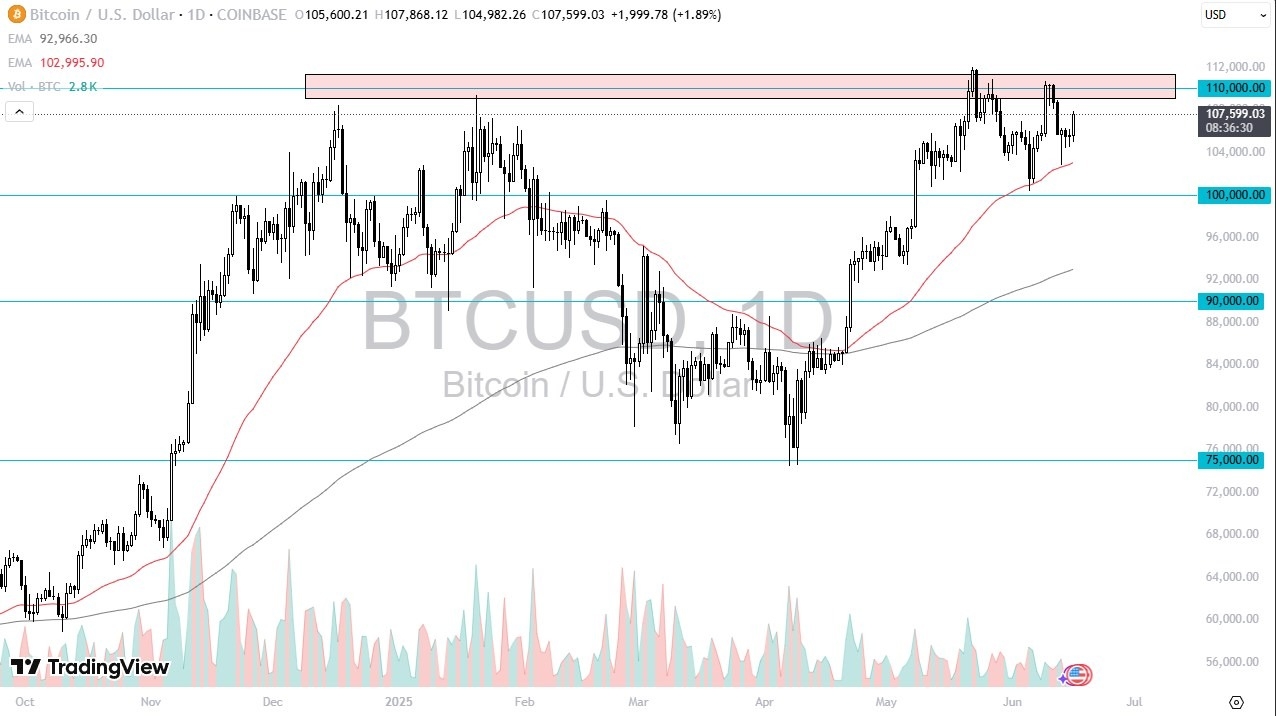

- The bitcoin market has rallied a bit during the early part of the trading session on Monday, after initially trying to fall.

- The market looks as if it is paying close attention to the $105,000 level, an area that has been important multiple times, and with that being the case, I think that’s an area that we need to continue to watch, and it is particularly interesting that we have launched from there yet again.

- Underneath there, the 50 Day EMA currently hangs around the $102,000 level and is rising, so therefore I do believe that there is support in that particular area.

Technical Analysis

The technical analysis for this market is obviously bullish, but we also have a significant amount of resistance above that is going to continue to be something that we need to pay close attention to, especially near the $112,000 level, an area that was the most recent high.

If we can break above there, the market is likely to open up the next leg higher, and we could have a situation where traders will continue to look at this through the prism of a “buy on the dip” scenario, but I also recognize that bitcoin can be very volatile, and with all of the noise that we see around the world, it does make a certain amount of sense that we might get the occasional sharp pullback.

The 50 Day EMA obviously is important, but even if we break down below it, I anticipate that the $100,000 level is an area that should be massive support as well. As long as we can stay above that level, then I think we get a certain number of buyers jumping into the market. Anything below would be a bit of a surprise and could open up a much deeper correction. Nonetheless, I think that correction will probably be somewhat limited, and probably more or less something to do with a random headline that spooks the market, but longer term, this looks like a bullish market to me.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.