After going through a very bearish period including a large drop from a record high and a new 4-month low price, Bitcoin is starting to look more bullish, with one key analyst seeing Bitcoin as likely to exceed $125,000 per coin as early as this summer.

Bitcoin (BTC) started the week holding firmly above the $82,000 level as an analyst made a bullish mid-year projection for BTC price.

Data from CoinMarketCap and TradingView reveal BTC price trading at $83,470, 8.5% above its weekly low of $76,700, reached on March 11.

Will Bitcoin continue its bull run to new all-time highs?

Bitcoin’s V-Shaped Pattern Means $109,000

BTC’s price has painted a V-shaped recovery chart pattern in the daily timeframe, projecting a massive move upward.

A V-shaped recovery is a bullish pattern formed when an asset experiences a sharp price increase after a steep decline. It is completed when the price moves up to the resistance at the top of the V formation, also known as the neckline.

Bitcoin’s price action since January 21 appears to be developing a similar chart formation, as shown in the price chart below.

The price now trades below key supply/demand levels: The immediate resistance around $84,100 embraced by the 200-day simple moving average (SMA) and the area between $92,000 and $96,000, where the 500-day SMA and 100-day SMA currently sit.

This suggests that bulls need to push BTC above these levels to increase the chances of the price rising to another major barrier at $100,000.

Higher than that, the next logical move would be the neckline of the prevailing chart pattern above $109,000. This would represent a 30% rise from the current price.

BTC/USD daily chart. Source: TradingView

The relative strength index has increased from an oversold condition at 24 on February 26 to 43 on March 17, suggesting that bullish momentum is picking up.

Analyst Predicts $126K BTC Price by June

Bitcoin has now traded as low as 23% below its $109,114 all-time high, reached on January 20. The magnitude of this drop is normal in bull market drops, and one analyst sees a potential for BTC’s comeback to continue its bull run.

According to network economist Timothy Peterson, Bitcoin has the potential to hit new all-time highs by June this year, based on historical patterns.

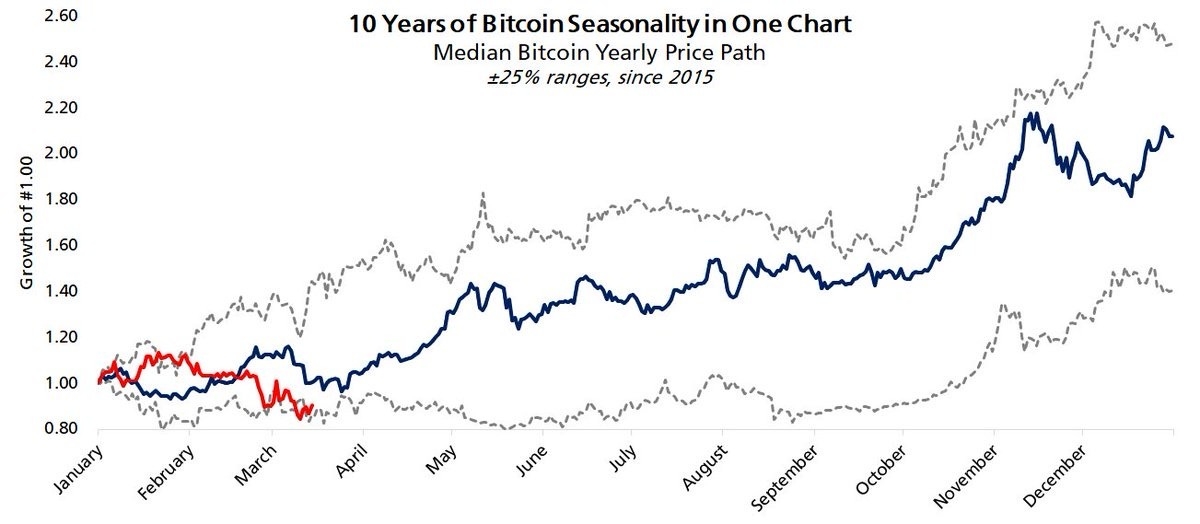

“Bitcoin is trading near the low end of its historical seasonal range,” he said in a March 15 post on X.

The caption accompanying a chart comparing BTC price cycles read:

“Nearly all of Bitcoin’s annual performance occurs in 2 months: April and October. It is entirely possible Bitcoin could reach a new all-time high before June.”

Bitcoin: 10 years of seasonality chart. Source: Timothy Peterson

Continuing, Peterson suggested a median target of $126,000 by June 1, 2025.

In a chart showing the performance of $100 in BTC, he also revealed that corrections in bull market performance have always been temporary.

“Bitcoin average time below trend = 4 months. The red dotted trend line = $126,000 on June 1.”

Bitcoin growth of $100. Source: Timothy Peterson

Peterson is renowned for creating several Bitcoin price metrics over the years. One of his key price metrics is “Lowest Price Forward”, which has successfully defined levels below which Bitcoin’s price never falls after a crossing above them at a certain point.

After its recovery from multi-year lows at $3,857 in March 2020, Lowest Price Forward predicted that BTC price would never trade under $10,000 again from September onward. This has held true because the last time Bitcoin price traded below the $10,000 mark was in early September 2020.

Meanwhile, a new likely floor level has appeared this year: $69,000, which has a “95% chance” of holding.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.