Headline risk is real

Headline Risk – when you can throw all your technical and fundamental factors away because the news can completely override all currently available information about the stock market. Sometimes the headlines are good (like today) and sometimes they make you re-consider everything (think the day after the tariffs were announced…OUCH).

Two things to note about that recent OUCH moment in April – trend was already not looking good. The Directional Movement Index (shown below) was already showing that sellers were in control (Red line is above Blue) and the candle bars were already Red (showing RRG Trend). However, the three days leading up to the April sell-off gave some false hope that the market could be turning around…before smacking us all upside the head.

As for the YAY! Moment (today), the candles (RRG Trend) were already Green and Directional Movement had recently turned positive (Blue line is above Red). But in either case, the news that triggered these moves wasn’t expected. Today’s positive news about tariff negotiations could have gone bad in the same amount but in the other direction.

Where are the ducks “heading?”

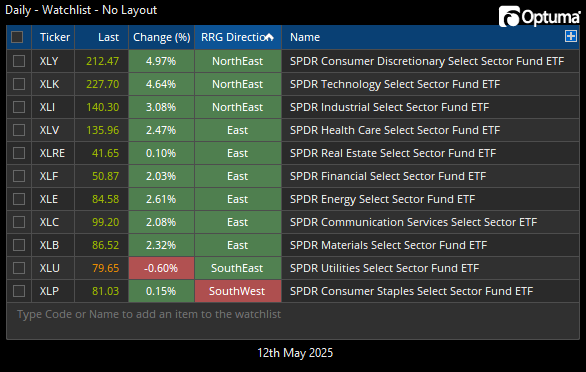

When looking at the S&P 500 sectors on RRG charts, I find several items worth noting. First, I note not only which quadrant (Lagging, Improving, etc.) the “ducks” are in, but also where (in which direction) the “ducks” are heading. This can give a decent heads-up on when a sector, index, or stock might be coming in (or going out) of favor.

In Optuma, I have the current direction listed as a heading (RRG Direction) and colored Green or Red, depending on the current direction of each sector. (Not shown today, I also can have Blue or Orange if a sector is starting its transition from Green to Red or vice versa.)

Mathew Verdouw from Optuma wrote a white paper on this back in 2016 that is worth checking out. TL;DR – It showed that a 45 degree angle (NorthEast heading) is a solid starting point to go shopping for: in this case, a sector to buy.

But let’s take this further. Which of these “ducks” have the best headings right now? Consumer Discretionary (XLY), Technology (XLK), Industrials (XLI), Financials (XLF), and Communications (XLC). The sectors that we’d consider “Growth” are all leading: XLK, XLC, & XLY. While all the “Defensive” names are ranked lower: XLV, XLP, XLU, XLRE. And the “Value” names are split: XLI and XLF vs XLE and XLB.

Growth tends to lead the market, in both directions, so this group is worth watching. And right now, they are all looking good.

Big day for consumer discretionary

This is one of those days when I’m flipping through the performance results of the Sector ETFs and I notice one that jumps way out of the average. While many Sector ETFs were showing a positive 2%+, the Consumer Discretionary sector shows being up almost 5% today. Wow, that is quite a gap upward.

So what drove that? The top holding is Amazon (AMZN), which was up 8.07% today. Also, Tesla (TSLA) was up 6.75%. Yeah, that will help. Just these two stocks make up just over 38% of this index. The next top holdings in this index all looked similar to the other sectors. What a difference just a few holdings can make!

While a somewhat surprise up-day in the market is always welcome, I’m still keeping in mind the potential Seasonality issues that tend to appear in mid-May. There is also a “Bear” image in my Stock Trader’s Almanac for tomorrow, meaning a high-probability of a down day on May 13th. Those may be working together behind the scenes to give us some short-term volatility. And don’t forget that this Friday is options expiration.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!