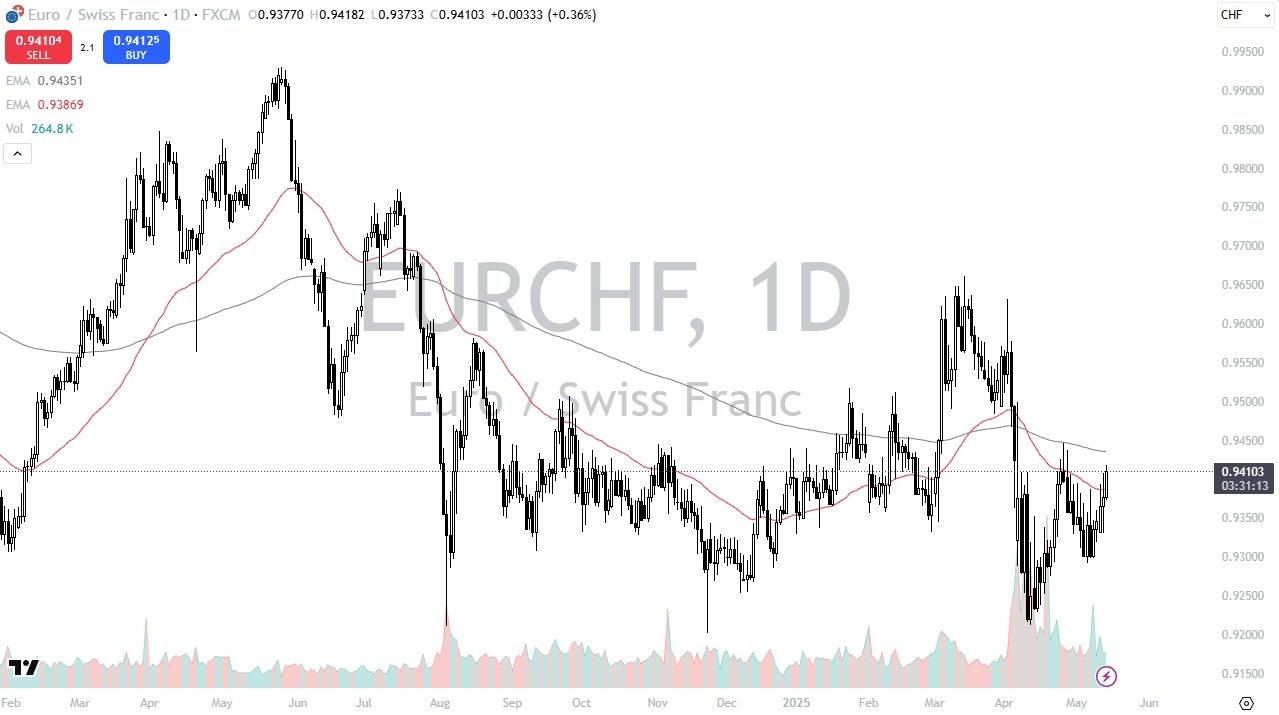

- The Euro has rallied against the Swiss franc during trading on Wednesday as we are now above the 50 Day EMA, which is an indicator that a lot of people will pay close attention to.

- With that being said, this is a market that I think will continue to pay close attention to the recent price action underneath, which formed a bit of a “double bottom.”

- This of course is a well-known pattern that suggests that we may have formed a little bit of a bottom, but we also have to keep in mind that this is a very choppy pair to say the least.

- This is mainly due to the fact that there are a lot of cross-border moves in this market due to the fact that Switzerland of course is surrounded by the European Union.

Technical Analysis

The technical analysis for this pair is somewhat mixed at the moment, but we are getting close enough to a potential move to the upside that a lot of people are starting to pay attention. Keep in mind that the 200 Day EMA sits at the 0.9440 level, an area that of course is backed up by the 200 Day EMA, as well as recent selling pressure. If we can get above that, then it’s likely that we will see a lot of traders jump into this market and try to take advantage of the overall momentum.

Keep in mind that this pair tends to rise when there is more risk appetite out there, and it’s probably worth noting that the Swiss franc is considered one of the biggest safety currencies a trader will pay attention to and start to buy in order to protect their position. Ultimately, I do think that we are in the midst of trying to turn things around, but there’s been a lot of selling pressure previously that traders will have to chew through. In other words, I think this will be a slow grind to the upside, but I do prefer the upside, and I think that short-term pullbacks offer buying opportunities.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.