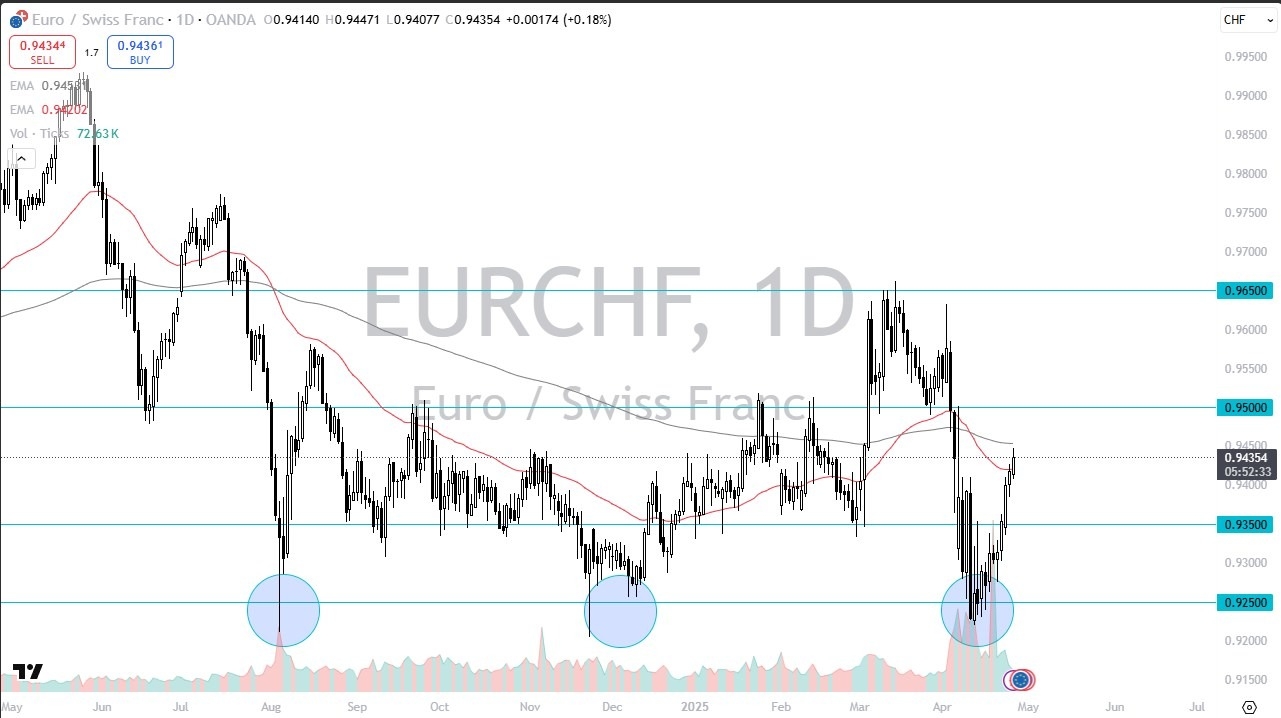

- The Euro has rallied a bit against the Swiss franc, but it has given back some of the gains as we approached the crucial 200 day EMA.

- Comments coming out of the Swiss National Bank today suggested that intervention is in fact a very real possibility.

- The reality is that the Swiss may have already done it because the 0.9250 level underneath is like a brick wall.

The Swiss are notorious for intervening in the FX markets, even more so than the Japanese. That being said, as we go into the later part of the session, it looks as if the market is going to continue to pay close attention to the 200 day EMA. And it looks like a short term pullback is very possible. This is the most likely scenario that I see, as the market is overdone, at least for the time being.Is a Pullback an Opportunity in this Pair?

I think this pullback could end up being a buying opportunity if the Euro can stay above 0.9350. On the other hand, if we were to break above the 200 day EMA without a pullback, then I think the pair goes looking to the 0.95 level above, which has been very important.

Ultimately, this is a market that I think sees a lot of back and forth choppy behavior, but I do look at this as a market that’s in transaction and transition to try to turn things around. That doesn’t mean quick and easy moves. What that means is more or less a backfill and grind higher. We’ll have to wait and see how that plays out, but keep in mind that it is a good risk barometer with the Swiss franc being a safety currency and the euro being a risky currency, at least in this scenario.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.