Short Trade Idea

Enter your short position between 217.92 (the descending midpoint of its bearish price channel) and 221.32 (the close of its last bullish candle).

Market Index Analysis

- Cintas Corporation (CTAS) is a member of the NASDAQ 100 and the S&P 500.

- Both indices are near record highs with technical cracks flashing warning signals.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Futures suggest more volatility ahead after US President Trump announced a trade deal with Japan and tariffs of 15%. He also announced a trade deal with the Philippines, but Manila has not confirmed anything. Earnings will drive market sentiment, and the AI craze is dominant, but investors should not ignore the non-AI sector, where economic red flags suggest uncertainty. Today’s trading session might offer little direction, as investors await earnings from Alphabet and Tesla after the bell.

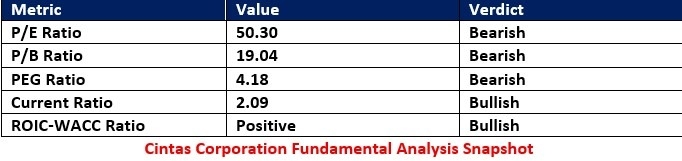

Cintas Corporation Fundamental Analysis

Cintas Corporation provides corporate uniforms via rental and sales programs. It also sells a range of office equipment from janitorial to safety products. It is one of the largest companies in its sector with over 44,000 employees.

So, why am I bearish on CTAS after its earnings release?

Cintas announced upbeat guidance, but its valuations are sky-high, and its share price continues to correct itself. While the US announced patchwork trade deals, economic uncertainty remains, as each trade deal features higher tariffs than the current 10%. The PEG ratio suggests earnings do not grow fast enough to justify its current price, and investors underestimate the foreign exchange impact on CTAS.

The price-to-earnings (P/E) ratio of 50.30 makes CTAS an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.10.

The average analyst price target for CTAS is 218.93. It suggests limited upside potential from current levels.

Cintas Corporation Technical Analysis

Today’s CTAS Signal

- The CTAS D1 chart shows price action inside a bearish price channel.

- It also shows a breakdown below the 50.0% Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bullish but displays rising bearish momentum.

- Trading volumes are higher during selloffs than during rallies.

- CTAS corrected as the S&P 500 Index rallied to fresh highs, a significant bearish development.

My Call

I am taking a short position in CTAS between 217.92 and 221.32. The valuations and PEG ratio are fundamental issues, while the technical picture flashes sufficient bearish confirmations. I see limited upside potential in CTAS, while downside risks continue to increase.

- CTAS Entry Level: Between 217.92 and 221.32

- CTAS Take Profit: Between 184.61 and 196.38

- CTAS Stop Loss: Between 229.24 and 236.12

- Risk/Reward Ratio: 2.94

Ready to trade our free signals? Here is our list of the best brokers for trading worth checking out.