- During the trading session on Tuesday, we saw the euro initially dip but then turned around to show a significant amount of strength.

- At this point in time, this is a pair that I think is trying to figure out where it goes next, because quite frankly, I believe that we are in the midst of a consolidation area, which makes sense considering that we had shot straight up in the air.

Consolidation

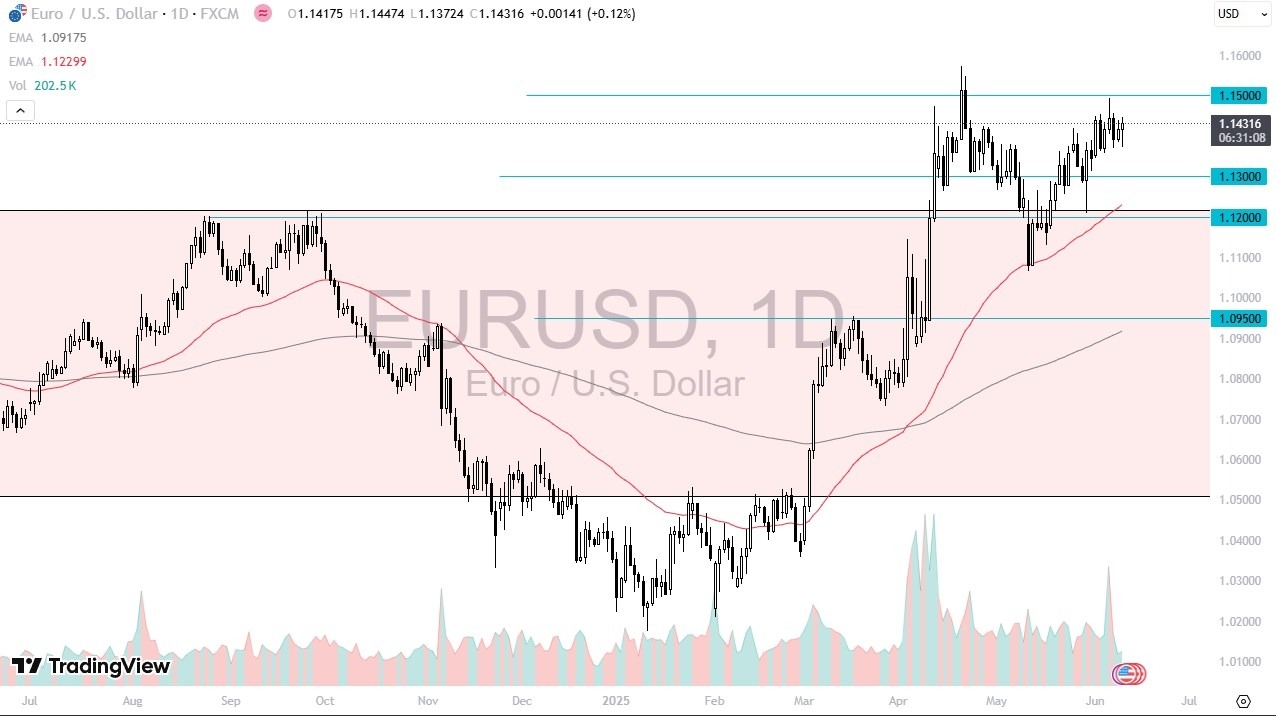

The consolidation area that I am currently watching is the area between the 1.12 level below and the 1.15 level above. The market continues to see a lot of noisy behavior, which makes sense considering that we got here so quickly, and of course the fact that the Federal Reserve and its monetary policy is a bit of a question at this point, as inflation is somewhat sticky in the United States, and of course we get the CPI numbers on Wednesday.

This could have a major influence on what happens next, but the jobs market is still relatively stable in America, so this just adds to more questions as to when the Federal Reserve could cut rates.

On the other hand, there are some questions about what’s going on in Europe at the moment, because we did see a nice recovery, but the question now is whether or not it is going to continue? All things being equal, this is a market that I think need some type of further information to make a decision as to where it wants to go for the longer term, but it is also very common for this pair to simply chop back and forth. That is essentially what’s going on now, so I would argue that this is more or less the common state of how the EUR/USD pair trades. Because of this, I think we see more of the same until we get some type of shock to the system, something that the market is somewhat resilient to at the moment.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.