- The euro initially gapped lower against the Japanese yen during trading on Monday and then continue to drop from there.

- That being said, the market is likely to continue to see a lot of noisy behavior, as the market has been very choppy over the last several weeks.

- In fact, the shape of the candlestick is somewhat like a hammer, but I would also pay attention to the other bits and pieces of technical analysis that could give you a bit of a “heads up” as to where we are going to go next.

Technical Analysis

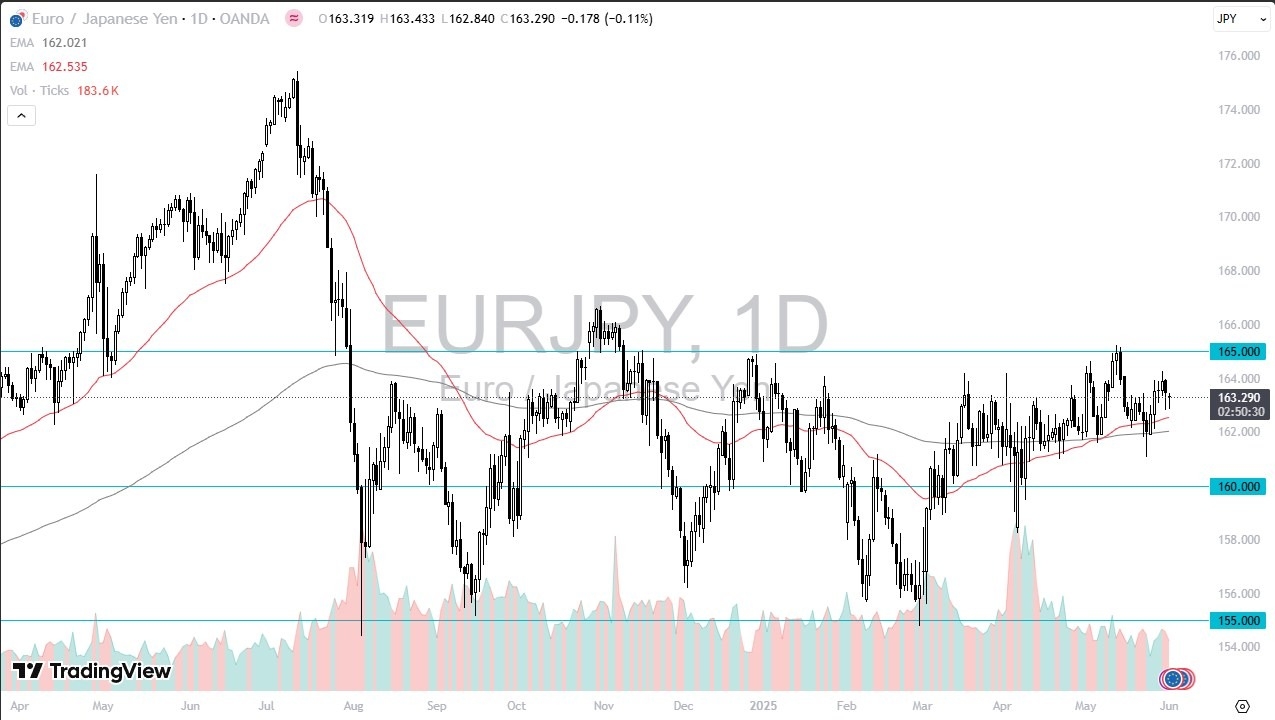

The technical analysis for this EUR/JPY pair is somewhat bullish, but it is contained within a very well defined consolidation range. The ¥165 level continues to be an area worth watching, as it had been a significant resistance barrier before, and of course it is an area that seen a lot of market memory attached to it in the past. If we can break above that level, then I do think that the euro has a real shot at going much higher against the Japanese yen, but I would point out that this is probably a move that would be more about the Japanese yen than anything else.

On the other hand, if we do fall from here, it’s worth noting that the 50 Day EMA’s is just below, and then underneath there we have the 200 Day EMA which is currently right around the ¥162 level. The market breaking down below that level would be very negative, and it could open up the possibility of a drop toward the ¥155 level, but at this point in time it doesn’t look like we have any real appetite to start buying the yen. Because of this, I think we remain a little bit more “risk on” than would be required for the Japanese yen to suddenly strengthen, and with that I look at the short term pullbacks along the way as potential buying opportunities in this pair.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.