- EUR/USD trims gains after reaching 1.1420 on tariff relief; holiday-thinned markets keep the Dollar under pressure.

- Trump postpones 50% EU tariff threat to July 9, easing near-term trade tensions.

- ECB’s Lagarde hints Euro could rival Dollar if bloc strengthens its financial unity.

- Fed’s Kashkari flags stagflation risks from tariffs; September policy path remains uncertain.

EUR/USD begins the week on the front foot but trims some of its earlier gains after hitting a four-week high of 1.1420, sponsored by US President Donald Trump’s reversal on his decision to enact tariffs on the European Union (EU) on June 1. At the time of writing, the major currency trades at 1.1380, up 0.20%.

Last week, late Friday, Trump threatened to impose 50% tariffs on EU goods on June 1, as negotiations with the bloc are not advancing as expected. This triggered a leg-up in EUR/USD, ending at a two-day high of 1.1375. Nevertheless, a call between EU Commission President Ursula von der Leyen and Trump on Sunday bought some time for both parties to reach an agreement with a deadline of July 9.

The Greenback’s decline has favored the Euro, which, according to European Central Bank (ECB) President Christine Lagarde, could become a viable alternative to the US Dollar (USD) as the world’s reserve currency. However, she stated this could happen if governments strengthened the bloc’s financial and security architecture.

The US Dollar Index (DXY), which tracks the performance of the American currency against six other currencies, is down 0.10%. Still, it remains steady at 99.00 due to subdued trading conditions in observance of a US Memorial Day holiday.

Minneapolis Federal Reserve (Fed) President Neel Kashkari said uncertainty is top of mind for the Fed and US businesses. He said the September meeting is open for “anything,” adding that the US central bank is in wait-and-see mode. He added that the shock of tariffs is stagflationary.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | -0.27% | 0.19% | 0.03% | 0.10% | -0.22% | -0.03% | |

| EUR | 0.14% | -0.12% | 0.36% | 0.17% | 0.24% | -0.08% | 0.12% | |

| GBP | 0.27% | 0.12% | 0.15% | 0.29% | 0.36% | 0.04% | 0.26% | |

| JPY | -0.19% | -0.36% | -0.15% | -0.15% | -0.09% | -0.46% | -0.21% | |

| CAD | -0.03% | -0.17% | -0.29% | 0.15% | 0.08% | -0.25% | -0.03% | |

| AUD | -0.10% | -0.24% | -0.36% | 0.09% | -0.08% | -0.36% | -0.10% | |

| NZD | 0.22% | 0.08% | -0.04% | 0.46% | 0.25% | 0.36% | 0.22% | |

| CHF | 0.03% | -0.12% | -0.26% | 0.21% | 0.03% | 0.10% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD daily market movers: Underpinned by large US fiscal deficit, strong EU data

- Recent data in the EU supports further upside on the EUR/USD pair as Germany’s economy grew faster than expected. The Gross Domestic Product (GDP) for Q1 2025 was 0.4% up from 0.2%.

- The Greenback remains on the back foot, weighed down by the approval of Trump’s tax bill in the House of Representatives, which is on its way to the Senate. If passed, the proposal would add close to $4 trillion to the US debt ceiling over a decade, according to the Congressional Budget Office (CBO).

- EUR/USD would remain driven by economic data. The EU’s economic schedule will feature Germany’s Gfk Consumer Confidence, employment and Retail Sales data in the EU. Inflation will be reported in Germany, France, Italy, Spain and the EU.

- The US economic docket will feature April Durable Goods Orders, the Federal Open Market Committee (FOMC) meeting minutes, the second estimate for Q1 2025 GDP and the release of the Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation metric.

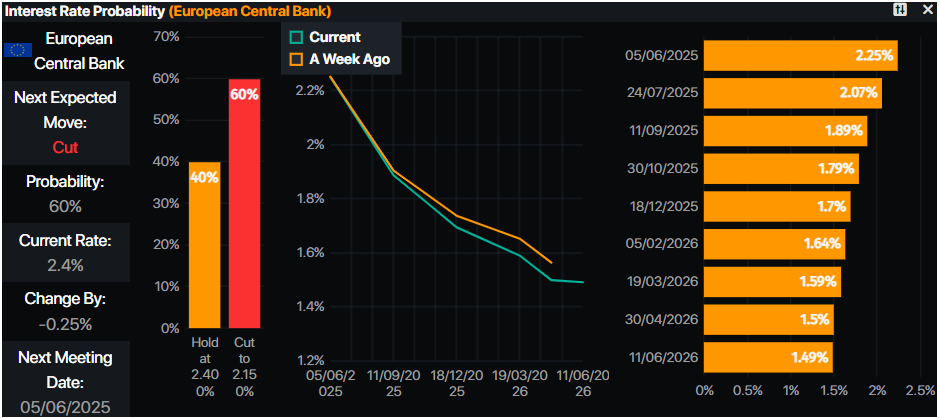

- The European Central Bank (ECB) is expected to lower interest rates at the upcoming meeting. On Friday, ECB’s Rehn and Stournaras backed a rate cut in June, with the latter supporting a pause after that meeting.

Source: Prime Market Terminal

EUR/USD technical outlook: Set to challenge 1.1400 in the near term

EUR/USD remains upward biased despite forming an ‘inverted hammer,’ which indicates that sellers are outpacing buyers due to the large upper shadow in today’s price action. However, further confirmation is needed, and the pair must drop below 1.1300 for sellers if they want to test lower prices.

The next key support level would be the 20-day Simple Moving Average (SMA) at 1.1270, followed by the 1.1200 mark.

On the upside, if EUR/USD stays above 1.1375, the next resistance would be the May 26 high of 1.1418, followed by 1.1450 and 1.1500.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.