Key takeaways

-

CHWY’s Q1 net sales rose 8.3% year over year to $3.12B, led by strength across customer segments.

-

Hardgoods sales rose 12.3% on better inventory, new brands and faster market execution.

-

Autoship sales grew 14.8% to $2.56B, reaching a record 82.2% of total net sales in the quarter.

Chewy, Inc. (CHWY – Free Report) reported solid first-quarter fiscal 2025 results, wherein both top and bottom lines beat the Zacks Consensus Estimate and increased year over year.

The company delivered top-line growth that exceeded the high-end of its net sales guidance. Its strong performance was driven by robust active customer growth and high Autoship customer loyalty.

The company continued expanding its Chewy Vet Care initiative, opening three new clinics and bringing the total to 11 locations across four states. Performance exceeded expectations in customer acquisition and ecosystem engagement. The company remains on track to open eight to 10 new clinics in fiscal 2025.

Chewy price, consensus and EPS Surprise

CHWY’s quarterly performance: Key metrics and insights

Chewy posted adjusted earnings of 35 cents per share, which beat the Zacks Consensus Estimate of 34 cents. The figure increased 12.9% from the prior-year period. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The company reported net sales of $3,116 million, surpassing the Zacks Consensus Estimate of $3,076 million. The figure increased 8.3% from $2,877.7 million posted in the year-ago period. The strong performance was supported by continued momentum across new and existing customers, a favorable mix of core consumables, health and wellness categories, and particularly strong growth in hardgoods.

Hardgoods sales grew 12.3% year over year to $342.2 million, driven by improved assortment, better inventory lifecycle management, enhanced discoverability and a faster go-to-market strategy, including the addition of more than 150 new brands in the past two quarters. Consumable sales grew 6.4% year over year to $2.18 billion. The Zacks Consensus Estimate was pegged at a 6.1% rise in Hardgoods net sales and a 5.7% increase in Consumables net sales for the fiscal first quarter.

The Autoship subscription program remained a cornerstone of Chewy’s model. Autoship customer sales grew 14.8% to $2.56 billion, outpacing overall net sales growth. The metric represented 82.2% of total net sales, a record for the company. New customers and reactivations increased, while gross churn improved. The company ended the fiscal first quarter with 20.8 million active customers, a 3.8% increase year over year.

Chewy’s net sales per active customer reached $583, reflecting a 3.7% year-over-year increase. Improvements were attributed to stronger customer retention, higher reorder rates and increased cross-category purchases, especially from members in the Chewy+ loyalty program, which showed early promise following its launch.

CHWY’s margin and cost performance

Chewy’s gross profit increased 8.2% year over year to $923.8 million. The gross margin decreased 10 basis points (bps) to 29.6% compared with 29.7% in the first quarter of fiscal 2024.

SG&A expenses rose 8.4% year over year to $653.1 million in the fiscal quarter. As a percentage of net sales, SG&A expenses increased 10 bps year over year to 21%. Advertising and marketing expenses for the fiscal first quarter totaled $193.8 million, up 3.7% year over year. Due to the timing of certain marketing campaigns, this expense category provided a modest leverage benefit during the quarter.

The adjusted EBITDA was $192.7 million, an increase of 18.3% from $162.9 million reported in the year-ago quarter. The adjusted EBITDA margin increased 50 bps year over year to 6.2%.

CHWY’s financial health snapshot

The company ended the quarter with $616.4 million in cash and cash equivalents, remained debt-free and reported total liquidity of approximately $1.4 billion. Total shareholders’ equity was $375.6 million.

In the fiscal first quarter, the company reported free cash flow of $48.7 million, with $86.4 million in net cash provided by operating activities and $37.7 million in capital expenditures.

The company repurchased approximately 665,000 shares for a total of $23.2 million under the existing program. As of the end of the quarter, $383.5 million of repurchase capacity remained available under the current authorization.

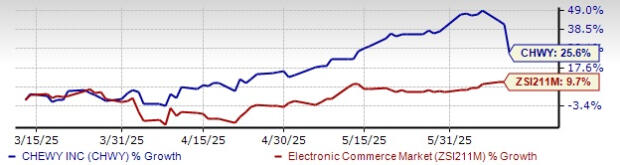

CHWY stock Past three-month performancep

Image Source: Zacks Investment Research

What to expect from CHWY in the future?

For the second quarter of fiscal 2025, Chewy expects net sales to be between $3.06 billion and $3.09 billion, representing year-over-year growth of approximately 7% to 8%. Adjusted earnings per share are projected to range from 30 cents to 35 cents. Gross margin is expected to show sequential improvement from the fiscal first quarter, driven by continued strength in sponsored ads, favorable product mix and Autoship contribution. However, adjusted EBITDA margin is expected to modestly decline from the fiscal first quarter due to normal seasonal trends and the timing of certain investments.

For fiscal 2025, Chewy expects net sales to be between $12.3 billion and $12.5 billion, representing approximately 6% to 7% year-over-year growth when adjusted to exclude the impact of the 53rd week in fiscal 2024. The company is maintaining its adjusted EBITDA margin guidance between 5.4% and 5.7%. The midpoint of this range represents approximately 75 basis points of year-over-year expansion. Approximately 60% of this margin expansion is expected to come from improvements in gross margin.

Chewy anticipates converting around 80% of adjusted EBITDA into free cash flow in fiscal 2025, translating to approximately $550 million. Capital expenditures are expected to come in at the low end of the previously stated range of 1.5% to 2% of net sales. Advertising and marketing expenses are projected to remain in line with the prior year, at approximately 6.7% to 6.8% of net sales, consistent with the long-term target range of 6% to 7%.

This Zacks Rank #3 (Hold) stock has gained 25.6% in the past three months compared with the industry’s growth of 9.7%.

Stocks to consider

Sprouts Farmers (SFM – Free Report) , which is engaged in the retailing of fresh, natural and organic food products, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SFM delivered a trailing four-quarter earnings surprise of 16.5%, on average. The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings implies growth of 13.7% and 35.5%, respectively, from the year-ago reported numbers.

Urban Outfitters Inc. (URBN – Free Report) is a lifestyle specialty retailer that offers fashion apparel and accessories, footwear, home decor and gift products. It currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for URBN’s fiscal 2025 earnings and sales implies growth of 21.2% and 8.1%, respectively, from the year-ago actuals. URBN delivered a trailing four-quarter average earnings surprise of 29%.

Canada Goose (GOOS – Free Report) is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Canada Goose’s current fiscal-year earnings and sales indicates growth of 10% and 2.9%, respectively, from the year-ago actuals. Canada Goose delivered a trailing four-quarter average earnings surprise of 57.2%.

Five stocks set to double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report