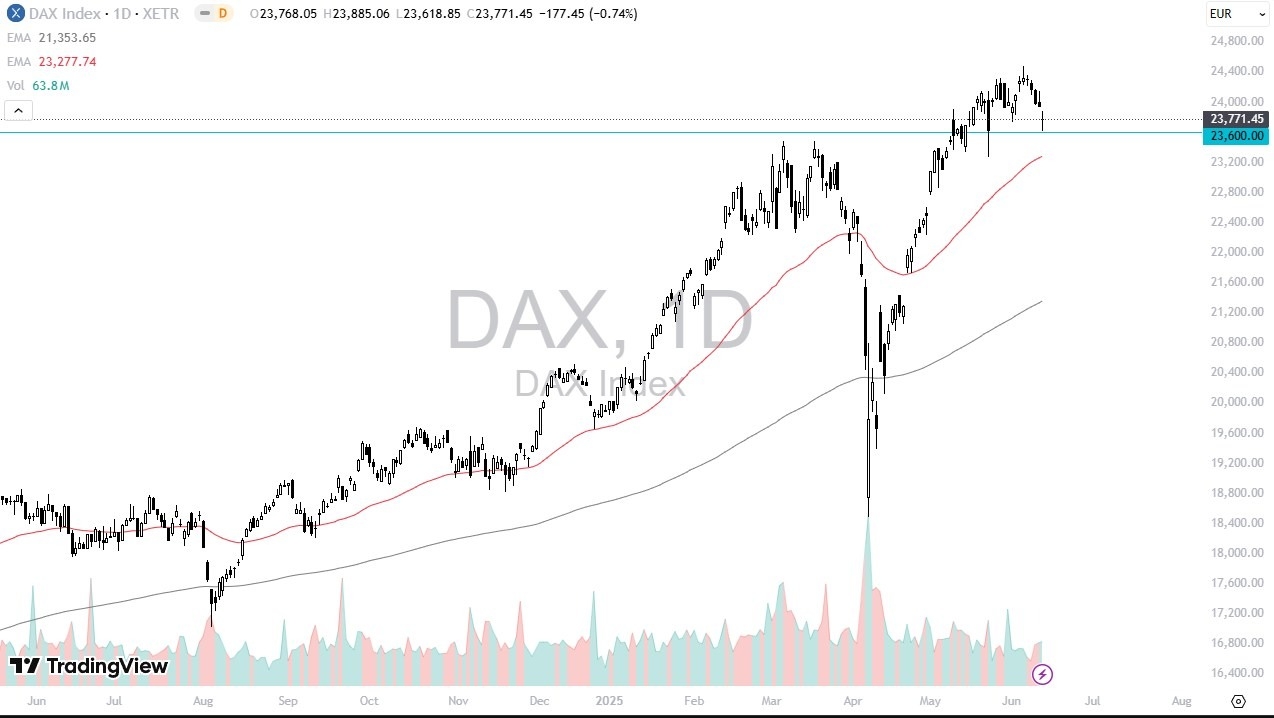

- The German index had gapped lower during the trading session at the open and then went back and forth pretty wildly.

- As we continue to look at the 23,600 euros level as an area of interest from a support standpoint, the 50 day EMA is sitting at the 23,200 euro level and rising.

- So, this obviously has a bit of an influence on how things go, but ultimately, I think this is a scenario where you are still buying the dip.

I think there are still plenty of reasons to think that the DAX continues to go higher, but I also recognize that the market breaking down below there and the 50 day EMA is possible.

Not likely, But Possible

It’s somewhat unlikely at the moment, but it is possible. And it’s something that we will have to keep an eye on. Ultimately though, I think it’s a situation where the traders are just looking at this through the prism of value as Germany of course is the biggest economy in the European Union.

There is a school of thought that thinks the European Union is going to be firing on all cylinders. If that’s the case, then Germany will lead the way, and we have seen that over the last several weeks. A break above the 24,500 euro level opens up a move to the 25,000 euro level, but we have some work to do. I think right now we’re probably going to settle in a little bit of sideways grinding action. This could happen for a little while, but ultimately, I believe that Germany will return to being one of the best indices that I follow going forward. I have no thoughts whatsoever of shorting this market, and will remain bullish and patient in the meantime.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.