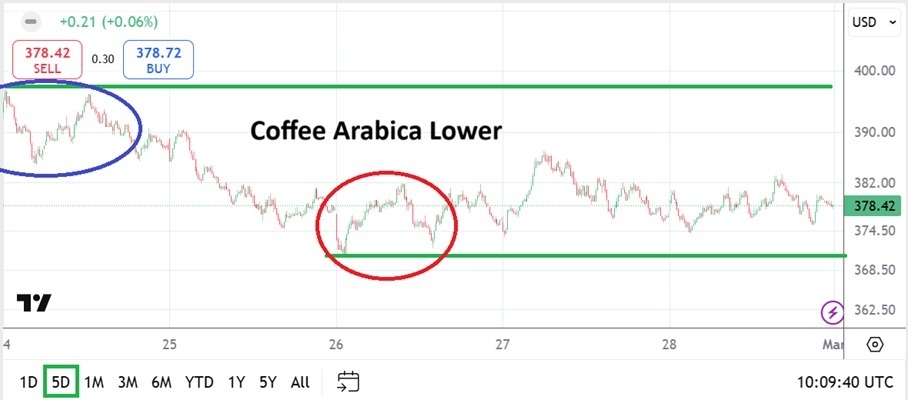

- Selling continued to be seen in Coffee Arabica this past week, and speculators dreaming about taking advantage of an anticipated downturn in the commodity following its strong bullish trend the past year and a half may be getting intrigued.

- The downturn in the price of Coffee Arabica continued last week. The commodity has gone into this weekend near the 378.42 ratio.

- The high in Coffee Arabica last week was early on Monday when the commodity challenged the 400.00 level briefly, but it really never went above the mark and another try higher a few hours later only challenged the 396.00 vicinity before stumbling with velocity.

- Lows on Monday of last week encountered the 386.00 level and from there Coffee Arabica began to show signs of weakness. Yes, the commodity certainly remains highly valued, but the 375.00 price was seen on Tuesday and then after a brief reversal higher back above 380.00 late in the day,

- Coffee Arabica opened trading on Wednesday with a surge lower.

Wednesday’s low around 370.60 were interesting. The price of Coffee Arabica did see some buying develop, but it wasn’t overtly strong. Was this a sign that buyers who have been dominant in Coffee Arabica are beginning to lose their taste for speculative highs. The inability to sustain prices over the 380.00 level Wednesday through Friday is intriguing. Support levels should not be used over ambitiously by day traders as targets, and they should also keep in mind that the selling pressure seen since the 19th of February could end violently.

The ability of Coffee Arabica to fall from 420.00 in mid-February to its current price levels needs to be treated carefully. We have seen momentary waves of Coffee Arabica selling before during the past year and a half, only to watch buyers come in and punish those speculating on lower prices. Having said that, the price of Coffee Arabica continues to look over valued. But the reality of the price is not an opinion, it is what the cash market determines. Cocoa values have also continued to show signs of lower values however, perhaps offering a correlation.

If a speculator has enough fortitude and deep enough pockets to bet on Coffee Arabica they still need to be careful. The trend lower in Coffee Arabica must be treated with respect and risk management is needed in a significant manner.

- The upwards climb in Coffee Arabica may have only run into a momentary lapse.

- But the notion that the commodity remains in overbought territory and that it will continue to decline in value is rather intriguing.

- Betting on the lower momentum to continue is dangerous.

- Saying that the 370.00 support level is important may only be an illusion.

- Traders can get different perspectives depending on the timeframes they are considering in Coffee Arabica.

Coffee Arabica has been one of the most prosperous and dangerous commodities the past year and a half for speculators. The upside price action for those fortunate enough to have hitchhiked a ride on the coattails of large players upwards was profitable. For those who were betting against the trend higher it was an expensive and painful long duration of losses.

The past two weeks have seen a downturn certainly in Coffee Arabica. While narratives regarding weather, production and supply remain key factors, there is little doubt that Coffee Arabica was likely overbought. Is the downturn now being seen going to continue?

Betting on lower direction may seem logical, but it needs to be remembered we have been here before during the past year. The price of the Coffee Arabica has been brutally strong and cautious traders may want more evidence of lower prices. If a trader does decide to pursue lower values they should not be overly ambitious and cash out winnings before they vanish into thin air. If Coffee Arabica sees sustained prices below the 370.00 level and a challenge to 360.00 this week it would not be surprising, but an upwards move that shakes and destroys all bearish selling attempts wouldn’t be a shock either.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Futures Brokers For Commodity Trading to check out.