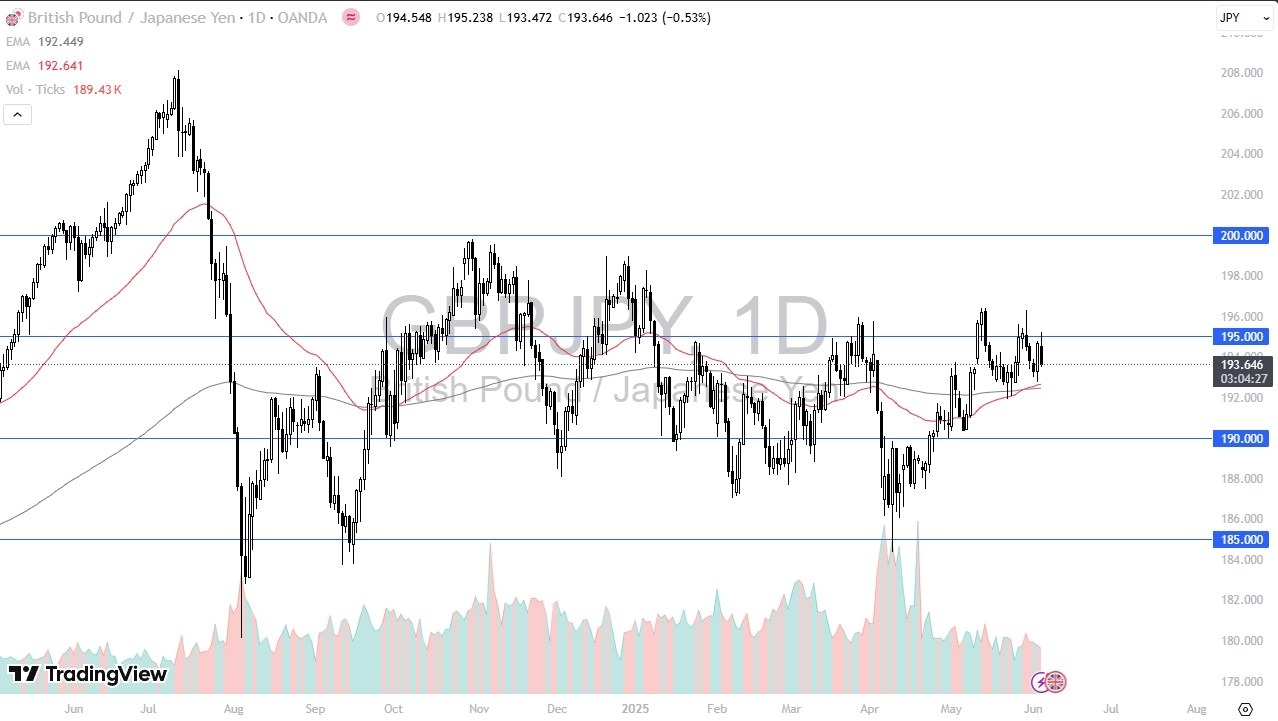

- The British pound initially rallied against the Japanese in during the trading session on Wednesday as we tested the crucial 195 level again.

- The 195 level is an area that’s been important multiple times.

- So, I do think it makes a lot of sense that we are just hanging out here.

With that being said, I like the idea of buying dips, but we may get a little bit deeper correction from which we can trade from. With that being the case, I am taking a look at the 50 day EMA as well as the 200 day EMA indicators underneath to offer a bit of support. Anything below there probably opens up a move back down to the 190 yen level. The interest rate differential between the United Kingdom and the Japanese yen itself is pretty wide. So, I do think that there will be buyers out there willing to get involved and start buying the pound.

Timing Will Matter

Nonetheless, this is more or less a question of when finding a trade, whether or not you can find the timing correct as well. This is a very volatile market, but you should also keep in mind that this is a market that, quite frankly, I think you want to be looking at the upside, regardless of the fact that we had a pretty ugly day on Wednesday. A lot of this might have been driven mainly by bad news out of the United States with the employment and the ISM services PMI.

As you can see, we had fallen on the hourly chart pretty significantly, but really at the end of the day, sooner or later, people realize that the British pound and the Japanese yen have nothing to do with the United States, at least not directly. And they come in and they take advantage of that carry trade.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.