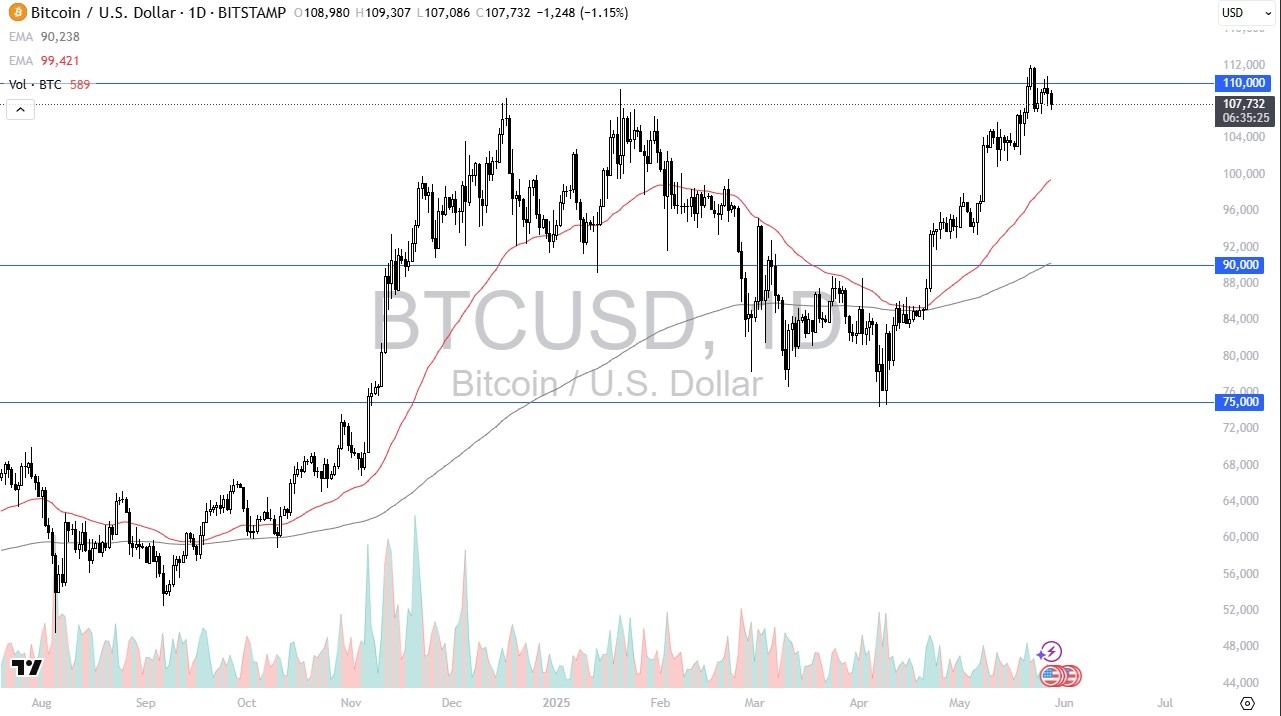

- Bitcoin has fallen a bit during the trading session on Wednesday as we continue to see a lot of noise overall.

- That being said, I do think you have a situation where we are just trying to determine whether or not we can continue to go higher.

- The $110,000 level is an area that I think a lot of people will be paying close attention to.

As a result, we need to just let the market come to us as it were. I don’t have any real interest in trying to short Bitcoin. And even if we do fall from here, then fine. I’ll be looking at the $100,000 level as a potential area of interest, assuming we even drop that far. And quite frankly, I don’t know that we will.

Areas of Interest

There is some interest right around $105,000 as well. So, I think your downside is somewhat limited here. I’m not even a Bitcoin believer, but I’m the first to admit that prices go up. It goes from the lower left to the upper right. And that’s really the most important story here. If we can break above the recent swing high at about $112,000, your next measured move is to $120,000.

Although I think we will go higher than that. Now, all of that being said, we have rallied significantly over the course of a month and added roughly 35-40 % to the price of Bitcoin, so a pullback isn’t the most ridiculous thing to think about. In fact, it’s quite healthy.

So, in this environment, generally you will see either a significant pullback or sideways action, both of which are about killing off some of the excess froth, and we most certainly have it here. So, a little bit of patience probably goes a long way. Either way, I remain bullish. I don’t have any interest in shorting Bitcoin.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.