By Robert Petrucci

Fact-checker Justin Paolini

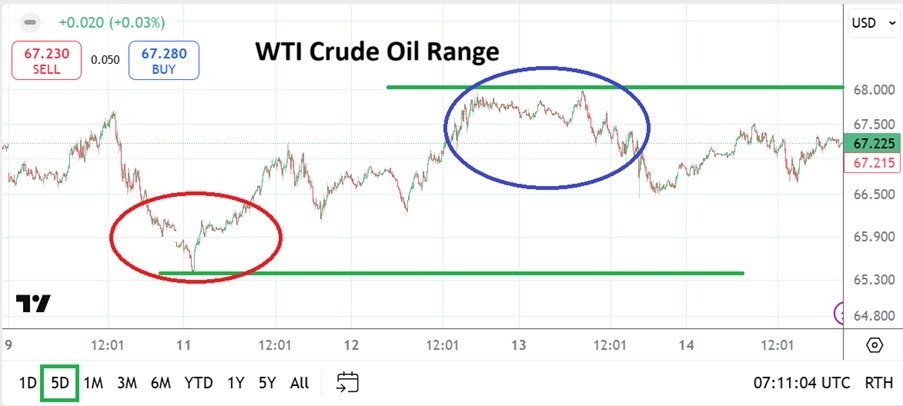

- WTI Crude Oil has become a speculative delight for traders seeking to take advantage of technical ratios, as its range appears to be solidifying. The weakness that has been demonstrated in the commodity the past two months has been clear and this has happened in no small measure because of President Trump’s proactive energy stance.

- The price of WTI Crude Oil started out last week with a test of lower boundaries and approached the 65.200 level on Tuesday, but then the commodity embraced a reversal upwards which took it to nearly 68.000 USD on Wednesday, only to see sellers then get motivated and go into the weekend around 67.225.

- Sustained trading within the lower realms of its one month technical price range are rather easy to define with a simple glance at charts.

No, there isn’t a way to guarantee that WTI Crude Oil will not go higher because of a loud geopolitical event, or some large players who try to drive the price of the commodity higher. However, the appearance of sustained prices below the 68.000 with only hairline outliers happening this past Wednesday, indicates WTI Crude Oil remains with the grasp of a market that believes it is likely priced fairly for the moment.

Traders looking to take advantage of WTI Crude Oil could simply jump into wagers with market orders that try to engage price momentum. Yet, patient speculators may find that opportunities await bets which try to take advantage of perceived support and resistance areas which are provideing rather durable signals. The plunge lower last week certainly must be considered, but anything below 66.000 USD in WTI Crude Oil can still be looked upon suspiciously.

Yes, the price of the commodity can certainly go lower and be sustained, but until trading below the 65.000 USD mark is demonstrated for a duration, looking for upside around 66.000 feels logical. However, as day traders also know finding solid lows or durable resistance above is not easy. Thus, wagering on a middle range perhaps between 67.750 to 66.500 may prove like a legitimate playing field in the near-term. It still appears that there is less likelihood of a strong surge higher in WTI Crude Oil compared to a stronger move lower.

- Pain thresholds for speculators are important when they are considering their trades.

- It is unlikely that a chosen direction in WTI Crude Oil will be accomplished right away for a trader.

- Traders must be able to endure some momentum which initially goes against them when wagering on the commodity.

- Stop losses must be used, but also give you enough space to allow WTI Crude Oil to trade when it is battling a range.

The past two months of trading in WTI Crude Oil have been comfortable for traders who have had patience and sought lower values. However, now that the commodity has attained the lower price realms and is banging up against long-term support, trends in WTI Crude Oil will likely be more difficult to find, which means day traders will once again will have to consider active price ranges.

The lows seen last week were intriguing, while not shocking that the 65.200 vicinity was challenged, the 66.000 ratio would have to see sustained trading below to consider the 65.000 mark vulnerable. The Trump administration would certainly like to see prices lower in WTI Crude Oil and this goal will keep them proactive, but at some point business also becomes important and the knowledge that producers must make a profit is legitimate. Meaning that prices that are too low could become problematic too, the temptation to think WTI Crude Oil will remain trading within its current range is not farfetched.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.