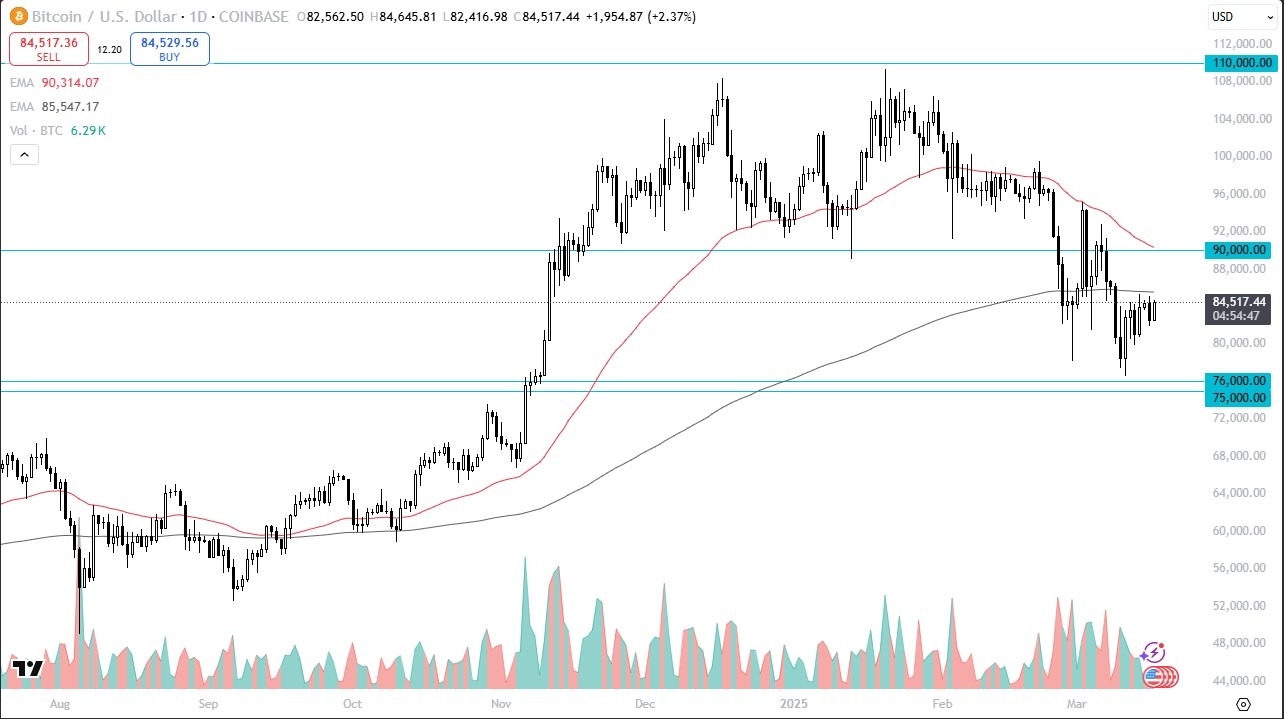

- The Bitcoin market has been rather positive during the trading session on Monday, but at this point in time, we are still paying close attention to the 200 day EMA just above that could cause some technical issues.

- So, we’ll have to wait and see. But right now, this certainly looks like a market that is at least trying to challenge that crucial 200 day EMA, which is an important indicator of the trend.

I don’t have any interest whatsoever in trying to get too overly exposed to Bitcoin at the moment. And generally, I have been looking at short-term pull banks as an opportunity to add to an already existing position. I don’t know if Bitcoin has momentum or the juice, if you will, to really take off to the upside here, but I do recognize that it is extraordinarily overextended to the downside over the last few weeks, so it should eventually attract value hunters.

The $75000 Level Continues to Be Important

Ultimately, I look at this through the prism of the $75,000 level underneath being a massive support level. And I think that will continue to attract a certain amount of attention. If we were to break down below $75,000, then I think things will get a little uglier. Right now, I think we’re in the midst of trying to form some type of trading range. And that trading range could very well be between the $75,000 level and the $90,000 level. Regardless, Bitcoin is a risk sensitive asset. Risk appetite is pretty shaken at the moment. So, I think more sideways action is probably likely to be the outcome of this latest move, as traders try to get a grip on where we are going next.

Ready to trade Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.