Key takeaways

-

DXCM Q2 sales rose 15.2% to $1.16B, beating estimates; U.S. and international markets both grew double digits.

-

DXCM gross margin fell 340bps to 60.1% on logistics costs; full-year gross margin guidance remains at 62%.

-

DXCM raised 2025 revenue outlook to $4.6-$4.625B, citing new coverage wins and strong CGM demand momentum.

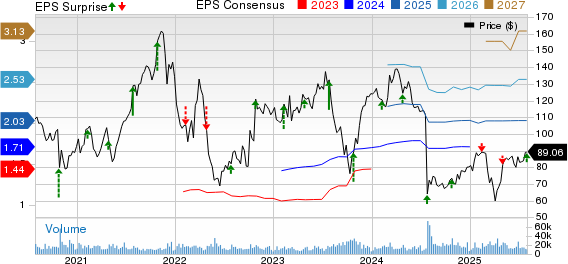

DexCom, Inc. (DXCM – Free Report) reported second-quarter 2025 adjusted earnings per share (EPS) of 48 cents, which beat the Zacks Consensus Estimate of 45 cents by 6.7%. The company reported earnings of 43 cents per share in the prior-year quarter.

DXCM registered GAAP net income per share of 45 cents, up from the year-ago quarter’s figure of 35 cents.

Revenue details of dexcom

Total revenues grew 15.2% (15% on an organic basis) to $1.16 billion year over year. Sales beat the Zacks Consensus Estimate by 3.1%. The year-over-year revenue growth was driven by continued strong category demand, focused execution and a growing contribution from recent access wins, especially for type 2 diabetes.

Despite better-than-expected results, shares of DXCM declined almost 5.5% during after-hours trading on July 30. The stock has gained 9.9% year to date against a 7.3% decline in the industry. The broader S&P 500 Index has moved up 8% in the same period.

Image Source: Zacks Investment Research

Segmental details of DXCM

Sensor and other revenues (97% of total revenues) increased 18% on a year-over-year basis to $1.12 billion. Hardware revenues (3%) decreased 31% year over year to $39.3 million.

Dexcom revenues by geography

U.S. revenues (73% of total revenues) increased 15% on a year-over-year basis to $841 million. International revenues (27%) improved 16% (14% on an organic basis) year over year to $316.1 million.

Margin analysis of DXCM

Adjusted gross profit totaled $695.9 million, up 9.1% from the prior-year quarter’s level. DexCom reported an adjusted gross margin (as a percentage of revenues) of 60.1%, down 340 basis points year over year.

Research and development expenses totaled $148.2 million, up 9% year over year. Selling, general, and administrative expenses totaled $328 million, down 1.4%.

The company reported total adjusted operating income of $221.8 million, up 13.5% from the prior-year period’s recorded number. Adjusted operating margin (as a percentage of revenues) was 19.2%, down 30 basis points year over year.

Financial position of dexcom

DXCM exited the second quarter with cash, cash equivalents, and marketable securities worth $2.93 billion compared with $2.7 billion in the first quarter of 2025.

Total assets amounted to $7.33 billion, up sequentially from $6.75 billion.

DXCM’s 2025 guidance

DexCom raised its outlook for 2025 revenues. The company now expects revenues to be in the range of $4.6-$4.625 billion (previously $4.6 billion), implying 14-15% year-over-year growth. The Zacks Consensus Estimate was pegged at $4.61 billion.

DXCM expects adjusted gross margin to be approximately 62%. Adjusted operating margin is projected to be approximately 21%.

DexCom, Inc. price, consensus and EPS surprise

Wrapping up

DexCom delivered a solid second-quarter update, marked by double-digit top-line growth and a confident raise in full-year guidance, as it executes on broadening access to CGM and scaling its innovation engine.

Strong new customer additions on the back of expanded reimbursement for the fast-growing type 2 non-insulin population drove U.S. sales. Meanwhile, momentum in international markets was driven by key coverage wins such as Ontario’s Drug Benefit program in Canada and continued traction for the cost-effective DexCom ONE+ platform across Europe.

On the product front, DexCom is leveraging both hardware and software to to keep its business afloat amid rising competition. The upcoming 15-day G7 sensor, cleared by the FDA, is set to be launched in the second half of 2025, while development on the next-gen G8 platform is underway, promising smaller, multi-analyte-ready wearables. Meanwhile, over 400,000 downloads of DexCom’s new Stelo biosensor app highlight consumer adoption beyond diabetes, with integrations like Oura Ring enabling a more personalized health ecosystem.

DXCM’s new AI-powered Smart Food Logging feature for G7 and Stelo enables users to snap meal photos, automatically log details, and assess glycemic impact — enhancing personalization, improving dietary awareness and simplifying diabetes management.

Margins faced near-term pressure, with gross margin at 60.1% due to expedited logistics costs as inventory was being rebuilt. Still, DexCom reaffirmed its 2025 gross margin guidance of 62% and raised full-year revenue guidance.

Management also flagged a succession plan — current CEO Kevin Sayer will step down in early 2026, passing the reins to long-time executive Jake Leach. The transition comes as DexCom doubles down on expanding CGM access, scaling globally and integrating AI-driven features across its platforms.

While CMS’s proposed competitive bidding program for Medicare CGM could emerge as a future headwind, DexCom believes the 2027 start timeline and its differentiated clinical data give it a strong footing. The company’s CGM sensors are now covered by the three largest pharmacy benefit managers. With access opened to approximately 6 million new lives, DexCom sees this as the first step toward a 25 million-person opportunity. With ample cash reserves and a steadily growing base of prescribers and end-users, the company appears well-positioned to maintain leadership in a rapidly expanding CGM market.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report