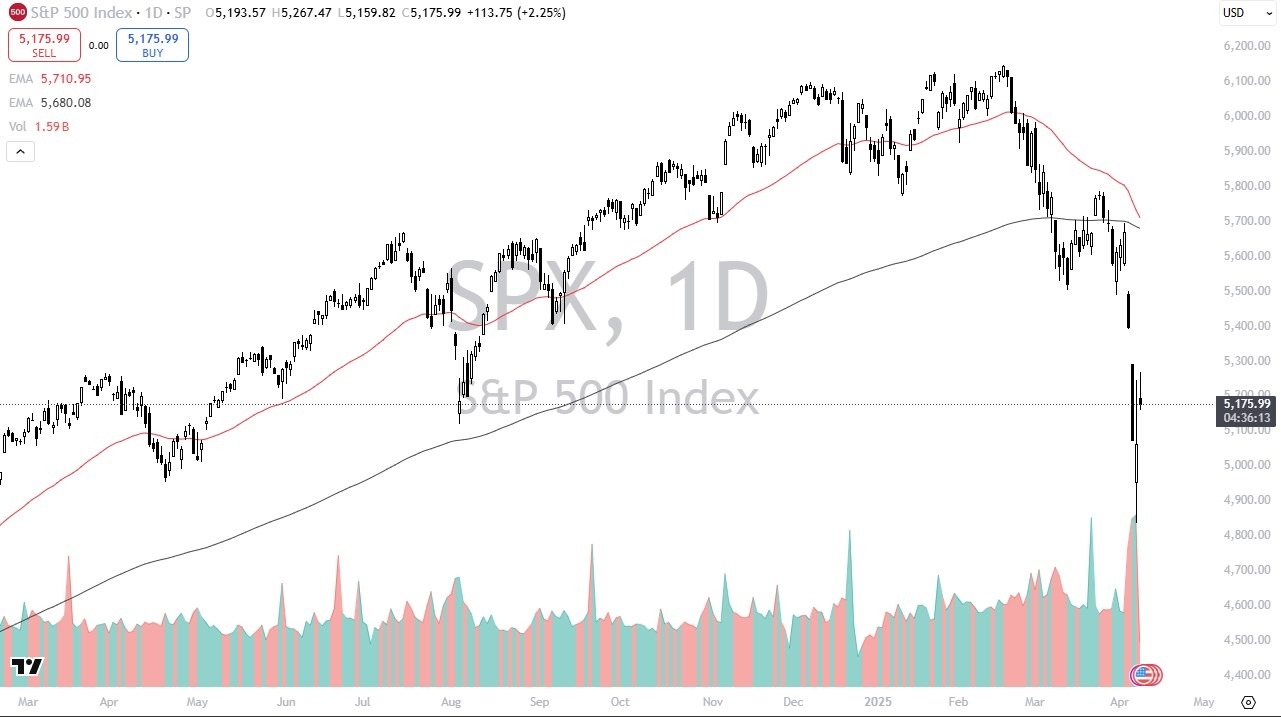

- The S&P 500 has been all over the place during the trading session on Tuesday, but it is worth noting that we gapped higher and therefore the candlestick for the day right now just shows that we’re hanging around that same area.

- I think you have a real potential for a bit of a huge bear market bounce, but we’ll have to wait and see how that plays out because we are still at the time of recording up about 2.6%.

- And while that is a nice sounding gain, the reality is that the market was just simply oversold. I think it makes a certain amount of sense that we might see traders perhaps cover short positions. And that might have been part of what happened. We just don’t know.

Not Unidirectional. Despite What has Been Going on Recently.

But at this point in time, you need to keep in mind that markets can’t go in one direction forever. So that causes this bounce. But at the same time, it isn’t exactly like we are going to turn around and rally viciously to the upside from here forever either. I do think that the S&P 500 is a little oversold, but at this point I would also have to acknowledge the fact that it’s very likely that rallies will continue to be sold into.

This is not the environment that changes much mainly due to the fact that we still have a lot of tariff concerns out there, which of course could have a major influence on exactly what type of global growth there will be. Now I recognize that the markets are at least getting a little bit of relief during the day, but I would not chase this.

I think we still have a lot of erratic behavior ahead. As somebody who traded through the 2008 debacle, I can tell you that these moments arise a few times along the way. Nothing has fundamentally changed. And therefore, you have to be very careful with this. I would anticipate trouble at the 5300 level, followed by the 5400 level, and most certainly by the 5500 level. Any of those areas could bring in further selling on signs of exhaustion.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.