BNB is trading near $863 today, holding firm after reclaiming the $850 mark earlier this month.

The token is testing resistance just below its yearly highs, backed by institutional demand and strong technical positioning.

Price Holds Above $850 After Institutional Buying

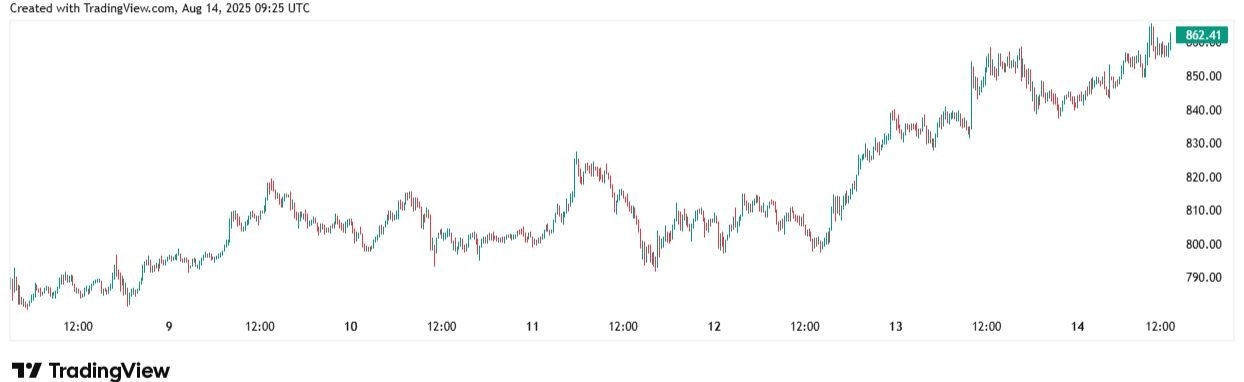

BNB Price | Source: TradingView

BNB has gained around 3–4% in the past 24 hours, extending a weekly advance that has pushed it into the upper end of its 2025 trading range. Today’s price has moved between $839 and $865, with intraday dips quickly met by buyers.

This stability follows a period of heavy accumulation by larger players. Notably, CEA Industries purchased 200,000 BNB this month, adding to bullish sentiment.

That buying activity has reinforced the $830–$835 zone as a critical line of defense for bulls, which turns it into a key support area.

The wider crypto market is providing a supportive backdrop. Bitcoin is consolidating above $121,000, and Ethereum is steady near $4,741. The absence of sharp pullbacks in majors is allowing BNB to maintain momentum without facing aggressive profit-taking pressure.

$830 Support and $865 Resistance Define the Current Range

The immediate support for BNB now sits in the $830–$835 band. This range has already absorbed several profit-taking events this week, proving its importance for short-term stability.

If price breaks below this level, the next area of interest is $802–$805, a pivot zone marked by prior consolidation.

Resistance is building at $860–$865. Sellers have repeatedly capped rallies here in recent sessions. A close above $865 on strong volume would signal a potential push to $880–$900.

Breaking $900 could trigger follow-on buying from momentum traders and test historical resistance zones seen in earlier market cycles.

Technical Indicators Suggest Momentum With Caution Signs

Momentum remains on the side of buyers, though some indicators are showing early signs of overheating. The Relative Strength Index (RSI) is around 62, which is bullish but still shy of overbought levels. This leaves room for further upside, but the pace of gains may slow if RSI moves above 70.

The Moving Average Convergence Divergence (MACD) remains in positive territory but has flattened in recent sessions, hinting at a possible moderation in momentum. Stochastic and Williams %R readings are in overbought territory, suggesting that short-term consolidation could occur even within a broader uptrend.

BNB is trading well above all major exponential moving averages (20, 50, 100, 200), reinforcing the strength of the rally. The 20-day EMA, currently near $778, is the nearest dynamic support and well below current prices.

Price action is also pressing against the upper Bollinger Band, a sign of strong directional bias but one that often precedes sideways movement.

Market Flows Show Accumulation

On-chain and exchange data show steady accumulation by large holders, reversing a distribution trend from earlier in the year. Spot trading volumes have risen, alongside price, indicating that there is participation from new buyers, rather than gains being driven solely by short covering.

Exchange reserves have ticked up, which may mean some traders are preparing to sell into strength. This mixed picture, accumulation on one hand, potential profit-taking on the other, suggests the uptrend is supported but not without short-term risks.

In derivatives, open interest in BNB contracts has climbed with the rally, and funding rates are positive but not extreme. This points to growing speculative positioning, but without signs of excessive leverage that often precede sharp reversals.

Key Scenarios for the Days Ahead

If BNB closes above $865 on rising volume, the next upside targets are $880 and $900. Clearing $900 could set up a run toward higher resistance zones from past bull cycles.

If the token fails to break current resistance and falls below $835, short-term momentum would weaken, shifting focus to $802–$805. A deeper pullback to $780 could occur if broader market sentiment sours.

Ready to trade BNB? Here’s a list of some of the best crypto brokers to check out.