SOL price is up 3% over the last 24 hours and 35% over the last 30 days to trade at $194 at the time of writing. Analysts are optimistic that Solana will continue rallying, first reaching toward $250 in the short term before challenging the all-time highs at $295 and into price discovery.

This optimism is driven by expectations that a US-based spot Solana exchange-traded fund (ETF) could soon become a reality and surging institutional interest.

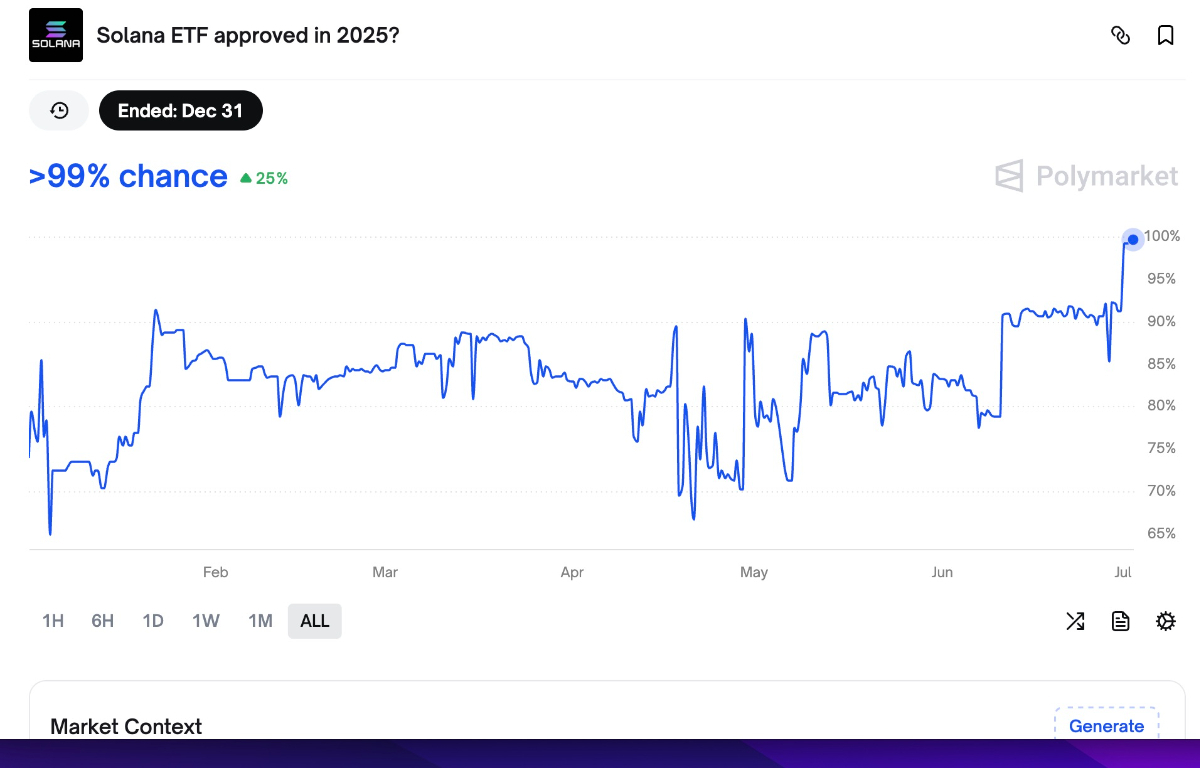

Solana ETF Approval Odds Hit 99% on Polymarket

The prospect of a spot Solana ETF has become a focal point for crypto investors, with the likelihood of the US Securities and Exchange Commission approving (SEC) approving a spot Solana exchange-traded fund (ETF) in 2025 jumping to 99.7% on July 2, according to Polymarket data.

The odds currently stand at 99% at the time of writing on Monday, signaling investor confidence in Solana’s future in traditional financial markets.

Solana ETF Approval Odds on Polymarket. Source: Polymarket

This surge in confidence follows a series of developments that signal a more crypto-friendly regulatory environment.

Major asset managers, including VanEck, Grayscale, Bitwise, 21Shares, and Canary Capital, have filed applications for Solana ETFs with the SEC, signaling strong market demand for regulated SOL investment vehicles.

Bloomberg senior ETF analyst James Seyffart has noted that the SEC’s recent interactions with issuers are a positive sign, despite delays in decisions, such as Fidelity Investments’ spot Solana application.

Seyffart expects a “wave of new ETFs” in the second half of 2025, with Solana leading the charge alongside other altcoins.

He places Solana ETF approval odds at 95%, according to a July 1 post on the X social media platform.

Analysts’ Odds on Crypto ETFS: Source: James Seyffart

The shift in SEC leadership further bolsters the optimism surrounding Solana’s ETF approval. With Gary Gensler being replaced by Paul Atkins as SEC Chair in April 2025, analysts expect a more favorable stance toward digital asset ETFs.

Moreover, the launch of the REX-Osprey Solana Staking ETF, which attracted $73 million in inflows shortly after its debut, highlights the market’s appetite for Solana-based investment products, further fueling expectations of a price rally.

Emergence of Solana Treasury Companies Backs SOL’s Upside

Institutional adoption of Solana is accelerating, with corporate treasuries increasingly allocating capital to SOL as a strategic reserve asset. DeFi Development Corp recently made headlines by purchasing over 153,000 SOL tokens, positioning itself as one of the largest holders of the asset.

The recent acquisition included spot purchases, discounted locked SOL, and 867 tokens earned through staking, validator revenue, and “other onchain activity,” according to DeFi Development Corp.

“All newly acquired SOL is being staked immediately, earning native yield while helping secure the Solana network,” the firm said in an X post on Monday.

As corporate treasuries continue to diversify into SOL, this sustained demand-side pressure is expected to drive significant price appreciation, aligning with analysts’ bullish outlook.

Source: DeFi Development Corp

This move reflects a broader trend of public companies shifting from traditional Bitcoin reserves to Solana-focused treasury strategies, driven by Solana’s superior technological infrastructure, high throughput, and staking yield opportunities.

Companies like SOL Strategies, which filed a $1 billion prospectus for SOL accumulation, and MemeStrategy, a Hong Kong-listed firm that added $370,000 in SOL to its treasury, are leading this charge.

Classover Holdings also secured $500 million in financing specifically for SOL accumulation, sending its shares soaring nearly 40%.

Solana Rounded Bottom Price Pattern Targets $260

From a technical point of view, SOL’s price displayed strength after breaking above a rounded bottom chart pattern on the daily chart. The bulls will now attempt to push the price toward the technical target of the prevailing chart pattern at $260. This represents a 35% uptick from the current price.

SOL/USD Weekly Price Chart.

The relative strength index (RSI) is still in the positive region at 64 and is facing upward, suggesting that the market conditions still favor the upside.

Conversely, at 70, the RSI suggests slightly overbought conditions that could trigger a correction toward the neckline of the rounded-bottom pattern at $200.

According to Bitget Wallet CMO Jamie Elkaleh, improving institutional confidence paves the way for SOL’s rally to $250 and beyond.

“ETF conversations around SOL are further amplifying interest,” said Elkaleh. “With a more crypto-friendly regulatory tone emerging in the US, sentiment around SOL remains constructive.”

Ready to trade our technical analysis of Solana? Here’s our list of the best MT4 crypto brokers worth reviewing.