- Tesla and Alphabet are falling behind their Magnificent Seven peers

- Earnings may show lackluster results, AI monetization in focus

- Big techs use cost restructuring to speed up AI revolution

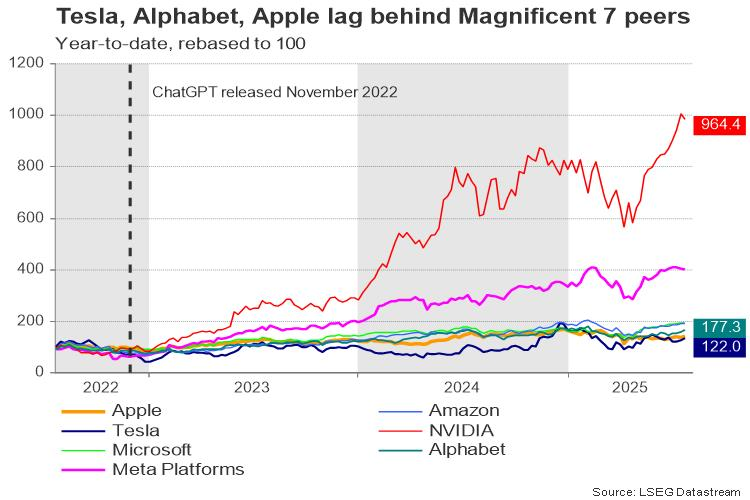

Magnificent seven start to grow apart

Tesla and Google’s parent company, Alphabet, will kick off earnings season for the “Magnificent Seven” on Wednesday after the market close. Their reports are likely to set the tone for stock markets in the absence of major U.S. economic data releases and as Federal Reserve policymakers enter the blackout period ahead of the upcoming FOMC meeting.

However, headlines on the trade front may overshadow the market impact of earnings. Global economies face a two-week deadline, until August 1, to reach an agreement with the U.S. administration or risk facing harsh tariffs. Still, since services are not directly targeted by the tariffs, Alphabet’s results may lead to greater market volatility.

Both Tesla and Alphabet, along with Apple, have been underperforming their Magnificent Seven peers due to their relatively slower progress in artificial Intelligence compared to companies like Nvidia, Meta Platforms, and Microsoft. As more AI- and crypto-focused firms gain a larger share of the S&P 500 index and diversions emerge within the earnings prospects of the Magnificent Seven, the big tech companies will need to address their shortcomings and adopt cost-effective strategies to successfully navigate the new technological revolution. After all, not every company excels at everything.

Tesla

Investors are aware that the U.S. government’s elimination of EV tax credits could weigh on Tesla’s sales in the upcoming quarters. Early delivery data already revealed a 13.5% drop from the June 2024 quarter – a historic decline. Forecasts point to a 13% year-over-year decrease in revenue to $22 billion and a 22% drop in earnings per share (EPS), with operating cash flow expected to turn negative after a year of continuous growth.

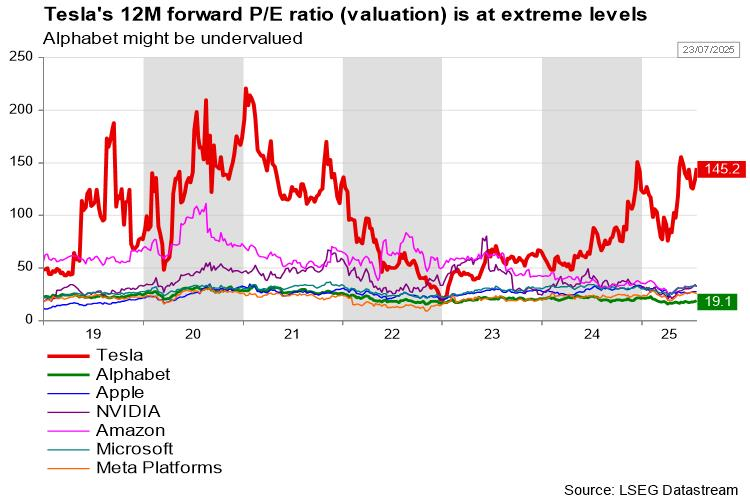

Profitability metrics also paint a grim picture. Gross profit margin is projected to fall near the pandemic-era lows last seen in Q4 2024. Additionally, Tesla has consistently missed expectations over the past year, while its stock remains priced at extreme multiples – trading at 145x earnings compared to the automobile industry’s average of 70. This high valuation largely reflects CEO Elon Musk’s ambitious vision, leaving the stock particularly sensitive to weaker-than-expected guidance. This is especially relevant now, as robotaxi testing has shown mixed results, the launch of Tesla vehicles in India failed to generate excitement, and Musk appears to be exploring political ambitions.

Still, LSEG analysts on average maintain a “buy” rating on Tesla despite recently lowered projections. While the company is under pressure from competitors in key markets such as China, it remains to be seen whether Tesla can continue leveraging its price-cutting strategy through the rollout of the affordable Model Y and improved battery technology to halt its sales decline. A key issue will be whether Tesla can use its overseas factories – especially the one in Germany – to circumvent new tariffs.

Importantly, Tesla’s story goes beyond electric vehicles. Musk’s innovative pipeline includes AI robotics and even a new “drive-in dining” experience, which could challenge the fast-food sector, including giants like McDonald’s.

