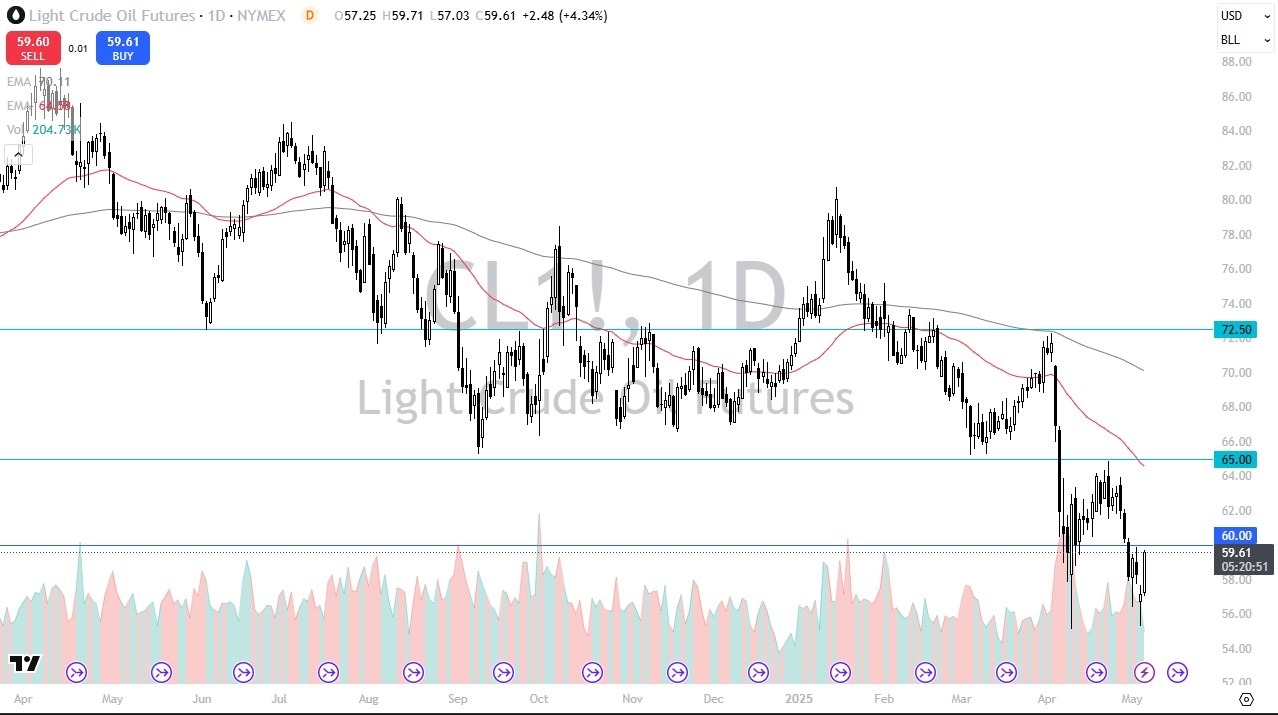

- The light sweet crude oil market has rallied pretty significantly during the trading session on Tuesday as we continue to see a lot of volatility.

- The market is in the process, at least it appears, of forming a double bottom at the $55 level.

- We attempted this once before at the $60 level. And I think this is one of those situations where sooner or later it has to stick.

- After all, no market falls forever, although lets not forget oil once went negative!

There are large orders coming into the market occasionally that I’ve been watching. So, I think somebody is trying to keep this somewhat afloat. It’s interesting because OPEC continues to pump oil out there while at the same time the demand is shrinking. So clearly something is breaking somewhere in the Middle East, I suspect, as they need to make money in order to make their citizenry happy.

I am Still Interested in Longs

So, as this plays out, I remain interested in crude oil, but I also need to see an impulsive move to the upside. This has been a very good one, but we also have the FOMC on Wednesday that will clearly have an influence as well. So, I would be very cautious at this point, but I am looking for buying opportunities. We need to get the FOMC out of the way. Then we can start to have that conversation. I do think you have a scenario where traders are going to look at this as a market where you try to find value. The question of course is, are you going to? I’d wait about 24 hours, but I am waiting to see on a daily close above 60. It might be worth taking a little bit of a risk here.

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.