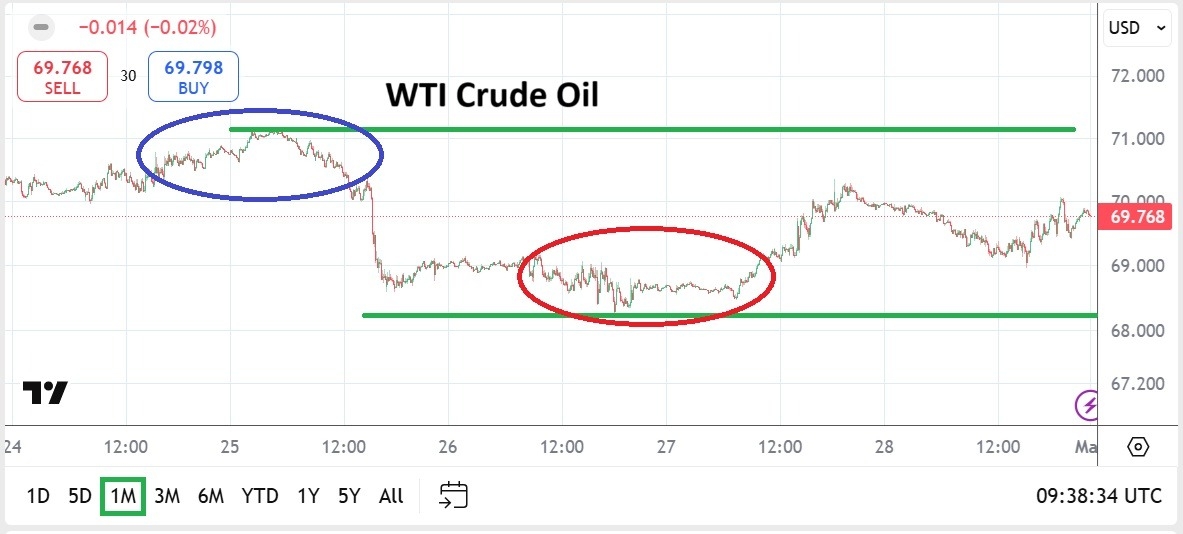

- The downturn in WTI Crude Oil saw price velocity increase downwards this week.

- After climbing to a high of nearly 71.170 on Tuesday, the commodity began to fall in price rapidly and was suddenly demonstrating a low around the 68.650 level.

- Selling didn’t stop after Tuesday’s low. Yes, there was a some timid buying displayed later on Tuesday and into Wednesday, but the 69.200 ratio proved rather durable as resistance during those two days.

- Lows on Wednesday and Thursday went below the 68.350 price. Thursday did see another push higher and the 70.300 ratio was seen, but then more selling developed, and on Friday a low around the 69.000 mark was challenged before going into the weekend near 69.770.

- Outlook remains the key in the energy sector and U.S impetus regarding proactive drilling will remain a central theme.

The ability of WTI Crude Oil to sustain values below 70.000 is significant. Yes, speculators can certainly look for reversals upwards, but they would be foolhardy to be overly ambitious unless there is a momentous shift in U.S policy or a black swan event were to take place globally. Last week’s lows touched values not seen since early December.

Traders need to be careful when looking at the prices of WTI Crude Oil and make sure they are looking at charts that correlate to the prices being offered by their brokers. There is a difference in the spot oil price compared to future contracts. Speculators trading CFDs need to make sure they know what there brokers are offering specifically, because prices can vary depending on the futures month being traded. The forward month is the most traded WTI contract typically and the one most brokers favor.

The upwards momentum produced late on Friday in WTI Crude Oil is intriguing. After showing signs of sustained lower values, the commodity did see a bit of an upswing in prices again. Traders need to remain attentive to narratives being spoken regarding WTI Crue Oil pricing.

- The rather public display of tempers between the U.S White House and Ukrainian President Zelensky this past Friday probably did effect the WTI Crude Oil price based on the notion speculators may have been anticipating a better outcome of the meeting.

- When discussions went sideways – wrong – via Trump and Zelensky this may have caused a reaction in outlook regarding supply.

- However, it likely didn’t hamper the notion that supply remains strong and price outlook does continue to face headwinds via resistance.

WTI Crude Oil traders are amongst the most experienced commodity traders when it comes to dealing with political intrigue. The proactive stance of the Trump White House regarding WTI Crude Oil obviously remains strong.

The prospect of a negotiated settlement for the Ukraine and Russia war now looks to be rather shaky, but things can change quickly in politics. Supply from Russia into the energy landscape via a wider group of buyers may be in question momentarily, but production and other sources of energy remain efficient.

WTI Crude Oil should be watched for early volatility this week as potential reactions are on display, but if the commodity continues to trade below 70.000 USD early this week it will open the door to the notion prices can go lower again. The 69.000 support level will be important to watch, but this may be overly ambitious early this coming week.

Traders need to pay attention to WTI Crude Oil early this week to see where sentiment takes the commodity as large players react to current global politics. Noise will likely continue to be heard, but resistance levels in WTI Crude Oil above 70.000 could prove to be strong if calmer rhetoric is displayed in the coming days.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.