Short Trade Idea

Enter your short position between 28.07 (the intra-day low of the current sell-off) and 30.00 (the mid-range of its horizontal resistance zone).

Market Index Analysis

- Carnival (CCL) is a member of the S&P 500.

- This index trades near record highs, but bearish developments build up underneath.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Equity markets pushed higher last week amid optimism for a 50-basis-point interest rate cut by the end of the year, supported by the ongoing hype surrounding AI. Inflation will come into focus with this week’s CPI and PPI reports, as investors await the impact of tariffs, but it may be too early to be reflected. Debt market jitters intensify, but equity investors ignore them for now. The underlying economic slowdown that may prompt an interest rate cut is a double-edged sword that could force a correction, but today’s sentiment remains bullish.

Carnival Fundamental Analysis

Carnival is a cruise ship operator with over 90 vessels in its fleet and nine cruise line brands. It is one of the most recognized cruise line operators, known for organizing theme-based cruises.

So, why am I bearish on CCL after its breakdown?

The economy is slowing, competition is rising, and CCL relies heavily on debt. Underlying shareholder value destruction and declining profit margins are red flags investors should not ignore. Double-digit negative earnings per share growth adds to concerns for Carnival, and it reported negative earnings in four of the past five years.

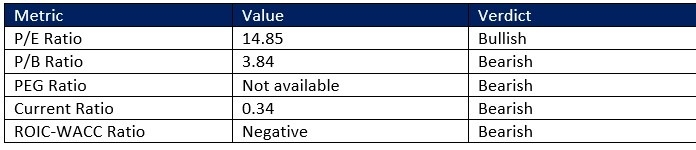

Carnival Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 14.85 makes CCL an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.49.

The average analyst price target for CCL is 32.68. The upside potential is limited, while downside risks are expanding.

Carnival Technical Analysis

Today’s CCL Signal

- The CCL D1 chart shows price action completing a breakdown below its horizontal resistance zone

- It also shows price action approaching its ascending 38.2% Fibonacci Retracement Fan level

- The Bull Bear Power Indicator is bearish with a descending trendline

- Bearish trading volumes have increased during the breakdown

- CCL corrected with the S&P 500 advancing, a significant bearish signal

My Call

I am taking a short position in CCL between 28.07 and 30.00. The underlying fundamentals support the breakdown, and technical bearish signals are rising. Carnival destroys shareholder value, uses debt to maintain a shrinking competitive edge, and remains on the cusp of losing its pricing power. I will sell the rallies in CCL.

- CCL Entry Level: Between 28.07 and 30.00

- CCL Take Profit: Between 20.50 and 22.11

- CCL Stop Loss: Between 31.01 and 32.68

- Risk/Reward Ratio: 2.58

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.