EUR/USD Analysis Summary Today

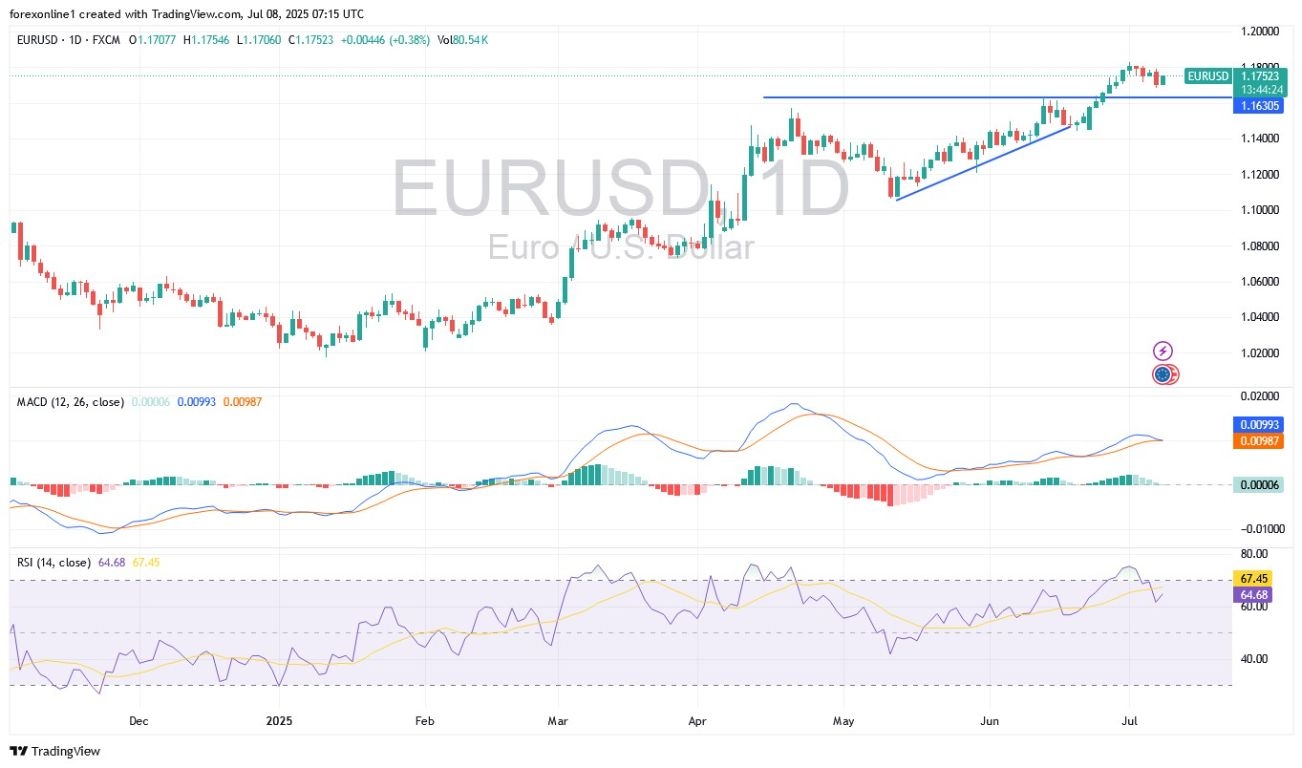

- Overall Trend: Bullish.

- Today’s EUR/USD Support Levels: 1.1720 – 1.1670 – 1.1590.

- Today’s EUR/USD Resistance Levels: 1.1800 – 1.1880 – 1.2000.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1660, with a target of 1.1820 and a stop loss of 1.1590.

- Sell EUR/USD from the resistance level of 1.1800, with a target of 1.1600 and a stop loss of 1.1880.

EUR/USD Technical Analysis Today:

At the start of this week’s trading, the EUR/USD saw a relative decline, with losses extending to the 1.1686 support level before recovering at the start of trading today, Tuesday, July 8, 2025, rebounding towards the 1.1757 resistance, around which it remains stable at the time of writing this analysis. The Euro’s losses came as investors cautiously await further clarity on upcoming US tariff measures. The European Union announced that it is making progress towards a trade agreement with the United States, aiming to prevent a significant escalation in tariffs through an initial agreement that would impose a comprehensive 10% tariff on many goods, with reduced rates for key sectors such as pharmaceuticals, alcohol, semiconductors, and commercial aircraft.

However, the European Union also announced preparations for retaliatory tariffs on a range of US products in response to President Trump’s metal tariffs. Officials warned that if an agreement is not reached, additional measures could follow, such as export controls and restrictions on US access to public contracts. Meanwhile, Commerce Secretary Howard Lutnick confirmed that the broader US tariff package—initially scheduled for July 9—has been postponed to August 1.

On the monetary policy front, markets now expect one more interest rate cut from the European Central Bank this year.

Trading Advice:

Be cautious about buying EUR/USD at higher levels. It is better to wait for stronger selling opportunities, but without taking excessive risks. Don’t forget that the Euro is approaching its 2021 high.

Technical Levels for the EUR/USD:

Based on the daily timeframe chart performance and across trusted trading platforms, the EUR/USD trend remains bullish. The 1.2000 psychological resistance will be within the bulls’ sights if they first move steadily above the 1.1810 resistance. Technically, the 14-day RSI (Relative Strength Index) is around a reading of 65 and still has room for stronger gains before reaching overbought territory. At the same time, the MACD (Moving Average Convergence Divergence) indicator lines are also in an upward position. On the downside, and within the same timeframe, an initial break of the EUR/USD’s upward trend would require a move towards the 1.1650 and 1.1570 support levels, respectively.

Today’s EUR/USD trading, through a free and exclusive trading bonus, is not only anticipating important US economic data but will primarily focus on the future of US trade wars against global economies, including the Eurozone. Today, at 9:00 AM Egypt time, the Eurozone’s trade balance figures will be announced. Less than an hour later, France’s trade balance figures will be released.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.