EUR/USD Analysis Summary Today

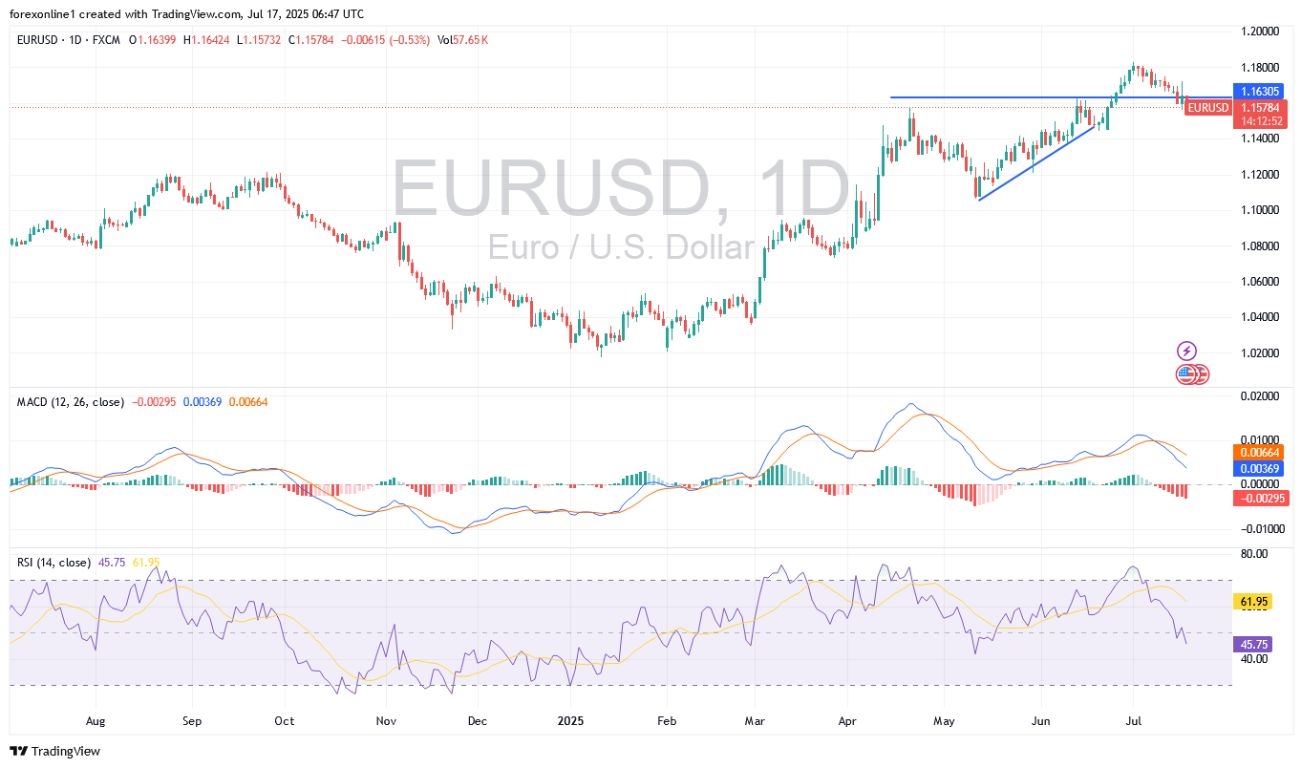

- Overall Trend: Moving within a counter-bearish channel.

- Today’s EUR/USD Support Levels: 1.1550 – 1.1470 – 1.1400.

- Today’s EUR/USD Resistance Levels: 1.1640 – 1.1740 – 1.1800.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1520 with a target of 1.1700 and a stop loss of 1.1440.

- Sell EUR/USD from the resistance level of 1.1660 with a target of 1.1500 and a stop loss of 1.1740.

EUR/USD Technical Analysis Today:

Investors continue to cautiously monitor economic and trade developments, awaiting a new wave of corporate earnings. Recently, market sentiment improved after US President Donald Trump denied reports that he planned to replace Federal Reserve Chair Jerome Powell. Also, China renewed its efforts to normalize relations with the European Union ahead of the China-EU leaders’ summit later this month. However, uncertainty persisted following the earlier US announcement of a 30% tariff on EU imports effective August 1st.

Amidst these rapid developments, the EUR/USD price is settling under bearish pressure around the 1.1573 support level, its lowest in over two weeks. As I’ve mentioned before in Euro-dollar analyses, bears’ success in moving below the 1.1600 level will increase downward pressure on the Euro against the US dollar. Against this backdrop, the currency pair awaits the announcement of Eurozone inflation figures at 12:00 PM Cairo time. Then, more importantly, US retail sales figures, weekly jobless claims, and the Philadelphia Manufacturing Index, all due at 3:30 PM Cairo time.

According to the current performance on the daily chart, EUR/USD has begun forming a counter-bearish channel, which will strengthen if bears successfully push to the 1.1460 support level. Currently, the 14-day RSI (Relative Strength Index) is around a reading of 46, having broken the midline, which provides bears with sufficient momentum to move strongly downward. At the same time, the MACD (Moving Average Convergence Divergence) lines are steadily heading downward, and technical indicators still have more time and room for losses before reaching oversold levels. On the upside, a return by bulls to the vicinity of the 1.1730 resistance would support a renewed upward momentum.

Trading Tips:

TradersUp’s traders are advised to monitor the factors influencing currency prices and avoid taking risks, anticipating further volatility given Trump’s policies.

What Recently Happened with EUR/USD Performance?

According to performance on trusted trading platforms, the EUR/USD exchange rate settled under bearish pressure, especially after the latest US inflation figures. Overall, the US dollar maintained its stability, with high yields continuing to provide net support. However there remains underlying concern about threats to the Federal Reserve’s independence.

According to forex trading experts, the euro’s medium-term trend remains bullish, but the recent decline has returned momentum indicators to neutral. The 50-day moving average (1.1479) continues to provide medium-term support, and we see the short-term range roughly confined between the 1.1650 support level and the 1.1720 resistance level. According to some experts, further losses are possible; the risk of the euro falling to 1.1625 is increasing. The downside risk will increase in the coming days as long as the strong resistance level at 1.1735 is not breached. ING Bank, for its part, sees scope for the EUR/USD pair to fall to the 1.15 support level by the end of the third quarter.

Overall, financial markets settled in relatively tight ranges during the day, but volatility remains prone to increase, especially as the holiday season approaches. Markets will also closely monitor trade talks between the EU and the US. According to the EU’s chief trade negotiator, Maroš Šefčovič, “We are very close to agreeing on the text of a trade agreement in principle, but it is clear that there are aspects where we face a significant gap between our positions.”

On the economic front, according to economic calendar results, US consumer prices rose by 0.3% for June, in line with expectations, although the headline inflation rate rose slightly more than expected to reach a four-month high of 2.7% from 2.4% previously. Concurrently, core prices rose by 0.2% compared to market expectations of 0.3%. Meanwhile, the annual rate increased slightly to 2.9% from 2.8%, compared to expectations of 3.0%.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to

check out.