EUR/USD Analysis Summary Today

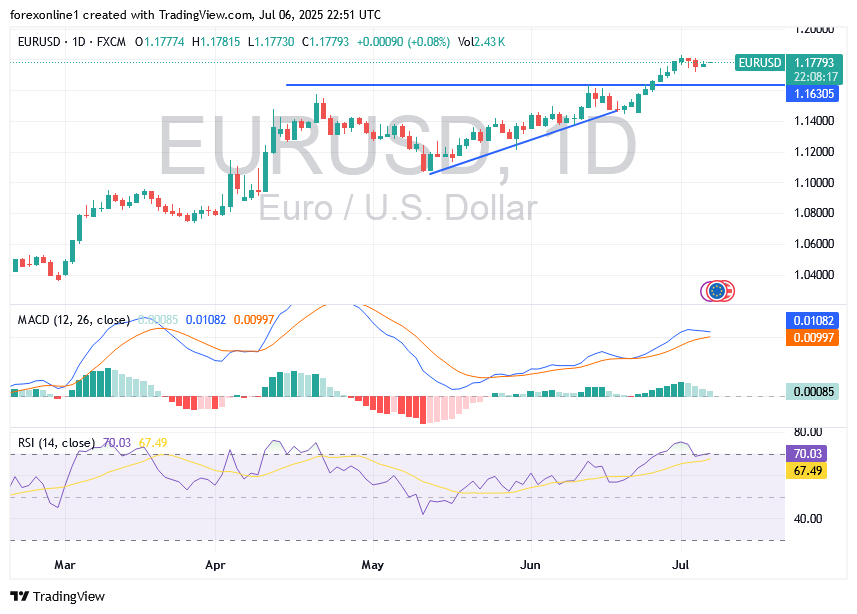

- Overall Trend: Bullish.

- Today’s Euro-Dollar Support Points: 1.1740 – 1.1680 – 1.1590.

- Today’s Euro-Dollar Resistance Points: 1.1820 – 1.1880 – 1.2000.

EUR/USD Trading Signals:

- Buy EUR/USD: From the support level of 1.1630, target 1.1820, stop loss 1.1560.

- Sell EUR/USD: From the resistance level of 1.1840, target 1.1600, stop loss 1.1900.

Daily Technical Analysis for EUR/USD:

By the end of last week’s trading, the EUR/USD exchange rate sharply declined to just below 1.1720 as a direct reaction to U.S. jobs data, before recovering to the 1.1760 level. After Friday’s holiday, the broader discussion about the future of the U.S. dollar price will remain in full swing, with a focus on the economy, trade agreements, and the budget bill. According to forex currency trading experts, despite the retreat, upward momentum remains strong, and there is still a chance for the euro price to retest the 1.1830 level. However, any further progress is unlikely to clearly exceed 1.1850.

Some forecasts point to a slightly longer timeframe; the upward trend is still in place, but near-term risks lean towards neutrality, with momentum indicators peaking at overbought levels. Longer-term resistance is limited before the 1.19 level and an average of 1.22.

Impact of U.S. Jobs Figures on Euro-Dollar Trading

It’s natural for the EUR/USD pair to be affected by the announcement of U.S. jobs and inflation figures, which determine the future policies of the U.S. Federal Reserve. As announced through the economic calendar, U.S. non-farm payrolls increased by 147,000 jobs for June, compared to consensus expectations of around 110,000 jobs, and after an adjusted increase of 144,000 jobs for May. However, U.S. private sector job growth saw a sharp slowdown, with only the healthcare sector making significant gains, and total jobs boosted by a strong increase of 73,000 jobs in government positions.

It was also announced that the country’s unemployment rate gradually fell to 4.1% from 4.2%, which is lower than market expectations of 4.3%. However, the U.S. household survey indicated only a slight increase in the number of employed people, with another jump in the number of people not participating in the labor force. This measure has increased by nearly 3 million jobs over the past year, indicating strong shifts in the labor market.

Nevertheless, economic data will not provide any new support for those advocating for near-term U.S. interest rate cuts. Following the data release, markets ruled out the possibility of a U.S. interest rate cut in July, with the likelihood of a September cut falling to just under 80%. According to experts’ view on U.S. figures, the stronger-than-expected June jobs report suggests no U.S. interest rate cut by the Federal Reserve before September, despite the President’s demands. However, households are becoming more pessimistic about employment prospects, with an increasing risk of layoffs in the second half of the year.

EUR/USD Forecast in the Coming Months

In this regard, Rabobank maintains a 12-month target price for EUR/USD at 1.20. Regarding fiscal policy, Senate Democrats postponed a full vote on the budget bill, but Republican leadership is confident in their ability to pass the legislation. Trade developments will also be important before this week’s deadline. The United States and Vietnam reached a trade agreement on Wednesday.

For his part, U.S. President Trump stated that Vietnamese goods would face a 20% tariff, while cross-shipments from third countries via Vietnam would face a 40% tax.

In the same vein as currency exchange rate forecasts, analysts at Conifer believe the euro’s advance faces accountability. A new analysis from a leading forex foreign exchange market firm warns that the rapid rise in the EUR/USD exchange rate is “fundamentally very fragile.” According to forecasts, the euro’s role in this rise is “insubstantial,” and “this rally has so far relied heavily on a continuous stream of pessimism about the U.S. dollar.”

However, this pessimism is increasingly being questioned, with new bullish bets on the euro declining over the past twenty-four hours, largely supported by the stronger-than-expected U.S. jobs report. The global brokerage firm notes that weekly risk reversals, used to measure directional bias, have been reduced to zero following the report, which indicates that the U.S. economy has not been significantly harmed under Trump.

Trading Tips:

Dear follower of TradersUp, despite the upward stability, I still advise selling EUR/USD, but without taking risks and by monitoring factors influencing currency prices.

Accordingly, long-term expectations for the EUR/USD pair have also declined, indicating a decreased conviction in its rise compared to the past two months.

Can the EUR/USD Exchange Rate Reach 1.20?

Regarding EUR/USD trading towards psychological resistance, the 1.20 level is currently a significant number in the forex market, even considered a “red line” by senior European Central Bank officials. This talk alone puts it in the crosshairs of many traders. Institutional analysts also view it as an important benchmark when building their highly influential forecasts. Forex currency trading experts believe that the “sell America” campaign may have ended before the exchange rate reached 1.20. They explained: “‘Sell America’ and the ‘Euro as the new dollar’ narrative grabbed headlines (though quieter recently) after Trump unleashed his unpredictable trade agenda. High tariffs, coupled with deep uncertainty about implementation, destabilized markets and undermined anything labeled American-made.”

Overall, the essence of the “sell America” campaign is that tariffs will lead to a rise in inflation, which will harm both consumers and businesses, depriving the Federal Reserve of the opportunity to cut U.S. interest rates.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.