EUR/USD Analysis Summary Today

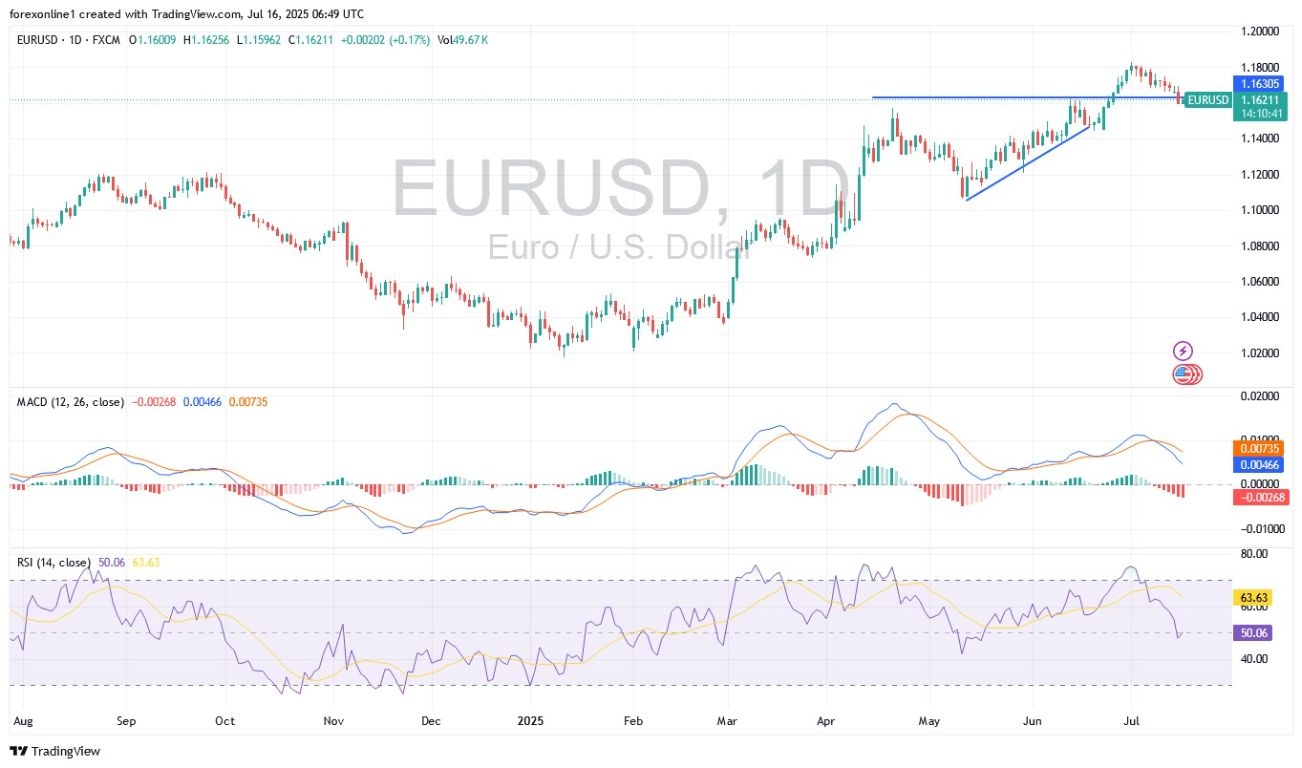

- Overall Trend: Beginning a bearish inclination.

- Today’s EUR/USD Support Levels: 1.1590 – 1.1500 – 1.1430.

- Today’s EUR/USD Resistance Levels: 1.1700 – 1.1780 – 1.1840.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1560 with a target of 1.1700 and a stop loss of 1.1500.

- Sell EUR/USD from the resistance level of 1.1750 with a target of 1.1600 and a stop loss of 1.1800.

EUR/USD Technical Analysis Today:

Bears have successfully pushed the EUR/USD pair lower for two consecutive days, moving it below the 1.1600 support level. This sets the currency pair up for a new bearish path if the recent strength of the US dollar continues. Selling pressure intensified after mixed US consumer inflation data prompted traders to scale back their expectations for Federal Reserve interest rate cuts. While headline inflation matched monthly and annual forecasts, core inflation came in weaker than expected. Adding to the cautious outlook, Dallas Federal Reserve President Lorie Logan stated that the US central bank will likely need to keep interest rates steady for an extended period to ensure inflation remains contained amid tariff-induced price pressures. Overall, financial markets are now pricing in a lower probability of multiple interest rate cuts this year, with the likelihood of a September move hovering just above 50%.

Technical Levels for the EUR/USD Pair Today:

According to trading on the daily timeframe chart, the EUR/USD pair is at the beginning of a bearish shift, moving below the 1.1600 level. This movement has pushed the 14-day RSI (Relative Strength Index) to break the midline, giving bears sufficient momentum to start moving lower. At the same time, the blue MACD (Moving Average Convergence Divergence) line has moved below the orange line, supporting the technical bearish shift and preparing for stronger losses before technical indicators reach strong oversold levels. The most important target for bears to control the currency pair will remain the 1.1450 support level. On the positive side, the 1.1760 resistance will remain crucial for the return of bullish control. The recent performance of the currency pair confirms the strength of our free recommendations to sell EUR/USD from every upward level.

Today’s EUR/USD trading coincides with the announcement of the Eurozone’s trade balance reading at 12:00 PM Cairo time. On the US side, the Producer Price Index (PPI) reading, one of the tools for measuring US inflation, will be announced at 3:30 PM Cairo time. In addition, there will be statements from some US Federal Reserve officials.

Will the Euro Rise Again?

According to forex trading experts’ forecasts, Euro trading may see further increases as the trend towards European assets continues to accelerate. According to the latest global fund manager survey conducted by Bank of America, global fund managers continue to increase their investments in European assets, with little indication of an imminent shift in their fortunes. The July survey shows the highest overweight in Eurozone equities since July 2021, with a net overweight percentage of 41%, up from just 1% at the beginning of the year.

According to performance on trusted currency trading platforms, the Euro itself saw its highest overweight since January 2005, with a net overweight percentage of 20% of fund managers. This represents a positive shift in investor sentiment compared to the 18% low recorded in January. At the same time, 31% of fund managers consider the Euro undervalued, while 47% consider the US dollar overvalued.

“Shorting the US dollar” has been described as the most crowded trade for the first time in the survey’s history, which is something to consider in the short term, as extremes in trading positions can be considered a contrarian indicator for an imminent market reversal. However, strong demand for hedges against US dollar weakness may limit the dollar’s ability to recover, reinforcing the advance of the EUR/USD exchange rate towards the psychological 1.20 resistance.

According to the report, the proportion of fund managers looking to increase their hedges against a weaker dollar reached 33% in July, down slightly from 39% in June, while 41% reported that they do not plan any changes to their foreign exchange hedging ratios.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.