Long Trade Idea

Enter your long position between 63.39 (the intra-day low of its last bearish candle) and 66.59 (yesterday’s intra-day high).

Market Index Analysis

- Best Buy (BBY) is a member of the S&P 500.

- This index remains near its record high, but bearish trading volumes have increased.

- The Bull Bear Power Indicator of the S&P 500 turned bearish.

Market Sentiment Analysis

Following yesterday’s reversal that recovered most of Friday’s post-NFP losses, the focus remains on tariffs and earnings. AMD will grab the attention as investors seek confirmation that the AI story remains strong. US President Trump continues his tariff strikes, once again singling out India and its trade with Russia, to which India responded with its data on US and EU trade with Russia. The last two sessions have shown that volatility is likely to persist, but the cracks in the bull cycle are becoming increasingly apparent.

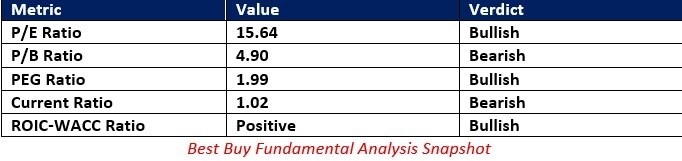

Best Buy Fundamental Analysis

Best Buy is a consumer electronics retailer in an ongoing transition to a multichannel online-first retailer. It also produces in-house products under eight brands.

So, why am I bullish on BBY despite price action retreating?

Best Buy remains one of the most recognized and trusted electronics retailers. I like its transition to online, which accounts for roughly one-third of US revenues, and consumers receive over 60% of orders within one day. The new partnership with Ikea should boost foot traffic. I also like its in-store zones for gaming, appliances, and VR, which confirms its focus on customer experience.

The price-to-earnings (P/E) ratio of 15.64 makes BBY an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 28.79.

The average analyst price target for BBY is 78.52. It suggests excellent upside potential from current levels.

Best Buy Technical Analysis

Today’s BBY Signal

- The BBY D1 chart shows price action inside a horizontal support zone.

- It also shows price action bouncing off the descending 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish but has been improving with the potential of a bullish crossover.

- Trading volumes remain bearish but within their average trading volumes.

- BBY corrected as the S&P 500 hovers near records, a bearish sign, but it remains well-positioned to enter a breakout sequence.

My Call

I am taking a long position in BBY between 63.39 and 66.59. BBY has low valuations with excellent growth prospects. Tariffs will have a short-term impact as consumers delay big-ticket purchases, but I believe the ongoing transition will deliver results. I will continue buying the dip in Best Buy.

- BBY Entry Level: Between 63.39 and 66.59

- BBY Take Profit: Between 76.40 and 78.52

- BBY Stop Loss: Between 59.16 and 60.30

- Risk/Reward Ratio: 3.08

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.