- Speculative buying in WTI Crude Oil has produced a price near 67.400 in the CFD futures market. This while the spot (cash market) price for WTI Crude Oil is within sight of 69.000 USD.

- The price on the 24th of June was nearly 64.300 in the futures market. A steady development of buying force has been seen in WTI Crude Oil the past two weeks possibly based on speculative strength, but also perhaps on the notion the U.S economy is showing signs of vigor.

- The price of WTI Crude Oil remains within a lower longer term band when judged historically. Any price for WTI Crude Oil below the 70.000 USD level is largely seen as a victory for manufacturers and consumers.

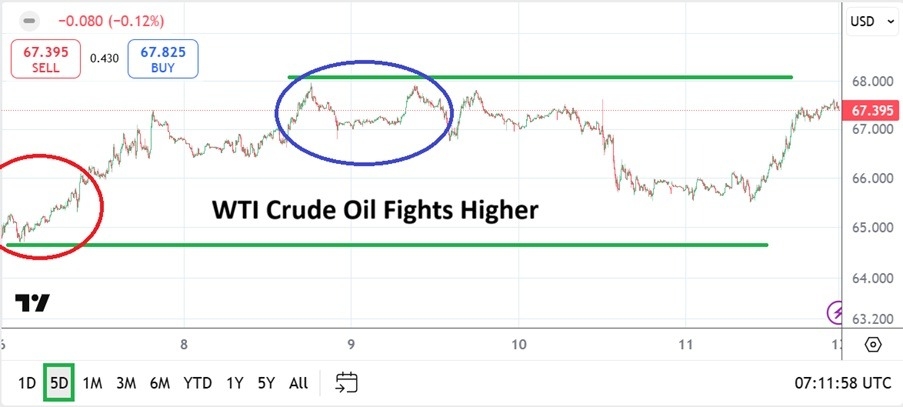

- The price of the commodity has risen in the past week again, highs near the 68.000 ratio were seen in the futures market on Tuesday and Wednesday. Depending on where a trader bets on WTI Crude Oil they should make sure exactly what they are trying to pursue, it can be a spot price or a futures (CFD) value – and there will be a difference.

After starting last week near the 64.700 CFD vicinity, the price of WTI Crude Oil quickly jumper higher and by late on Monday the ratio was near 67.400. Which is intriguing because going into this weekend the price of WTI Crude Oil is roughly the same thing. The give and take in WTI Crude Oil the past handful of days has seen normal price action when support and resistance levels are considered.

Yes, WTI Crude Oil finished the week’s trading with a higher price compared to its starting point. The buying in the commodity after starting last week near lows experienced solid support around 65.500 on Thursday and Friday. After challenging support levels on early Friday, WTI Crude Oil found some buyers once again. Tomorrow’s opening will prove useful for traders who want to observe the first couple of hours to try and get a feel for speculative sentiment.

While the GDP numbers from the U.S have been lackluster the past few months, lower inflation data and improved consumer sentiment statistics may be pointing towards an improving U.S economy. There are also the better than expected jobs numbers which were seen on the 3rd of July which hints at better outlook. This could be helping speculative buying notions in WTI.

- This week the U.S will issue inflation number mid-week and Retail Sales results as the week concludes.

- Crude Oil is certainly speculated on by large players who are trying to gauge demand and may believe there may be a larger need for WTI Crude Oil moving forward.

- However, supply remains plentiful and the price of the commodity may have found the top its it range when it flirted with the 68.000 vicinity in the futures markets.

- Yet, a warning sign blares, the price of WTI Crude Oil in the cash market is higher, which may indicate stronger demand exists near-term.

WTI Crude Oil turned in an impressive upwards trend last week, but buying price action has actually been seen the past couple of weeks. Support levels have incrementally risen and proven durable. If WTI Crude Oil tests the 66.000 level below early this week and shows that buyers step in, this could be a sign sentiment remains speculative and buyers may be leaning into targets that believe the commodity can go higher.

Day traders are advised not to get overly ambitious in WTI Crude Oil, a price range between 66.000 and 68.500 might prove to be a rather solid testing ground. If the upwards trend in WTI Crude Oil continues and highs are being seen after the U.S inflation reports mid-week, this could be a sign some actually believe a legitimate tests higher awaits. Having said that and pointed out reasons why WTI Crude Oil can go higher, if speculative buyers run out of steam, lower realms would not be ultra-surprising either this week given the price range of the commodity.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.