Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 36.35.

- Set a stop-loss order below 36.15.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.77.

Bearish Entry Points:

- Place a sell order for 36.75.

- Set a stop-loss order at or above 36.90.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.30.

” dir=”auto” id=”content-1686574122635″>

Turkish lira Analysis:

The USD/TRY pair has stabilized for most of this week’s trading within a narrow range, not exceeding 36.50 Lira per dollar. Unlike previous weeks, which saw a steady daily decline in the Lira’s price, the Turkish currency has stabilized within a limited range without registering new declines this week.

Investors followed a report issued by the Turkish Central Bank on the future of monetary policy in the country. The report stated that the tightening of monetary policy has significantly affected various income brackets, manifested in fundamental changes in consumer spending patterns. According to the report, monetary tightening has led to an increased tendency towards saving instead of spending, especially among high-income groups, which were the primary driver of consumer spending, adopting spending behaviours described as traditional, which significantly affected sales in markets. Obviously, this shift reflects how financial decisions are adapting to the government’s economic strategies in the face of inflation and currency instability challenges.

The report comes at a time when analysts’ views on current monetary policies vary, with some considering them to hinder economic recovery efforts, while others see them as necessary to manage inflation effectively. While experts express concern about the possibility of economic growth stagnation due to declining consumer confidence, there remains hope for corrective policies that balance the need for fiscal discipline and ensure financial stability for citizens.

Meanwhile, the Turkish government believes that addressing fundamental economic issues requires patience. flexibility from all sectors, calling on consumers and businesses to adapt to changing economic conditions to ensure the economy passes through this difficult phase with the least possible losses.

The Turkish Central Bank is scheduled to hold its next Monetary Policy Committee meeting on March 6, 2025, where the interest rate decision will be announced at 14:00 local time. In its previous meeting on January 23, 2025, the bank decided to reduce the main interest rate by 250 basis points to 45%. It is worth noting that the Turkish Central Bank holds periodic Monetary Policy Committee meetings to determine interest rates, according to the announced schedule, in its pursuit of monetary and economic stability in the country.

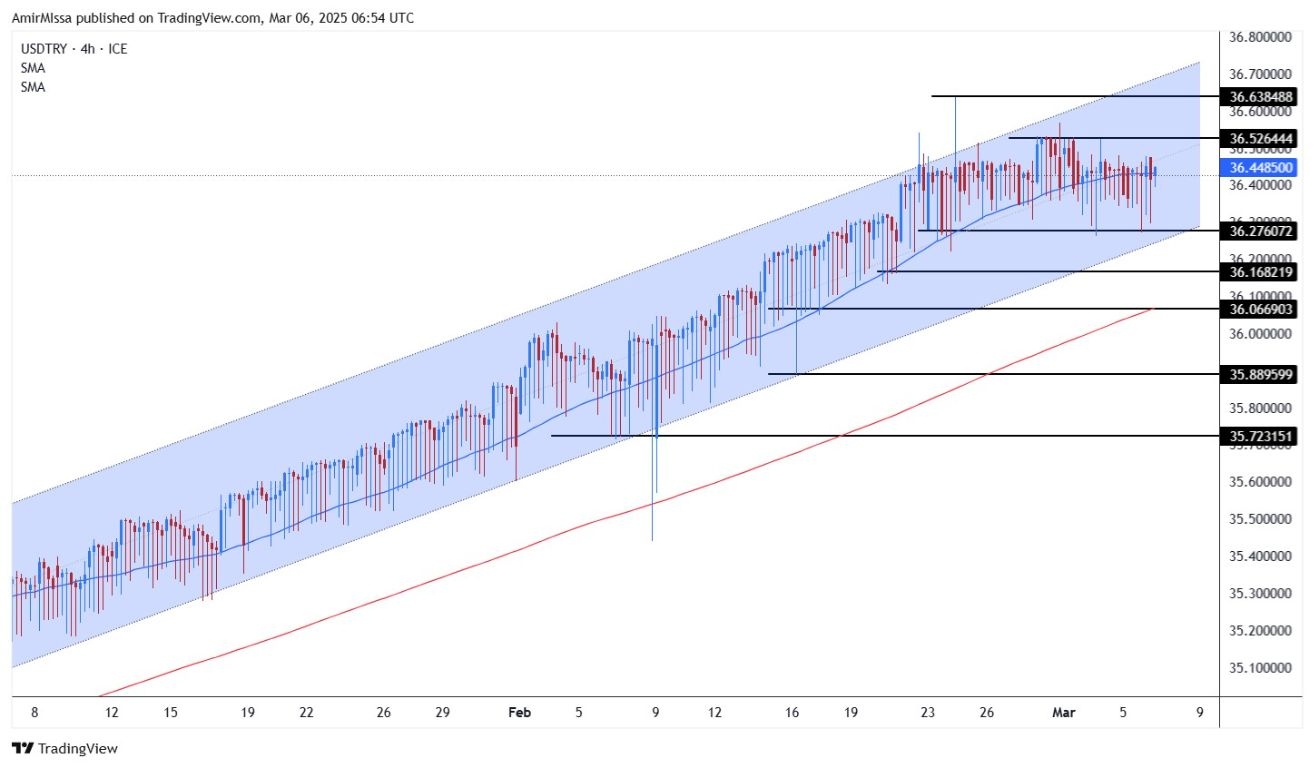

TRYUSD technical Analysis and Expectations Today:

Technically, the USD/TRY pair’s trading has stabilized without significant changes, with the price fluctuating around the 50-moving average on the four-hour time frame. The pair has also maintained its movement within the ascending price channel, which supports the continued rise of the dollar. Ultimately, Turkish Lira price forecasts indicate that the dollar will rise with every decline in the pair, targeting 36.75 Lira and 36.99 Lira, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from