Short Trade Idea

Enter your short position between 27.22 (the intra-day low of its last bearish candlestick) and 28.40 (the upper band of its horizontal resistance zone).

Market Index Analysis

- AT&T (T) is a member of the S&P 500 and the S&P 500.

- Both indices are at or near record highs, but cracks appear outside the AI sector.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Equity markets rallied to fresh highs yesterday, amid optimism over trade and tariff deals. Earnings season is bumpy with AI-related companies offering an upbeat outlook, while the non-AI-related sectors begin to show the impact of tariffs. Futures remain mixed after Alphabet boosted sentiment and Tesla tumbled in after-hours trading. Markets will focus on a slew of earnings today, which should dictate price action.

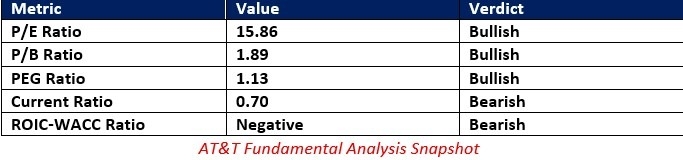

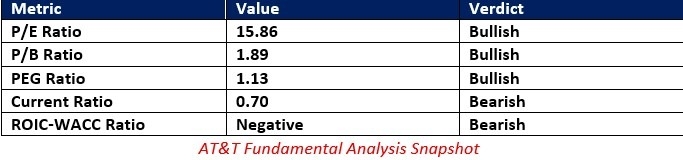

AT&T Fundamental Analysis

AT&T is a telecommunications holding company. It is also the third-largest telecom company by revenue globally and the third-largest mobile company in the US.

So, why am I bearish on T after its earnings release?

While AT&T reported improvements in select categories, like adding new mobile and high-speed internet subscribers, it continues to trail Mobile and Verizon. T also missed on its profit guidance. The share price popped amid an overall bullish mood on Wall Street, but the value destruction at AT&T and its weak balance sheet provide sufficient cause for concern. AT&T also suffers from a contraction in earnings per share, and it cannot sustain its current dividend at its current metrics.

The price-to-earning (P/E) ratio of 15.86 makes T an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 25.98.

The average analyst price target for T is 30.09. It suggests moderate upside potential, but the downside risks are greater.

AT&T Technical Analysis

Today’s T Signal

- The T D1 chart shows price action inside its horizontal resistance zone.

- It also shows resistance from the ascending 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish and has been contracting since April.

- Trading volumes are higher during selloffs than during rallies.

- T corrected as the S&P 500 rallied to fresh highs, a significant bearish development.

My Call

I am taking a short position in T between 27.22 and 28.40. The balance sheet is weak, its earnings do not support its dividend, and AT&T destroys shareholder value. With its profit outlook miss and competition from T-Mobile and Verizon, I see more downside ahead after price action spiked into its horizontal resistance zone.

- T Entry Level: Between 27.22 and 28.40

- T Take Profit: Between 22.79 and 24.89

- T Stop Loss: Between 28.61 and 29.19

- Risk/Reward Ratio: 3.19

Ready to trade our daily signals? Here is our list of the best brokers for trading worth checking out.