- The Bank of England is expected to lower its policy rate to 4.25%.

- UK inflation figures remain well above the BoE’s goal.

- GBP/USD receded from recent peaks, hovering around the 1.3300 zone.

The Bank of England (BoE) will announce its latest monetary policy decision on Thursday in what marks its third rate-setting meeting of 2025.

Markets widely expect the central bank to reduce its benchmark interest rate by 25 basis points to 4.25% after staying on the sidelines at its March 20 gathering.

The Monetary Policy Committee’s (MPC) decision will be accompanied by meeting Minutes and the Monetary Policy Report (MPR), offering a window into the internal debate, while Governor Andrew Bailey will address reporters in a post-decision press conference. His remarks will be scrutinised for any shift in tone, particularly around inflation risks, the potential of tariffs, and the likely timing of future rate reductions.

With the rate move largely priced in, the focus now shifts to the Bank’s forward guidance and its updated economic outlook — key signals that could shape expectations for the next few months.

UK economic outlook: Sticky inflation, tariffs, subdued growth

The Bank of England held interest rates steady in March, as widely expected, with eight members of the Monetary Policy Committee voting to maintain the benchmark rate. Swati Dhingra was the lone dissenter, backing a 25-basis-point cut in a nod to building disinflationary pressure.

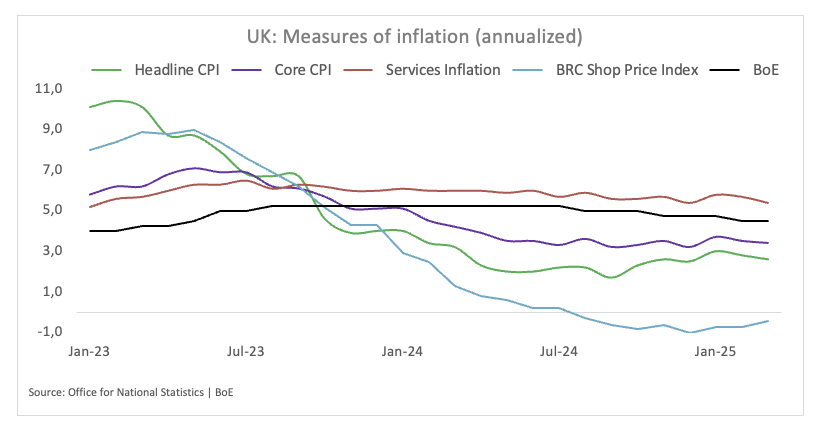

The decision came alongside fresh inflation data that surprised to the downside. Figures from the Office for National Statistics (ONS) showed annual headline CPI eased to 2.6% in March, down from 2.8% the previous month. Core inflation, which strips out volatile food and energy prices, also declined, falling to 3.4% — a further signal that underlying price pressure is gradually retreating.

Markets responded by firming up their bets on rate cuts. Interest rate futures now fully price in 100 basis points of easing by year-end, equivalent to four quarter-point reductions, up slightly from 94 basis points last week.

BoE officials have increasingly pointed to external risks as a factor in their outlook. Some policymakers noted that recent tariffs announced by US President Donald Trump could ultimately have a disinflationary effect on the UK. Governor Andrew Bailey, speaking during the International Monetary Fund’s spring meetings, warned that rising trade tensions could weigh on global growth.

The IMF echoed those concerns as it cut its 2025 growth forecast for the UK to 1.1%, down from 1.6%, reinforcing the case for a more dovish stance from the central bank in the months ahead.

That said, traders will be watching Bailey’s press conference for any signals on whether the BoE is preparing to accelerate its rate-cutting cycle in the face of softening inflation and global uncertainty.

How will the BoE interest rate decision impact GBP/USD?

Investors are bracing for the BOE to lower its benchmark rate to 4.25% on Thursday at 11:00 GMT.

While the decision itself is largely priced in, attention will centre on the vote split within the MPC and remarks from Governor Andrew Bailey for clues on the policy path ahead.

With expectations firmly set, the British Pound may show a muted reaction to the rate announcement but could shift direction depending on how dovish the tone proves to be.

In the lead-up to the meeting, GBP/USD appears embarked on a consolidative phase around the 1.3300 region, driven more by US Dollar (USD) dynamics and shifting sentiment around US trade policy than domestic catalysts.

“Cable came under renewed downside pressure after hitting more than three-year tops around 1.3440 on April 28, though it seems to have met some decent contention near 1.3260 so far,” said Pablo Piovano, Senior Analyst at FXStreet. He added that a clear break above the 2025 high could pave the way for a move toward the 2022 peak at 1.3748 reached on January 13.

On the downside, Piovano pointed to the 200-day Simple Moving Average (SMA) at 1.2849 as key support, followed by the provisional 100-day SMA at 1.2744, which precedes the April floor of 1.2707 (April 7). “If selling pressure builds, deeper support lies at the weekly troughs of 1.2558 (February 28) and 1.2332 (February 11),” he noted.

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.

Last release:

Thu Mar 20, 2025 12:00

Frequency:

Irregular

Actual:

4.5%

Consensus:

4.5%

Previous:

4.5%

Source:

Bank of England