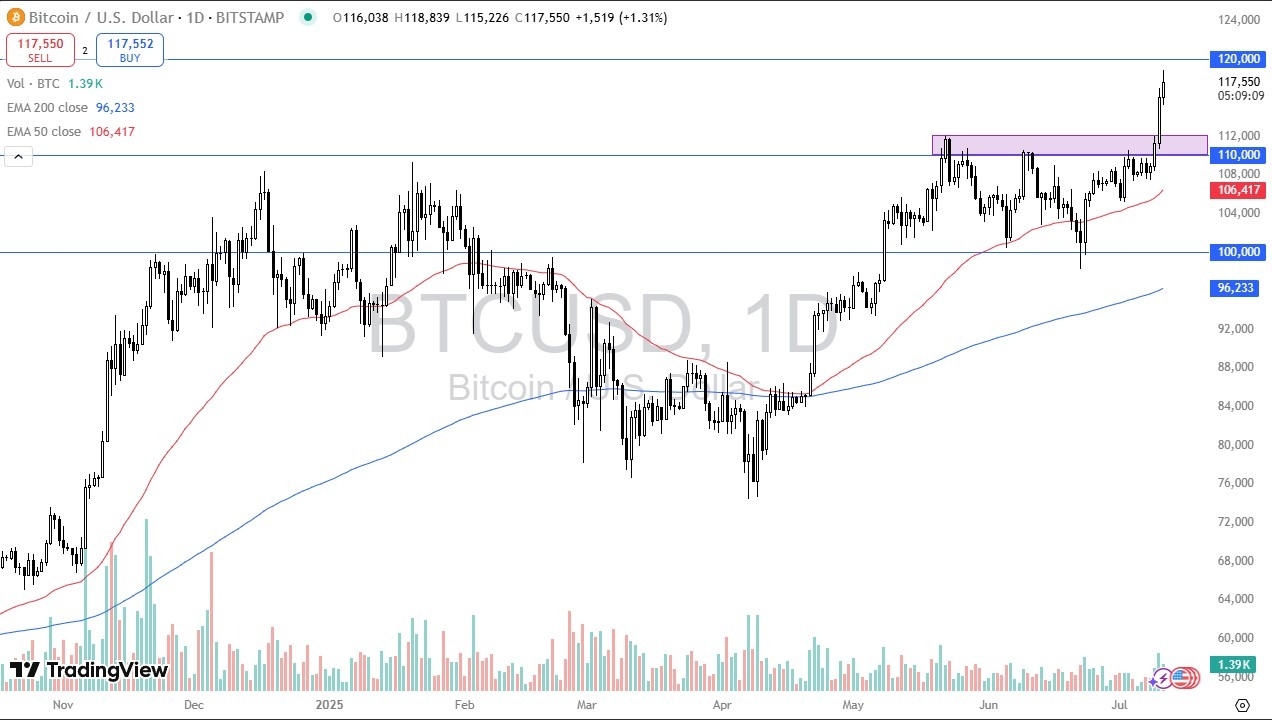

- Bitcoin continues to see buyers on Friday as we are reaching toward the crucial $120,000 level.

- The market has absolutely exploded to the last couple of days, which is a bit interesting because it seemingly came out of nowhere.

- This is exactly what Bitcoin does most of the time though, grains sideways and does nothing for long periods of time, only to see yet another impulsive move higher.

Now that bitcoin is a Wall Street asset, it’s hard to tell exactly what is driving this move most of the time, but it does make a certain amount of sense that traders will continue to look at this through the prism of what institutions are doing, as Bitcoin is no longer a “decentralized asset.” I know purists will argue this point, but the reality is that major corporations like BlackRock are now involved, and therefore it has completely changed the overall attitude of this market. In fact, I look at Bitcoin as an ETF at this point.

Momentum Begets Momentum

The thing about It point you need to understand is that momentum will drive even more momentum into the market. At this point, short-term pullbacks should attract a certain amount of attention as we have clearly gotten the attention of most traders now that we are well above the $112,000 level. If you have been following me for a while, I suggest that we consolidate and try to drive this market much higher, but the $112,000 level was a difficult barrier. I suggest that eventually we would have a “measured move” for Bitcoin to go looking to the $120,000 level, based on the consolidation that we have just broken out.

Ultimately, I believe that the area right around the $110,000 level should not be a bit of a floor, and therefore I think you have got a situation where traders will continue to look at this market as one that offers value on dips. If we break above the $120,000 level, then the next target will end up being $125,000, mainly due to the psychology involved in that level.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.