- The Dow Jones snapped a two-day winning streak on Thursday.

- US PPI inflation soared to a six-month high in July, erasing months of progress.

- Fed rate cut bets sank post-PPI, with rate traders yanking a third cut in 2025 off the table.

The Dow Jones Industrial Average (DJIA) declined on Thursday, ending a two-day bullish run and shedding around 100 points. Equities took a hit after United States (US) Producer Price Index (PPI) inflation rose much faster than expected in July, knocking back bets of three Federal Reserve (Fed) interest rate cuts before the end of the year.

The Dow Jones has fumbled a bullish push to regain the 45,000 major handle, but the major equity index is still trading well into bull country, a full two percent above the 50-day Exponential Moving Average (EMA) near 43,830. Despite fresh weakness on disappointing macro data, the Dow has still managed to claw out nearly 3.8% bottom-to-top from its last swing low.

US PPI rises sharply in July, trims Fed rate cut bets

Core US PPI inflation accelerated to 3.7% YoY in July versus the expected rise to 2.9%, wiping out four months of progress on taming inflation and pushing producer-level price pressures back to where they were when the year started. Headline PPI inflation also rose to a six-month high of 3.3% over the same period, while the previous period saw a slight upside revision to 2.4%.

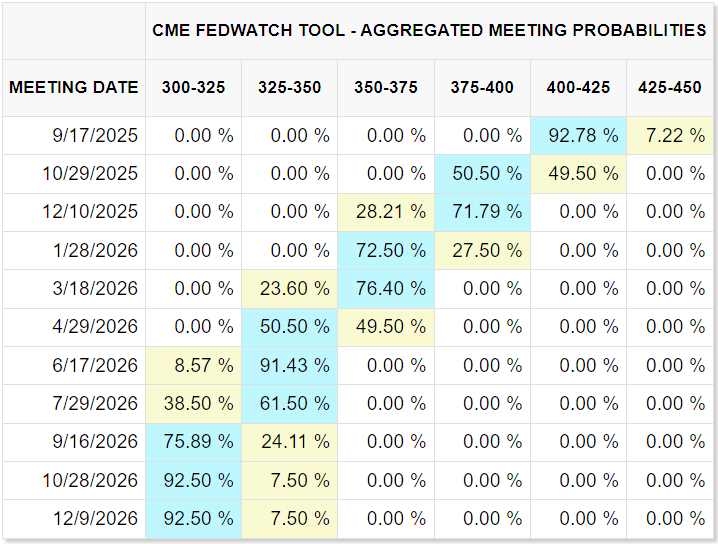

Interest rate markets are still pricing in over 90% odds of a quarter-point interest rate cut when the Fed makes its next rate call on September 17, but hopes for a new rate-cutting cycle were dashed by Thursday’s sharp increase in business-level inflation. According to the CME’s FedWatch tool, interest rate markets are now pricing in barely even odds of a second interest rate cut in October, and less than 30% odds of a third cut in December.

Dow Jones 5-minute chart

Dow Jones daily chart

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.