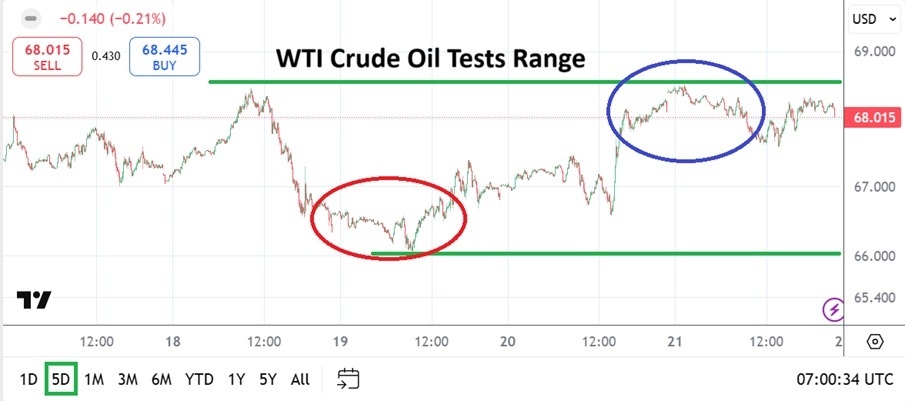

- WTI Crude Oil saw a test of its price range which tested highs above 68.450 USD on Tuesday. Lows near 66.070 on Wednesday, followed by an incremental climb which then sold off and touched a low near 66.600 on Thursday, sparking buying action and a high around 68.500. While finishing the week’s trading near 68.000.

- Signs that WTI Crude Oil has found equilibrium which large traders feel comfortable within have been evident the past few weeks.

- Support levels around 66.000 have been targets and produced outliers lower, but have also created reversals upwards which have tested 68.000 and above on occasion.

- Speculators will have interesting decisions to make and should certainly watch trading results on Monday and Tuesday of this week cautiously.

Price ranges in commodities like WTI Crude Oil certainly test outliers even as known price ranges are getting tested. Speculation in WTI Crude Oil has proven that a bearish trend has been in effect since the middle of January. A glance at a one month chart shows WTI Crude Oil is within the lower realms of its range, a look at a three month chart lends itself to the perception the commodity is definitly struggling and producing lows even after finishing near the 68.000 mark this weekend.

Perceptions via day traders will vary depending on their technical leanings early this week, but large players are the ones that control the WTI Crude Oil market. Proactive production rhetoric remains abundantly clear via the Trump administration, but it should be pointed out that it does take a while to get infrastructure in place to actually drill for oil. Meaning supply while healthy isn’t bursting at the seams quite yet.

WTI Crude Oil prices may be feeling some reactions to the ongoing talks of tariffs and economic outlooks globally. However, the commodity remains within its known price range and trading early this week will prove to be an interesting window into the thinking of large players.

- The ability to demonstrate the 68.500 vicinity, and consideration it is overbought territory is interesting.

- If WTI fails to test the 68.150 to 68.200 marks early this week, this could signal bearish sentiment is still in control of market forces.

- Price velocity lower early this week would not be an earth shattering surprise, but a steady move lower is more likely.

- What would be surprising is fast upwards price action that penetrates the 68.500 mark and actually tests the 69.000 limit.

The test of the known price range in WTI Crude Oil this past week should be of interest to day traders, but not a cause for alarm. The ability to move higher and test resistance levels may spark the temptation to look for lower values. If WTI Crude Oil opens with relatively tame price movement tomorrow, and shows little ambition of retesting higher resistance areas seen last week, may be a sign lower prices will be demonstrated.

However, the current price of WTI Crude Oil may also simply become choppy within its current realms. Lower prices seen recently are likely to be tested again, but it is a question of momentum and what larger players actually need to transact in the energy marketplace. The desire to look for prices in WTI which seek the 67.750 to 67.500 prices may prove to be correct, but speculators should remain realistic with their targets as they ride trends being created by influence coming from large commodity trading houses.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.