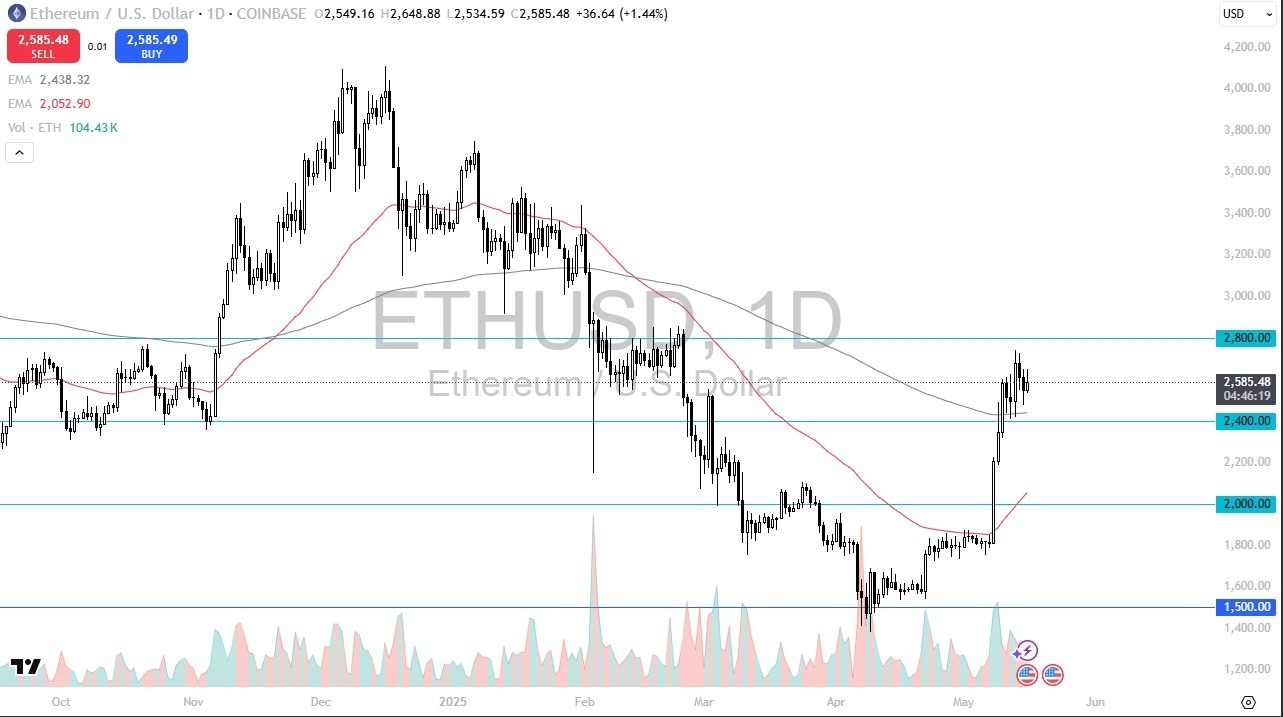

- On Friday we have seen Ethereum rally a bit, but we don’t seem to be able to really take off to the upside and therefore think you have got a situation where we will continue to try to work off some of the excess froth from the big move to the upside.

- The 200 Day EMA sits just below, so that could offer quite a bit of support, especially with the $2400 level sitting just below there.

- Ultimately, this is a market that I think will remain noisy, but I do think that we are trying to do everything we can to break out to the upside. The $2800 level is a bit of a ceiling, and an area where we have seen a lot of noise previously. If we can break above that, then Ethereum will really start to take off to the upside.

- At that point, we could go all the way back to the all-time highs over the next several months, but keep in mind that Ethereum needs a little bit of help from external pressures, mainly in the form of Bitcoin.

Buying Dips

Going forward, buying dips will probably remain the key way to get involved in Ethereum, and it’s likely that short-term buyers are looking to get involved.

If we were to break down below the $2400 level, then it’s possible that the $2200 level would be the next level, followed by the crucial and psychologically important $2000 level. Anything below there would be disastrous, but quite frankly as long as Bitcoin continues to look strong, I don’t necessarily think that Ethereum will fall apart, as it does tend to follow Bitcoin over the longer term.

Quite frankly, crypto tends all tends to move in the same direction given enough time, so if we see the Bitcoin market break out above the crucial $110,000 level, that might be reason enough to have the Ethereum market perk up. I have no interest in shorting this market, at least not at this point in time.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.

.jpeg)