Potential signal:

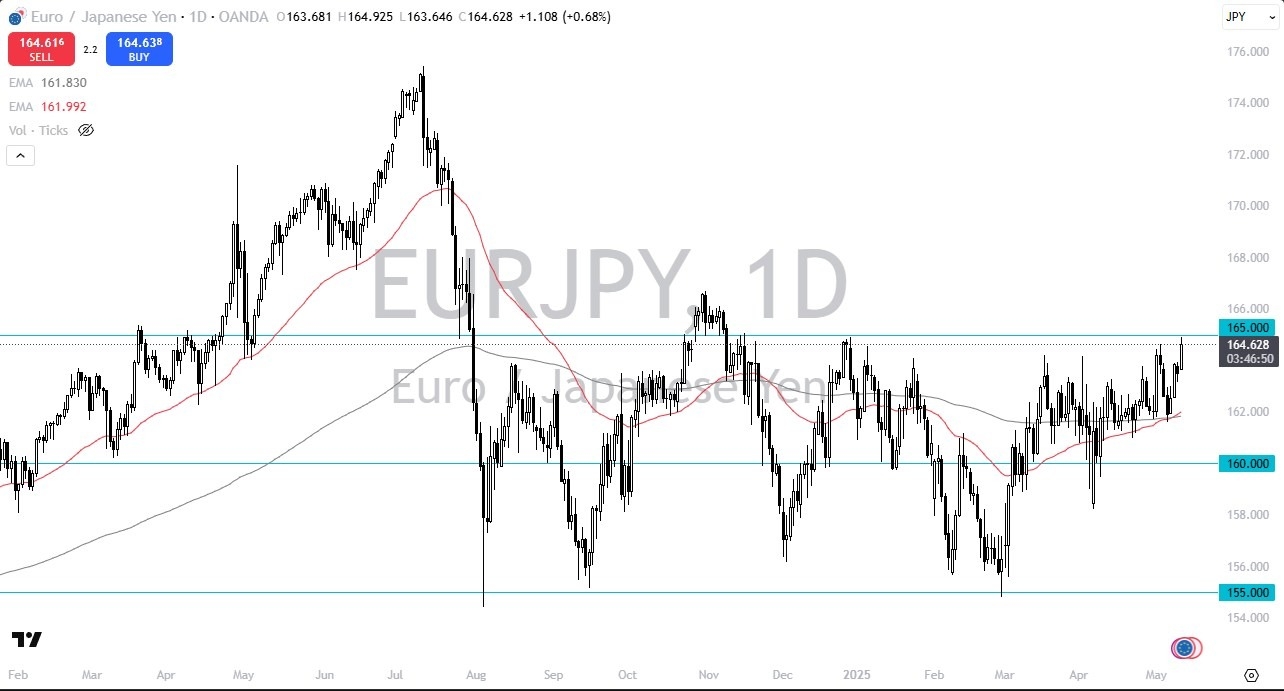

- I’d be a buyer of this market on a daily close above the ¥165 level with a stop loss at the ¥164 level.

- The target would be ¥160.

During the trading session on Monday, we have seen the euro rallied against the Japanese yen as the Japanese yen was sold off against almost everything.

After all, it’s more of a “risk on environment” now that the Americans in the Chinese have met over the weekend and have agreed to cut tariffs quite drastically in order to allow a 90 day timeframe to sort things out as far as the tariff war is concerned.

All things being equal, this is a market that tends to move on risk appetite, and of course the Japanese yen is considered to be a major safety currency, and as it sells off, that typically means that the market is likely to continue to see more upward pressure in places like the NASDAQ 100, Bitcoin, and riskier currency such as the Australian dollar or even the euro. Keep in mind though that this is a relative game, meaning that the euro isn’t necessarily a risky currency, it’s just “riskier than the Japanese yen.”

Technical Analysis

The technical analysis for this market is pretty straightforward, as we have been sideways for a while. The 50 Day EMA has just broken above the 200 Day EMA, near the ¥162 level. At this point, I am watching the ¥165 level very closely, as we did try to break above there during the day but gave back the gains. I suspect that if and when we can break above that level, we could see the euro start to grind it’s way even higher, perhaps really starting to punish the Japanese yen.

I would also watch other JPY-related pairs, making sure that they are all rallying before taking a trade to the upside. On the other hand, if we break down below the low of the trading session on Monday, then we probably drop toward that ¥162 level, where the moving averages currently said. That would also put us right back into the middle of the overall consolidation that we have been in.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.