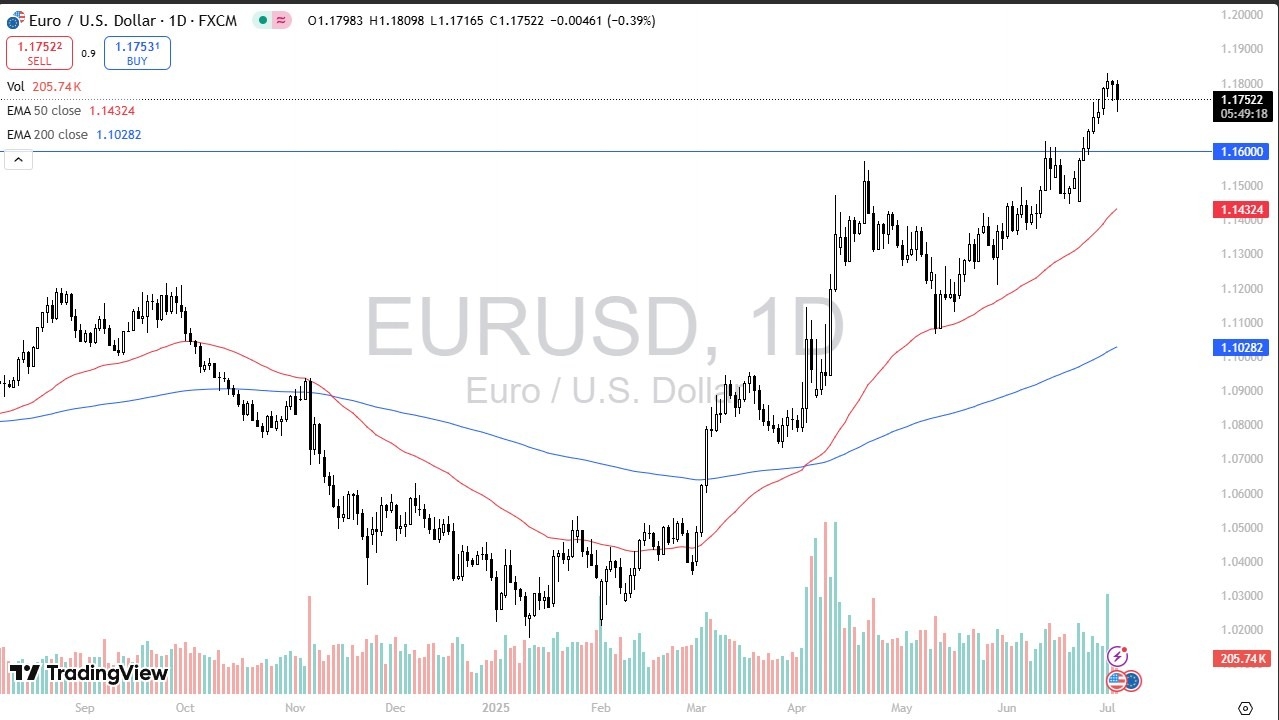

- The Euro has fallen pretty significantly against the US dollar during the trading session on Thursday as we got a stronger than anticipated non-farm payroll announcement coming out of the United States.

- This has people now starting to back away from the idea of a potential rate cut in July, which at one point was anticipated by a margin of 25%.

- The odds for a rate cut in July are now down to 5%.

The situation in September, I think, is really going to be a situation where traders kind of already know this. So now they want to pay attention to the Federal Reserve and what they say between now and then. If they make it clear that they will not cut in September, that will be the end of this trend.

Promised Rate Cut in America?

On the other hand, if they do, that could be a “sell on the event” type of situation. We’ll just have to wait and see. But in the short term, this looks like a market where traders are still willing to step into the market and take advantage of any value that they get with the 1.16 level being of particular interest as it was previous resistance and now it should be support.

The 50-day EMA is about 150 pips below there but it is racing towards that area so I could envision a world where we drift a little lower and then meet up with the 50-day EMA again. On the other hand, though if we break above the 1.1850 level it’s possible that the euro goes screaming to the upside and looking for the 1.20 level, which of course is the next large round figure. And really that wouldn’t be a surprise either. The one thing that you haven’t heard me say is that I’m going to short this market.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.