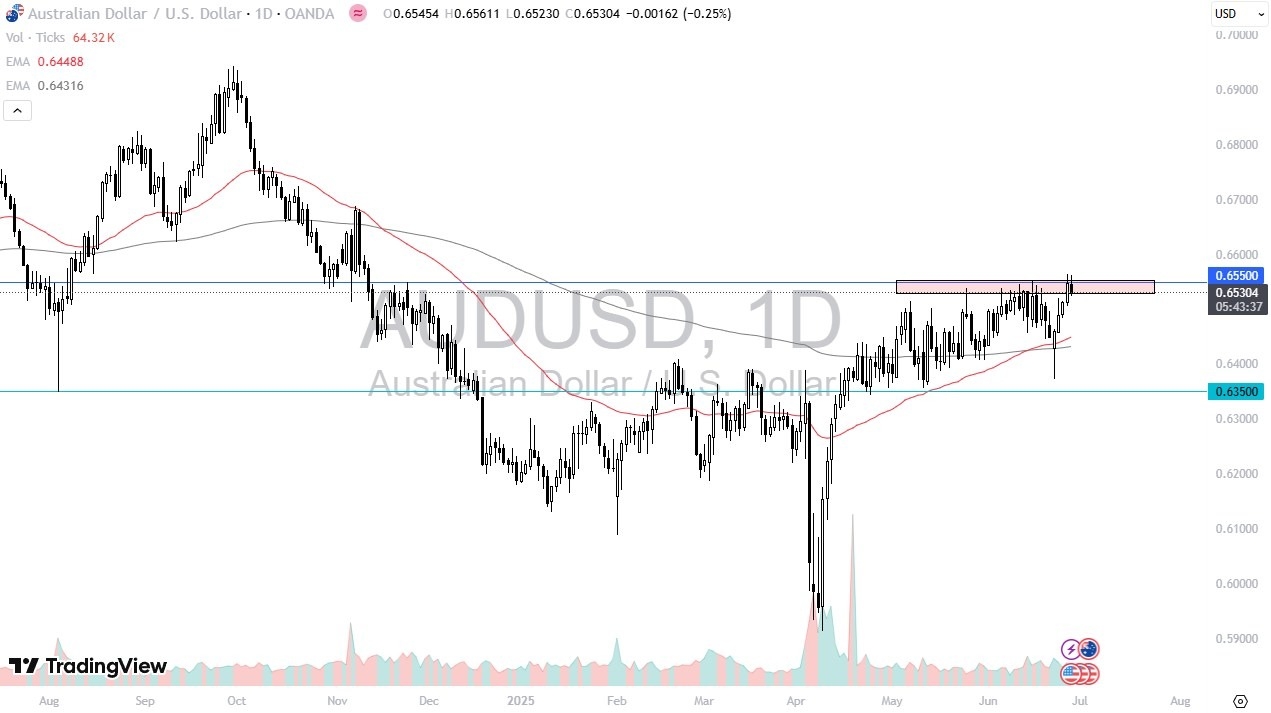

- The Friday session has seen the Australian dollar try to rally, but he gave back gains above the crucial 0.6550 level.

- This is an area that’s been like a brick wall over the last couple of weeks, and it’s also an area where we’ve seen a lot of action previously.

- What I find interesting is that it’s not just the Australian dollar that seems to be a bit sluggish against the US dollar, but also its cousin, the New Zealand dollar.

Ultimately, this is a pair that highly levered to the Chinese economy, which is interesting that we did not break out to the upside, considering that the Chinese have now stated they have a trade agreement with the United States. If that does not lift the Australian dollar, I have to question exactly what well. Gold is selling off, so that might possibly be a little bit of an anchor around the neck of the Australian dollar at this point, but ultimately, I think we have to just simply pay attention to the price action, and despite the fact it was so bullish earlier in the week, we still cannot get above the most important level.

The Importance of 0.6550

At this point in time, I cannot overstate the importance of the crucial 0.6550 level, an area that has been like a brick wall, and I think that we have to look at this through the prism of a market that also is just simply going to be choppy and noisy, and because of this, I think we have a scenario where short-term traders are flocking to this to do range bound trading, but they expect a big move, is probably a bit much, unless we get at the very least a daily close above the 0.6550 level.

If we turn around a breakdown below the 50 Day EMA, near the 0.65 level, then we could see selling pressure down to the 0.6350 level. That being said, it’s very difficult to imagine that happening very quickly, so I think we are essentially stuck in the short term region.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.