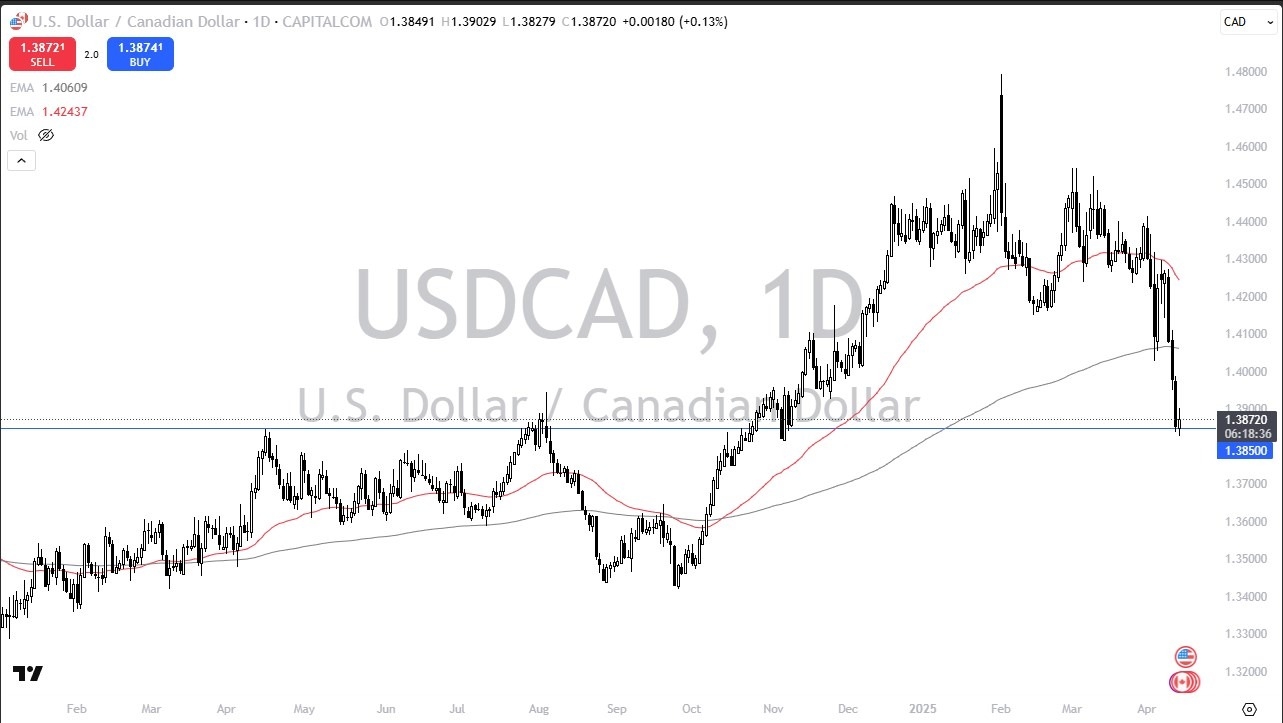

Potential signal:

- I would be a buyer of this pair on a daily close above the 1.3950 level, with a stop loss at the 1.3833 level, and a potential target of 1.4150.

The US dollar has fallen pretty significantly against the Canadian dollar over the last 3 sessions previous, but it looks as if we are trying to hang on to the 1.3850 level. This is an area that has been important multiple times in the past, so it doesn’t surprise me too much that we are starting to see a little bit of hope here. Ultimately, I think the US dollar is oversold against most currencies, and the Canadian dollar has no business strengthening over the longer term. After all, there is a significant amount of uncertainty when it comes to Canada, especially when it comes to trading with the Americans.

Bond Yields

Ironically, it might be falling bond yields in the United States that turns this USD/CAD pair around. Typically speaking, we look for higher yields in order to start purchasing currencies. However, the bond selloff in the United States had been so ugly that people were starting to question whether or not we were heading to some ugly resolution in the US. I think ultimately, now that money is slowing down its exodus from the United States, we will start to focus on the reality of both economies going forward, with the Canadian economy looking a bit limp. Furthermore, it is not as if Canada can suddenly shift its exports to other countries, at least not quickly. Because of this, it’s very likely that we will see the US dollar make a turnaround sooner or later. This will be especially true if there is some type of tariff resolution with China.

I believe at this point in time we have just simply gotten oversold, and it makes sense that we have to balance this pair back out. That being said, if we were to break down below the 1.37 level, then this pair falls apart quite drastically. Ultimately, this is a market that could be set up for a nice trade to the upside if we get a little bit of momentum.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.