- The Canadian Dollar fell even further against the Greenback on Friday.

- Trump has pivoted back to tariff threats on Canada as trade deals remain limited.

- The tariff deadline of August 1 is fast-approaching, and Canada has shown little movement thus far.

The Canadian Dollar (CAD) took another hit on Friday, extending into a two-day backslide against the US Dollar (USD) as Loonie traders hunker down for a fresh bout of tariff-fueled tirades from United States (US) President Donald Trump. The Trump administration’s self-imposed deadline of August 1 for steep “reciprocal” tariffs, which have been announced, delayed, and then delayed again, is approaching quickly. However, the Trump team has had significant difficulty securing meaningful trade deals so far.

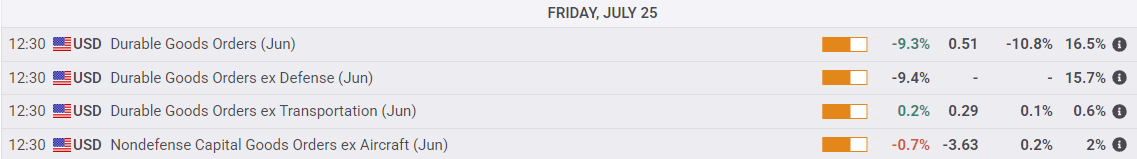

US Durable Goods Orders fell slightly less than expected in June, providing a questionable amount of support for the Greenback. Rumors are swirling that some sort of headway will be made on trade between the US and the European Union (EU) over the weekend, but nothing is set in stone.

Daily digest market movers: Trade talk returns to the top of the Canadian Dollar pile

- A sharp, two-day reversal in Loonie bidding has pushed the US Dollar even higher against the Canadian Dollar.

- Despite a firm bullish pivot near-term, USD/CAD is still trading within a stubborn congestion zone, and price action is knocking on key technical resistance levels.

- Trump mused about his lack of luck in trade talks with Canada, citing a lack of “negotiation” from Canadian Prime Minister Mark Carney’s government.

- The terms of trade between the US and Canada remain largely governed and unchanged from the USMCA trade deal that Trump himself renegotiated out of the long-standing NAFTA agreements during his first term.

- US Durable Goods Orders fell slightly less than expected, and markets are eating the -9.3% contraction with grace, brushing off the sharpest month-to-month decline in Durable Goods Orders since the COVID pandemic.

Canadian Dollar price forecast

Despite a firm bullish tilt in the USD/CAD pair, the Canadian Dollar is still holding strong against the US Dollar overall. USD/CAD has risen sharply in a two-day turnaround, rising back above 1.3700 for the first time in nearly a week, but the 50-day Exponential Moving Average (EMA) has priced in a firm technical ceiling near 1.3730.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.