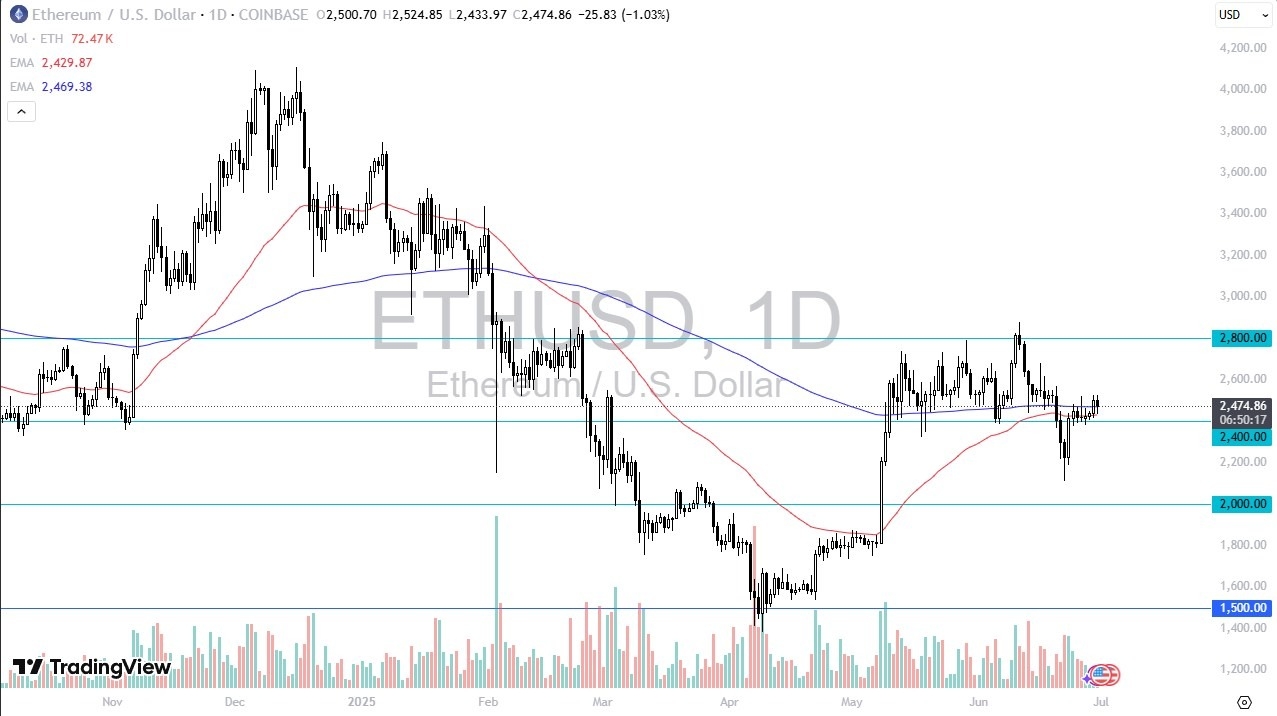

- Ethereum initially pulled back just a bit during the trading session here on Monday only to find buyers again near the 50 day EMA.

- All things being equal, this is a market that is paying close attention to the $2,400 level, an area that has been a large round psychologically significant and an area that’s been support multiple times.

- I do think that we have a situation where Ethereum is just hanging out and waiting to figure out what it is that Bitcoin is going to do because the Bitcoin market leads the rest.

- With all of that being said, I believe that you have a situation where if Bitcoin starts to take off, Ethereum probably makes a move towards the $2,800 level.

BTC and ETF

However, if Ethereum and Bitcoin both start falling in tandem, which is typically how it plays out, a move below the $2,400 level could open up a move down to the $2,200 level pretty quickly in this market. Keep in mind that Ethereum plays second fiddle to Bitcoin and that will always be the case. And therefore, you have to think of it, and I think a lot of traders do think of it in terms of gold versus silver.

Yes, Ethereum does tend to move in tandem with gold, but not necessarily tick for tick. I do think that Ethereum probably has more support than resistance at the moment. But I also recognize that it’s just waiting around for crypto in general to do something. After all, Bitcoin’s been sideways for a couple of months as well. If Ethereum starts to take off, a lot of traders will use that as a signal to start going into alternative markets, smaller coins such as Solana or Ripple or possibly even Cardano. All of those markets often follow Ethereum. So, it’s almost like a pyramid of crypto if you will. I’m watching it. It’s in an area that’s interesting, but right now we just don’t have the momentum.

Ready to trade our ETH/USD forecast? We’ve made a list of the best Forex crypto brokers worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.