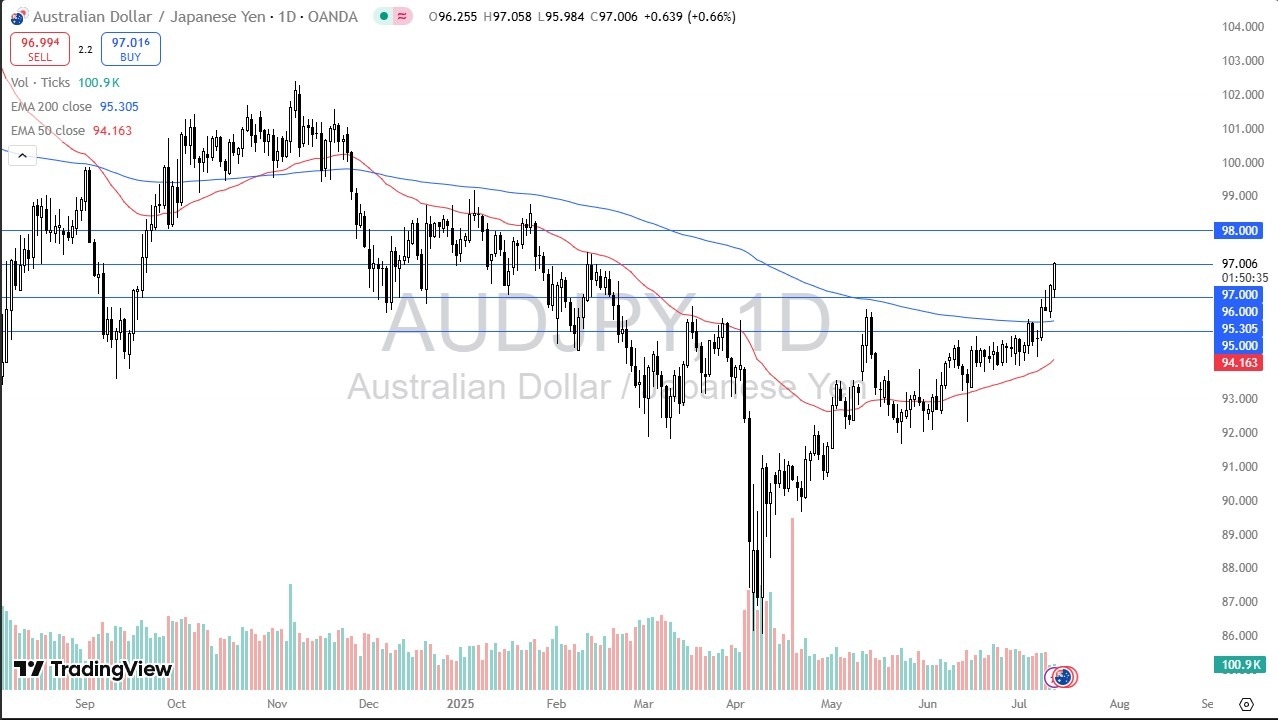

- The Australian dollar has raised higher against the Japanese yen during the trading session on Friday, reaching the crucial ¥97 level.

- This is a pair that I’m watching very closely due to the fact that although the Japanese yen is fairly weak, it’s not as if the Australian dollar has been extraordinarily strong.

- The fact that the Australian dollar has been so bullish against the Japanese yen tells you that the Japanese yen is in a bit of trouble here.

Technical Analysis

At this point in time, the market were to break above the ¥97 level, then I don’t see any reason why the pair will go looking to the ¥98 level. Furthermore, short-term pullbacks at this point in time probably sees plenty of support at the ¥97 level, and then again at the 200 Day EMA near the ¥95.30 level. Ultimately, I think this is a great signal as to what’s going on with the Japanese yen against most currencies, as if the lowly Australian dollar can scream higher against the Japanese yen, then other pairs are going to do quite well as well.

Furthermore, keep in mind that the Bank of Japan may have to start buying bonds if they don’t get enough bids in the Japanese Government Bond market, something that has happened a couple of times recently. In other words, that might force the Japanese to go into quantitative easing, which of course is very negative for a currency, as the central bank is forced to “monetize the debt.”

Either way, if we continue to see momentum, I think that we could go as high as ¥100, but it may not be a clean shot higher. One thing that people can do with this pair is determine what to do with the Japanese yen over the forex world. In other words, this pair continues to rally, then it’s possible that we could see trades set up in the GBP/JPY, USD/JPY, and so on.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.