- The Australian dollar rallied a bit during the early hours on Monday to continue its rally against the Japanese yen.

- Quite frankly, this is a situation where traders are looking at this through the prism of the interest rate differential, which obviously favors Australia as Japan may end up having to go back to quantitative easing if there bond market doesn’t perform better.

Range bound?

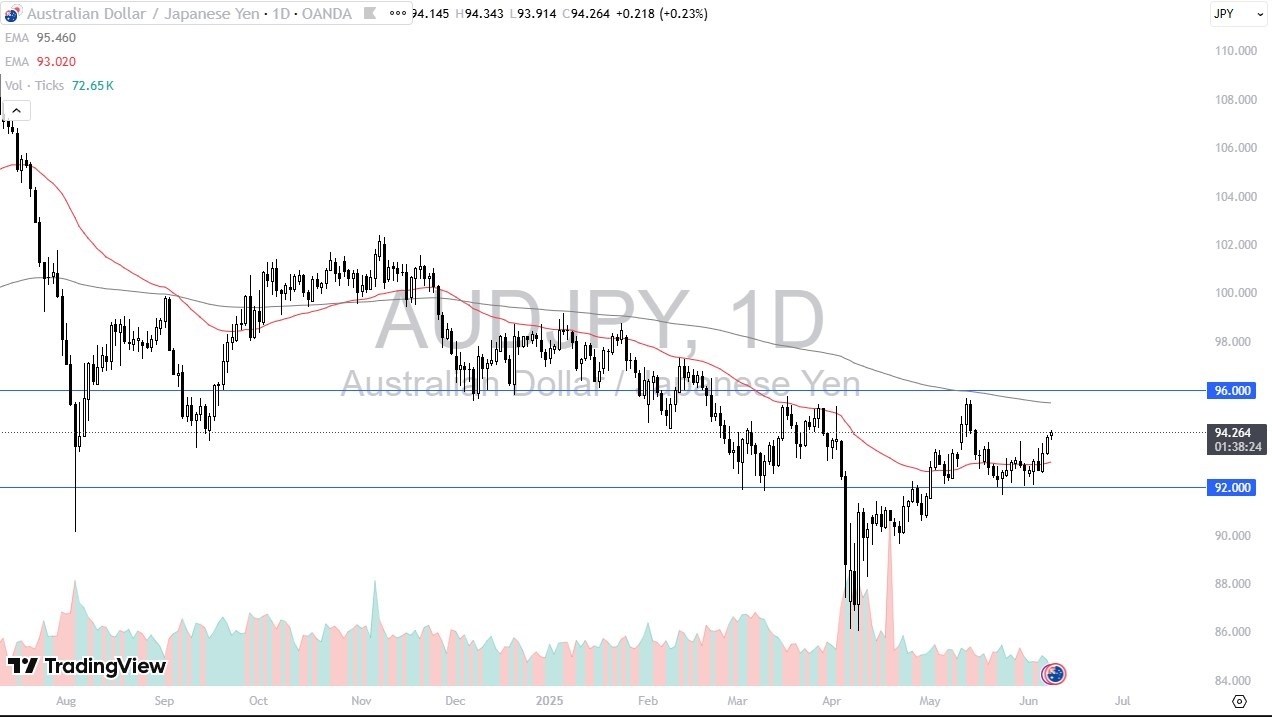

At this point in time, you could ask the question as to whether or not this pair is still Range bound, because we have an obvious support level at the ¥92 level, with an obvious resistance level at the ¥96 level. We are sitting between the 50 Day EMA underneath, and the 200 Day EMA above. Ultimately, I think this is a pair that you probably look to buy dips in, if for no other reason than the swap at the end of day. Whether or not that is enough to push the market higher remains to be seen, but I also recognize that the majority of traders prefer to go with the carry trade anyway.

I do believe at this point in time, one would have to look at the ¥92 level as a major barrier to overcome, if you were to try to short this pair. If you were to break down below the ¥92 level, then you could see the market dropping down to the ¥90 level right away. Ultimately, this is a scenario where traders will look at this through the prism of a market that is building a base, but whether or not it can retain momentum to the upside if and when it breaks out remains to be seen. I recognize that this might be a choppy affair going forward, but I suspect that the Japanese yen is about to see a lot of downward pressure overall, and therefore I think it could carry over here to see the Australian dollar strengthen.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.