Alphabet

As for Alphabet, the second quarter of 2024 wasn’t particularly strong. Revenue is expected to have grown at the slowest pace in two years – just 10.75% – dragged down by slower growth in its cloud services segment. Advertising revenue is also expected to expand at a softer rate of 7.75% year-over-year.

Analysts foresee a relatively uneventful year ahead in terms of earnings, and investor attention will likely focus on commentary regarding advertising trends and, more importantly, how Alphabet’s AI initiatives are translating into revenue. The rise of generative AI presents both opportunities and threats for the company. Startups like OpenAI and Perplexity have attracted millions of younger users, threatening Google’s dominance as the default search engine.

On the upside, Alphabet has managed to turn some competitors – such as OpenAI– into cloud clients. It also made its largest acquisition in history this March, purchasing Israeli cybersecurity firm Wiz for $32 billion to bolster its cloud and security offerings.

While Alphabet’s Gemini still lags behind ChatGPT, which is expected to be upgraded to ChatGPT-5 this summer, the company has a powerful asset in its TPU chip center, led by DeepMind. These chips are crucial for accelerating AI model training. Future AI-related projects – including its robotaxi initiative, Waymo – could excite investors, especially given Alphabet’s relatively low P/E ratio of 19, which may not yet reflect its full technological potential.

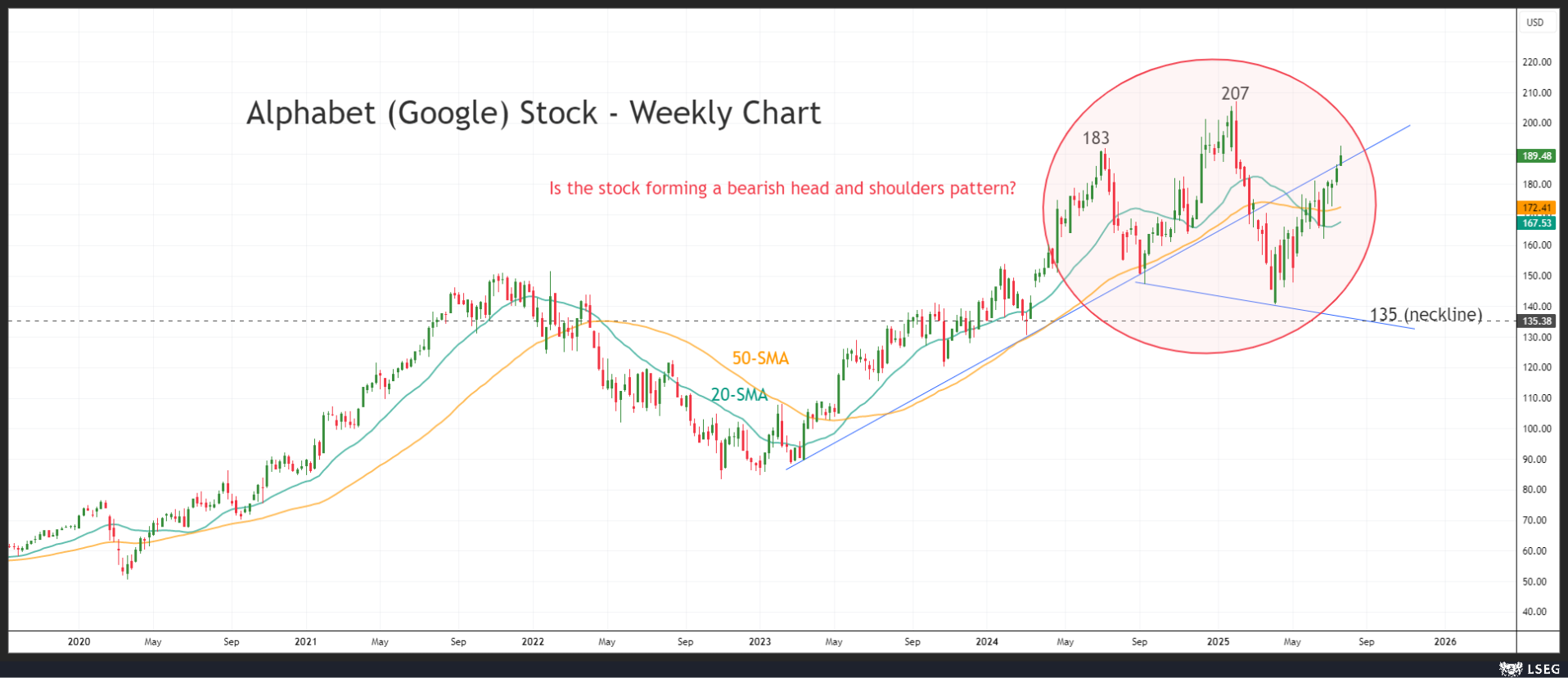

On the technical front, Alphabet’s ongoing stock rally appears to be part of a bearish head and shoulders pattern on the weekly chart. Can the bulls escape the trap above $200?

Cost effectiveness

Cost management may also become a focal point. Major tech firms including Google and Amazon have implemented layoffs in Q2, with some even offering voluntary packages to redirect resources toward AI development. If Alphabet signals further cost restructuring, U.S. indices could see a temporary boost on renewed rate-cut hopes. However, if upcoming data reignites concerns about slowing growth – particularly ahead of the nonfarm payrolls report – market pressures may resurface.