EUR/USD Analysis Summary Today

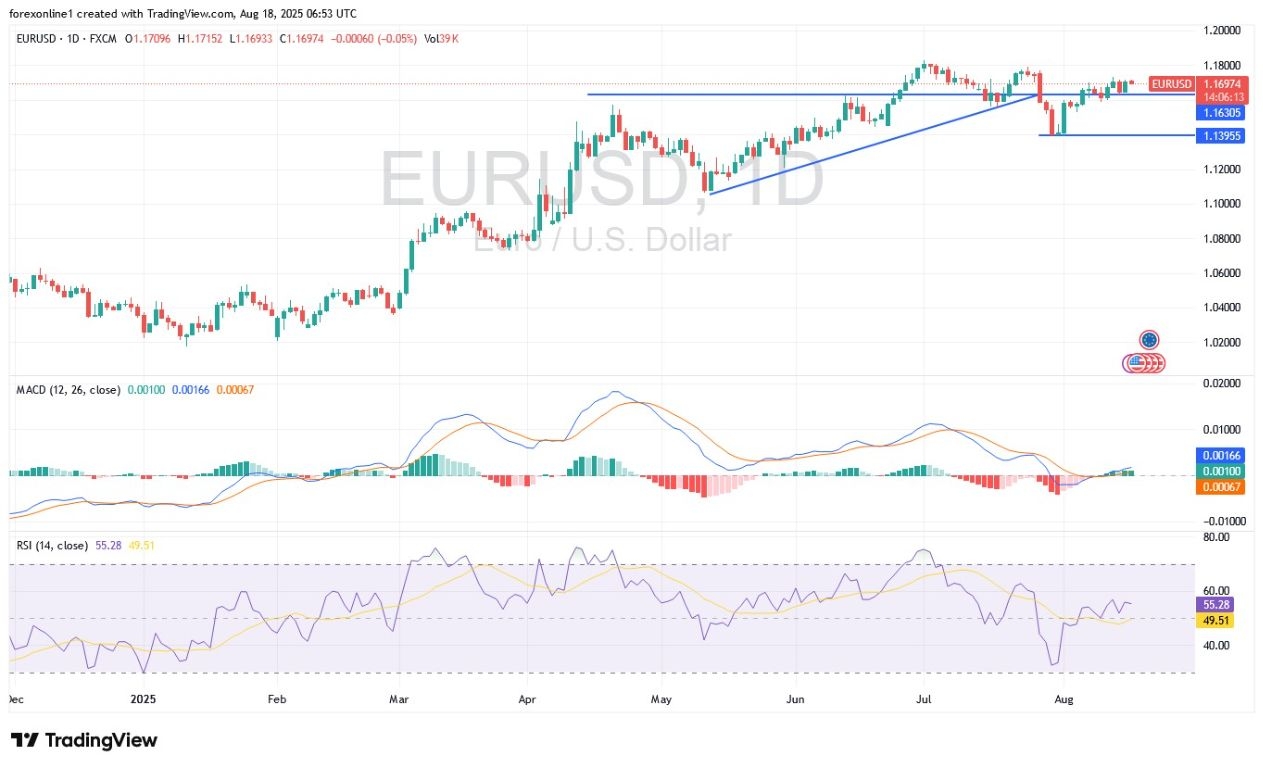

- Overall Trend: Neutral with an upward bias.

- Today’s Support Levels: 1.1650 – 1.1570 – 1.1500.

- Today’s Resistance Levels: 1.1740 – 1.1810 – 1.1900.

EUR/USD Trading Signals:

- Buy the EUR/USD from the support level of 1.1600, with a target of 1.1800 and a stop loss of 1.1540.

- Sell the EUR/USD from the resistance level of 1.1785, with a target of 1.1500 and a stop loss of 1.1860.

EUR/USD Technical Analysis Today:

According to most forex trading experts, the euro will benefit from a peace agreement in Ukraine. Following the start of the Trump-Putin summit late last week, the EUR/USD pair recovered to the 1.1715 resistance level, close to its highest point in two weeks. Forecasters expect the euro to benefit if US President Donald Trump is able to broker a peace deal between Ukraine and Russia.

The foreign exchange market’s focus is on the meeting between Trump and Vladimir Putin in Alaska, where a significant breakthrough on a ceasefire is hoped for. A ceasefire between Russia and Ukraine would be a crucial turning point, as it could significantly strengthen the euro by boosting economic activity in the Eurozone through lower energy prices and improved consumer and business confidence. However, this is not a core expectation.

It’s unrealistic to expect a deal on Friday, but there’s a strong possibility that it could pave the way for an eventual end to the conflict. According to performance across trusted trading platforms, with the euro rising by 12.75% against the US dollar by 2025, further gains are possible if geopolitical risks centered on Europe’s eastern flank dissipate.

Resolving the Ukraine Crisis Will Strengthen the Euro

Russia’s invasion of Ukraine marked a turning point for the European economy, which was highly dependent on Russian hydrocarbons. Without cheap gas, German industry, in particular, has become increasingly less competitive. While it’s unlikely Europe will return to Russian gas for a full generation, a peace agreement would at least lead to lower global oil prices, which could open the door to some promising economic opportunities for Europe, a major oil importer.

Accordingly, Citigroup expects Brent crude prices to reach the early $60s per barrel if progress is made toward a US-Russian agreement, in line with our average prices for the fourth quarter of 2025. Barclays models show that there is still a small EU-specific risk premium in the euro, although it has declined significantly since the invasion.

Overall, both the euro and the US dollar stand to benefit from a de-escalation. However, given the challenges, financial markets are naturally skeptical, which suggests that any breakthrough would be a genuine surprise—a surprise that could move the market and lead to a significant euro rally.

Trading Tips:

We advise caution when trading the EUR/USD. Furthermore, we still prefer to sell from any rising level.

Technical Indicators Still Confirm a Neutral Trend

Based on the daily chart, the EUR/USD pair’s trend remains neutral, as confirmed by the technical indicators. The 14-day Relative Strength Index (RSI) is holding around 55, slightly above the midpoint. At the same time, the MACD indicator is turning upward, awaiting further momentum to confirm a bullish shift. Obviously, a return by the bears to the support levels of 1.1630 and 1.1550 would pose a serious threat to a bearish reversal. Conversely, the 1.1800 resistance level remains crucial for the bulls to confirm their control over the trend. Today, the EUR/USD is not expecting any significant or influential economic releases from either the US or the Eurozone, which suggests the pair will likely trade within a tight range based on the market’s reaction to recent events.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.