- The bitcoin market has rallied during the trading session on Thursday as we continue to see a lot of noisy behavior, but this is a situation that I think needs to be paid close attention to.

- After all, we are getting relatively close to the $100,000 level, an area that would obviously have a lot of psychology attached to it.

- Furthermore, the $100,000 level has been important a couple of times in shorter term trades.

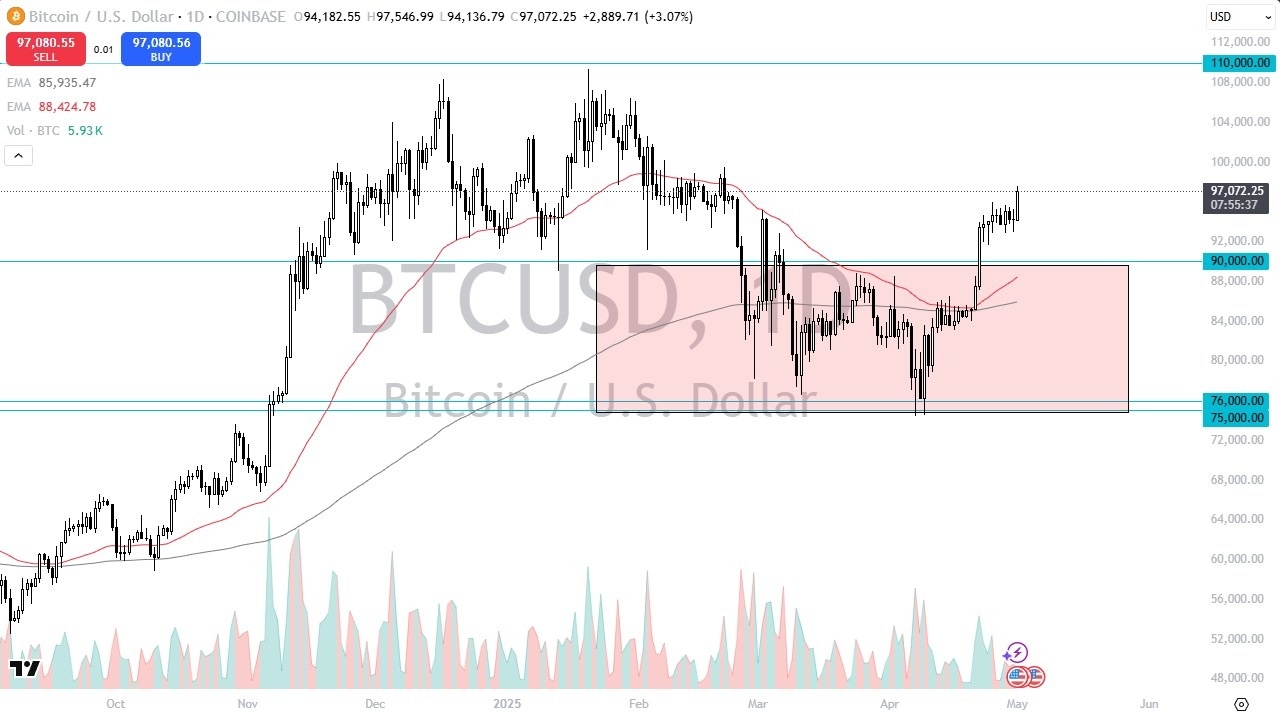

Underneath, we have the $90,000 level, which is a large, round, psychologically significant figure, and an area that has been previous resistance. Before that, it was significant support, so I do think that there is a lot of “market memory” in this general vicinity. The 50 Day EMA sits just below the $90,000 level, and therefore it solidifies that area as being important as well. That being said, keep in mind that Bitcoin is considered to be a “risky asset”, and a lot of people will be looking at that through the prism of what’s going on in the rest of the markets.

Friday Should Be Volatile

Keep in mind that Friday should be volatile, at least in other markets. The Non-Farm Payroll announcement is going to cause chaos in several other markets, so it’s possible that we could see a lot of volatility here. It should be noted that Bitcoin has done fairly well recently in that aspect, perhaps because it’s the first time that Bitcoin has been widely held by institutions as volatility skyrocketed. Perhaps we are starting to see a new paradigm here, but only time will be able to give us that answer.

All things being equal, I do think that Bitcoin will try to get to the $100,000 level, and if we can break above there then it opens up the possibility of returning to the $110,000 level after that. The $110,000 level is an area that’s been like a brick wall, so it’ll be interesting to see if we can ever build up enough inertia to break above there, although I suspect we will.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.