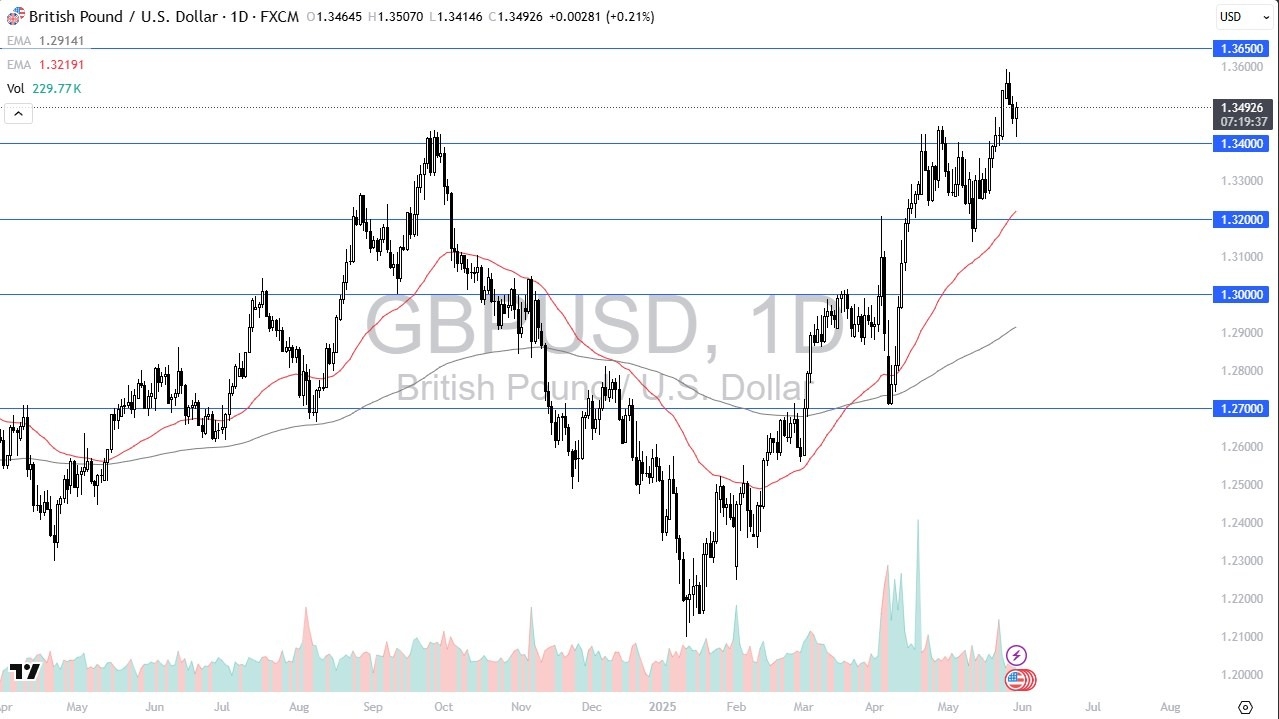

- The British pound initially fell during the trading session on Thursday, only to turn around and bounce quite significantly after the Americans released the Preliminary GDP numbers.

- The numbers came out at 0.2% instead of the expected 0.3%, which had the US dollar selling off overall.

- All things being equal, this is a market that has been trying to find a reason to find support at the 1.34 level, and it just did it.

Trend

The uptrend is still very much in the psyche of traders, and it looks like we are doing everything we can to continue to go higher, but keep an eye on the 1.3650 level above, as it is a major resistance barrier. I would anticipate that the next couple of days will be crucial, because if we start to take off to the top it could be a sign that we are truly going to blow out to the upside.

On the other hand, if we cannot keep the gains, that would be an absolutely horrible sign for the British pound, because it means that it could not take advantage of a weakening US economy, and a move below the 1.34 level really could send this market reeling to the downside.

In that environment, I would anticipate that the market goes looking to the 50 Day EMA, which is closer to the 1.32 level. Breaking down below there then opens up the floodgates to much lower pricing, which is something that is possible, but will have to wait and see. If traders are worried about some type of global recession, then the US dollar may find a bit from that standpoint alone. On the other hand, if we break above the 1.3650 level, then I think we go looking to the 1.40 level, perhaps above there as well, as it could lead to a super cycle to the upside. In this short time frame though, I think we need to keep an eye on what happens next, we are most certainly in an area that could be consolidation.

Ready to trade our GBP/USD daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.