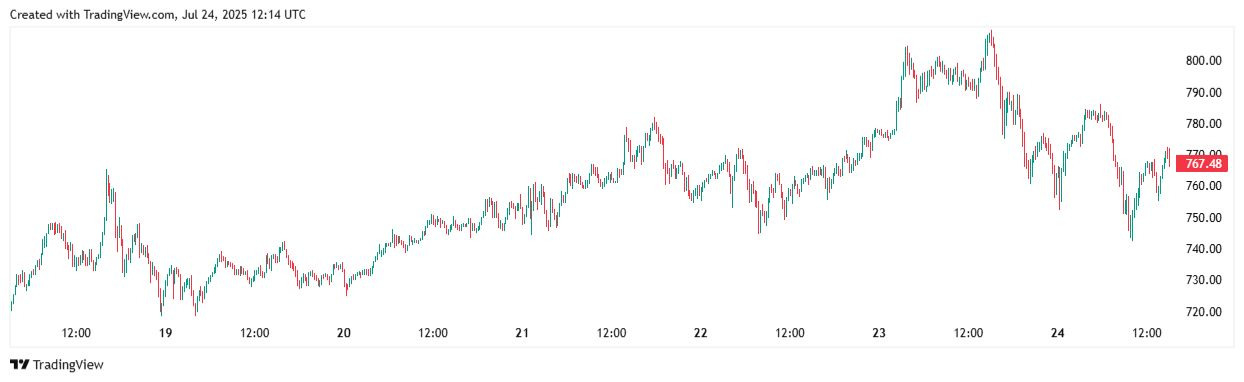

BNB is trading around $767, maintaining its position above key support after briefly touching a new all-time high near $804 earlier this week.

BNB Holds Above $750 After Institutional Surge

BNB Price Chart | Source: TradingView

BNB has pulled back slightly from its highs but remains up over 5% in the past week. The rally was triggered by a large acquisition by Nasdaq-listed Nano Labs, which purchased over 100,000 BNB tokens, which makes it one of the largest institutional moves in the asset this year.

The breakout above the previous resistance at $750 marked a significant technical shift. BNB had consolidated between $685 and $750 since late June, absorbing profit-taking and cooling off from earlier gains.

That range now serves as a base for what could be the next leg higher. Despite short-term volatility, BNB has held above $750 for three consecutive sessions, a bullish sign for trend continuation.

Broader market conditions remain supportive. Bitcoin is trading near $78,000 and Ethereum is holding the $4,400 level, both providing a constructive environment for large-cap altcoins.

$750 Support Holds as Bulls Eye $850 Breakout

The most immediate support for BNB lies at $750, a former resistance zone that now acts as a key area of demand. A break below that level could open the door to $720–$734, where the 50-day moving average and trendline support intersect.

Below that, deeper support sits at $684, which previously acted as a floor during June’s consolidation.

On the upside, resistance is forming around the recent high of $804. A daily close above this level could accelerate the move toward $850, followed by $860–$900, which align with Fibonacci extensions and prior psychological levels from earlier cycles.

If momentum extends further, bulls may set sights on $1,000, a round number that has historically attracted significant interest.

Technical Indicators Remain Bullish

BNB continues to trade above all major moving averages on the daily chart. The 20‑day EMA is climbing steeply and sits well below current price levels, suggesting strong near-term momentum.

The Relative Strength Index (RSI) is hovering near 69, just below overbought territory. While this reflects strong demand, it also indicates that the token may need to consolidate before another breakout.

The MACD is still trending upward, with the MACD line above the signal line and a growing histogram. This supports continued bullish pressure, unless the price reverses sharply in the next few sessions.

BNB is also pressing against the upper Bollinger Band, a technical sign of strength, but one that often precedes short periods of sideways movement or mild correction.

Whales Accumulate as DEX Volumes Top $14B

Exchange data shows a modest increase in BNB balances on trading platforms, suggesting that some investors may be preparing to realize gains. However, this is counterbalanced by rising decentralized exchange volume and increased token activity within Binance Smart Chain.

According to Dune Analytics, BNB daily DEX volume has surpassed $14 billion, highlighting growing engagement with DeFi protocols in the BNB ecosystem.

Institutional sentiment remains positive. The Nano Labs acquisition has sparked speculation of further strategic buying. Meanwhile, whale wallets have increased holdings, and the number of addresses holding more than 10,000 BNB continues to climb.

Network usage is rising as well. Active addresses and contract deployments are at multi-month highs, which points to healthy utility growth alongside price.

Price Scenarios to Watch

If BNB breaks above $804 on strong volume, it could trigger a wave of follow-through buying toward $850 and $860. Sustained momentum past that level opens the door to $900 and $1,000, especially if BTC remains stable or rallies.

Conversely, a failure to hold $750 would put $734 at risk. Any weakness below that zone could expose $684 as the next major support, especially if broader market sentiment softens.

Near-term consolidation between $750 and $804 remains likely if bulls pause before another attempt higher.

Ready to trade our technical analysis of BNB? Here’s our list of the best MT4 crypto brokers worth reviewing.